Random Spiel: Why Philippines Have Low Household Consumption

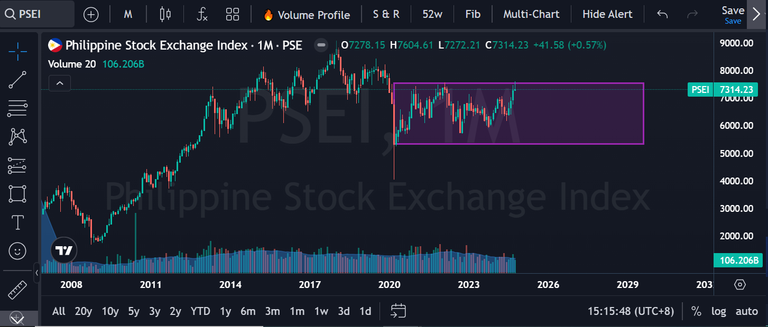

When I made a post about the Philippines setting up for a bull market, there was a lot of buzz that resulted in the recent run you'll see from the chart below. But if you noticed, it's been almost 4 complete years since the pandemic and the market has only been moving sideways. Far from the anticipated recovery.

PSE Index Source

Here's what the news has to say, just stick around for the first few minutes of the market news as economist wonder why people aren't spending their money as forecasted.

The chart below just supports the claim that consumer spending has fallen from expectations. It's been suggested that the food inflation, specifically the rise in the price of rice played a big factor. It's a commodity that people will pay for despite the price inflating because it's an inelastic good. For people living with poverty, and the middle class which are the main consumers in society, they suffer from the rise in prices. And these are the classes that get taxed more for consumption.

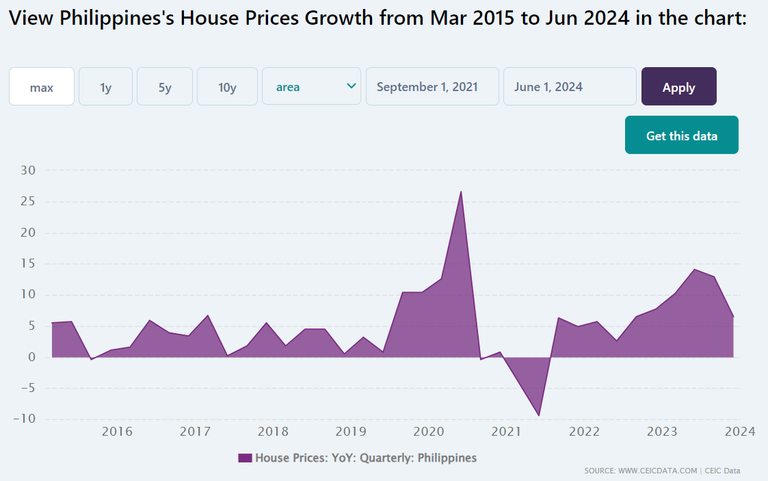

Below is the chart showing the rise in housing prices. If the pandemic made it worse for everyone, and the markets are showing a slow recovery, why is the growth in housing market prices still up and higher than pre pandemic levels? Because during times of crises, those who have deeper pockets will buy out assets for cheap from those that belong to the poor and middle class, then resell those assets or have them rented out when things become stable. I've had a long record of posts explaining the idea behind this claim.

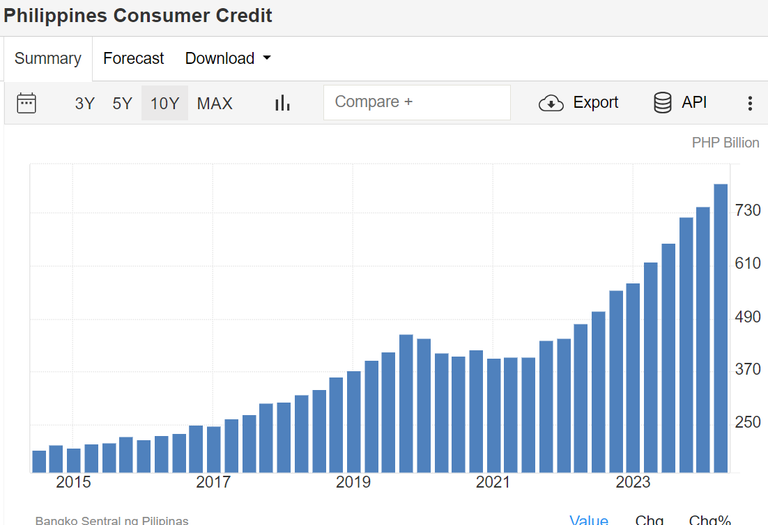

A rise in housing price growth meant that people are now paying more to own a home, take on higher mortgage rates, and maybe even paying for more rental prices. These costs eat up budget allocations that could have been used for investing and generational wealth building. To own a house now is the bare minimum sign of being in the middle class because having your own roof means no extra expenses for rent and mortgages to pay over the course of decades. The consumer credit, as seen in the chart below, shows that people are taking in more debt than before.

So even if people are taking in more debt, where does the money even go? who owns their debt? the banks? the government? who owns the banks? the wealthy individuals that supply the capital to fund the lending and same individuals that the government owes money to. Someone has to player the lender while the rest accept their debts. Even if inflation rates went down, these only shows the changes in rates year over year and month over month, not the accumulated price growth over the course of years but reporting the inflation rates going down seems like a good PR stunt for the government.

If majority of the consumers (consisting of everyone but not the rich) don't have any money to spend, the corporations and their stocks won't be showing positive growth in revenue. You need to give people money to spend and that's in the form of quantitative easing, lowering interest rates, and selling more "affordable" loans that commit individuals to pay for decades to keep the system going.

Thanks for your time.

Philippines continues to be a consumer-driven market. Consumer behaviour may change but seems like it's just more of a product shift. Example: Demand of rice maintains regardless of price; hence, will compensate through lesser demand on other grocery items (i.e. need to forego snacks).

Inflation will always be there but it does not stop Filipinos from spending. Malls are getting jampacked, international concerts are being brought in with high ticket sales, etc.

Quantitative easing (fiscal policy) & lowering interest rates (monetary policy) are just some of the tools to manage a nation's economy. It's the right amount of balance between fiscal and monetary policy that is needed by the country. While we have had great Central Bankers managing the monetary policies, fiscal policy is directed under different Administration. I think this is where it lacks consistency.

Them blaming it on rice is just funny to me. It's like forgetting people are accumulating more debt because the banking sector just reported a huge amount of gains over the recent quarters past and these are generated from loans. Who asks for these loans and pays for them? the average consumer and it would be good if only the interest rates were low but they're not that low, at least pre pandemic low.

@adamada, I paid out 0.849 HIVE and 0.145 HBD to reward 1 comments in this discussion thread.