MicroStrategy Is A Pyramid Scheme

MicroStrategy looking more like the biggest pyramid scheme in modern market history — and yes, that includes its potential fallout for Bitcoin itself.

- The Numbers Don’t Add Up

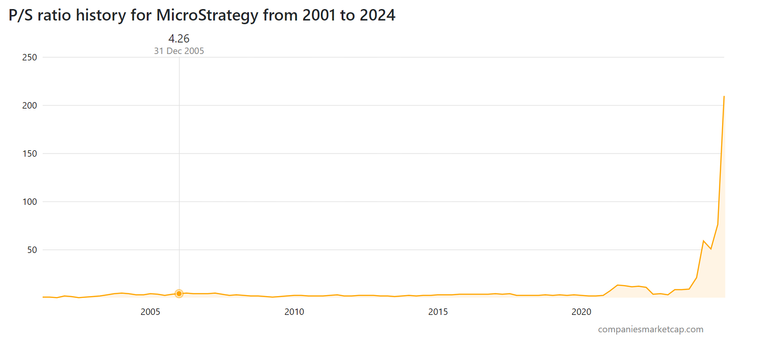

MicroStrategy is sitting at a mind-boggling $100 billion market valuation, but here’s the kicker: its actual core business is generating just $500 million in annual revenue. We’re talking a Price-to-Sales (P/S) ratio of 210x, this means that someone who buys MSTR stock pays 210X their revenues, which makes even the most overhyped tech stocks look like bargains.

Now, let’s zoom in on the bottom line. MicroStrategy’s operating income barely makes a dent in its expenses. It’s like trying to fuel a rocket ship with a lawnmower engine.

Their secret sauce? Issuing truckloads of convertible debt and new shares — all to buy more Bitcoin. Basically:

Issue debt.

Buy Bitcoin.

Pump the stock.

Issue more debt.

It’s a rinse-and-repeat cycle that’s been propping up MicroStrategy’s valuation, but eventually, something’s gotta give.

- How Much Bitcoin Does MicroStrategy Own?

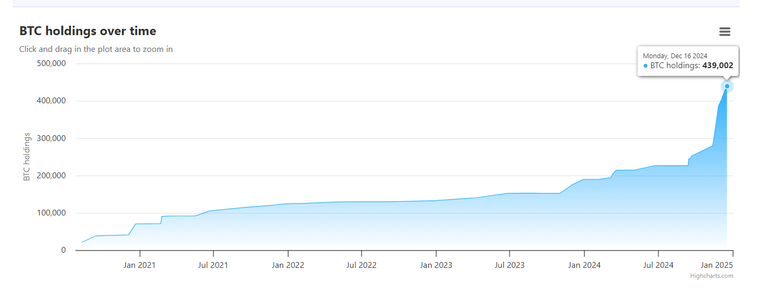

MicroStrategy owns 439,002 bitcoins as of Dec. 16, 2024. MicroStrategy states the average purchase price as $58,219 USD per bitcoin with a total cost of $23.41 billion USD. In November they bought 134,430 bitcoins they pace they are buying is unbelievable.

Here’s where things get interesting. MicroStrategy doesn’t just own Bitcoin; it’s leveraged to the gills to acquire it through debt.

- The Convertible Debt Time Bomb

Convertible debt has been MicroStrategy’s go-to weapon to fund its Bitcoin shopping spree. But this isn’t free money. Convertible bonds are essentially loans that can be turned into stock if the share price stays high. Here’s what happens if it doesn’t.

If MicroStrategy’s stock price collapses, bondholders will demand cash repayments instead of converting to equity.

MicroStrategy doesn’t have cash to cover this level of debt (they’re currently $4.7 billion in debt).

Bankruptcy starts looking very real.

The house of cards collapses.

Why is this dangerous? Because $MSTR’s stock price is completely tethered to Bitcoin’s price. If Bitcoin stumbles, the MicroStrategy pyramid comes crashing down.

- Bitcoin and MicroStrategy

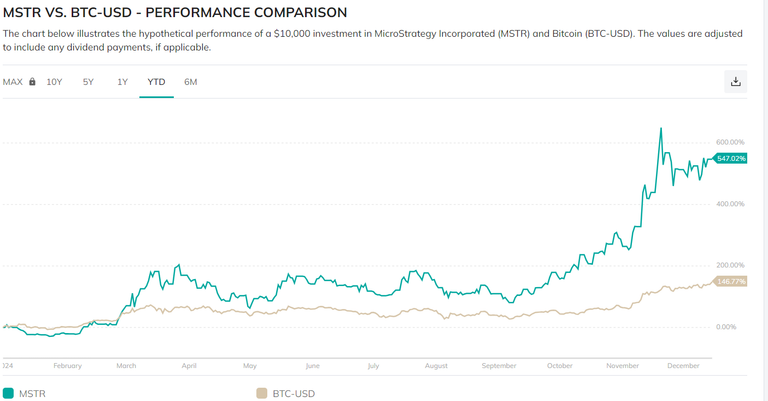

MicroStrategy’s stock is essentially a high-leverage Bitcoin ETF with a corporate wrapper. That’s fine when Bitcoin is going up, but let’s consider what happens when the hype fades.

If Bitcoin drops sharply, MicroStrategy’s stock tanks.

If the stock tanks, the convertible debt becomes an albatross.

If MicroStrategy is forced to liquidate Bitcoin to meet debt obligations, we’re looking at a potential fire sale of 439,002 BTC.

To put this into context, 439,002 BTC represents over 2% of the total Bitcoin supply. If MicroStrategy fails, it could send shockwaves through the entire crypto market, driving Bitcoin prices lower. Do you remember what the collapse of Luna and the selling pressure their holding in bitcoin put to the market?

- Valuation Metrics

Let’s compare MicroStrategy to, well, anything remotely sane

P/E Ratio: As of December 2024, MicroStrategy has a trailing twelve-month (TTM) P/E ratio of 47.3. This is raising concerns about overvaluation given MicroStrategy’s reliance on Bitcoin rather than strong operational revenue. Why? Because it doesn’t make money. The company is unprofitable.

Debt-to-Equity Ratio: A staggering 111.6%, meaning debt far outweighs the company’s equity.

Market Cap to Revenue: As mentioned earlier, 210x.

- Why It Matters for Bitcoin Investors

If the stock price falls then the convertible bond holders will demand cash MicroStrategy has 0 cash holdings so the only way to find cash would be to sell bitcoin this will add tremendous pressure to the market.

MicroStrategy is operating like a good pyramid scheme. They claim that if you buy their stock, you are effectively owning a piece of their Bitcoin. With the cash from stock purchases, they buy more Bitcoin, which in turn pumps up the price of BTC. The higher the price of Bitcoin, the higher the price of their stock.

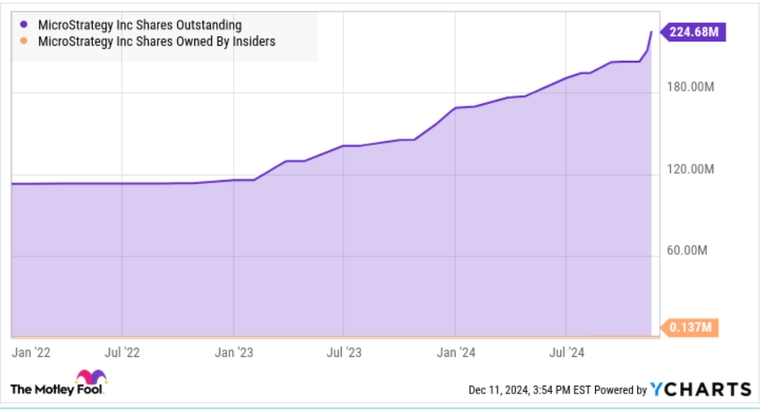

source

Those who bought shares believe that the same amount of stock they hold will translate to ownership of more Bitcoin over time because the company promises to keep buying. However, the only way MicroStrategy can keep buying is by issuing more stock to raise fresh capital. This dilutes ownership, meaning shareholders ultimately own less Bitcoin because the total number of shares increases compared to when they first bought.

source

I find it really idiotic for someone who wants to buy $BTC to pay 2x or 3x the price of bitcoin by buying the stock of MicroStrategy.

Posted Using InLeo Alpha

Yeah saw this on X and kinda agree.

The next crypto bear market will determine it’s future

It's a very dicey situation though, and if they're forced to sell BTC to balance their books, we all know the consequences. Let's wait and see though

Bitcoin's next correction will be epic. That's when I'll buy HIVE for $0.05

Good time to buy then eh? 😀

this is the best time 😂

😀

To the best of my knowledge, Microstrategy has never been through a bear market for Bitcoin. This has always caused me to read the billionaire investors comments and statements through the lens of his limited experience. second I have always wondered what would happen when the bear market struck. I guess we will find out in 2026, if the current bull market lasts that long.

Nice assessment. I tend to agree. The P/E and typical metrics are really not relevant. You nailed it with this single sentence :-

"MicroStrategy’s stock is essentially a high-leverage Bitcoin ETF with a corporate wrapper."

Looking like a high risk of disaster when the next crypto winter arrives.