Safe farming with Harvest Finance!

Originally published on Publish0x

One of the most terrifying things about DeFi and liquidity farming is the ever present danger of Impermanent Loss in providing liquidity to double sided pools. I have had some experience of this in the early days of Uniswap V1 where relative pricing between tokens ended up diverging so much that I ended up writing off the capital invested. This has made me incredibly wary of double sided liquidity pools now, and now I only join the pools where I would be happy completely ending up with more of one token than the other.

Still, I am more happy providing liquidity to single asset pools like those on Compound/Synthetix on Ethereum or Venus on Binance Smart Chain. Sure, the profits are not so phenomenal... but neither are the losses! plus, I can rest easy in the knowledge that the relative pricing between two highly volatile assets is not going to leave me in the lurch!

Gas gas gas....

In what has been a recurring theme on the Ethereum blockchain, the cost of gas has become too much for regular smart contract interactions. Sure, you can do token transfers and non-urgent smart contracts on certain times of the day and the weekends to avoid the biggest stings, but even then, you are losing a nice chunk of ETH each time and this is not sustainable for most people. Meanwhile, Layer 2 solutions have come on board like Optimism with Synthetix, but then you are in a different bind where your assets stuck on a side-chain and unable to use the composibility that is the strength of DeFi.

Which brings us to Binance Smart Chain and the projects that are being built on that smart contract alternative. Venus is a project that is very similar to Compound where you can provide collateral and then take loans against that collateral to try your luck in the big bad world of DeFi. Sure, I have no problem providing assets in exchange for interest and XVS, but I have no interest in trying to keep up with the 24 hour a day cycle of DeFi!

Single Asset Pools on Harvest Finance, a Perfect Fit!

I had been poking around on lending aggregators on Binance Smart Chain for a while. The fees are definitely much lower and that makes it more attractive to a non-whale like me! However, the problem is that the space is just so new with various projects and copycats popping up everyday that I have no trust with any of the protocols. As time has passed, there are now a few "trusted" brands on BSC, but there was nothing that had single asset pools. Venus was the closest, but that meant that you would need to take your VAI (overcollateralised) and go into the wilds again to try and make it earn!

With the arrival of Harvest Finance on BSC, I now had a trusted name that I could rely upon to do all the heavy lifting for the single asset pools! Even better, they had Venus products which meant that I now didn't need to interact with the Venus contracts at all!

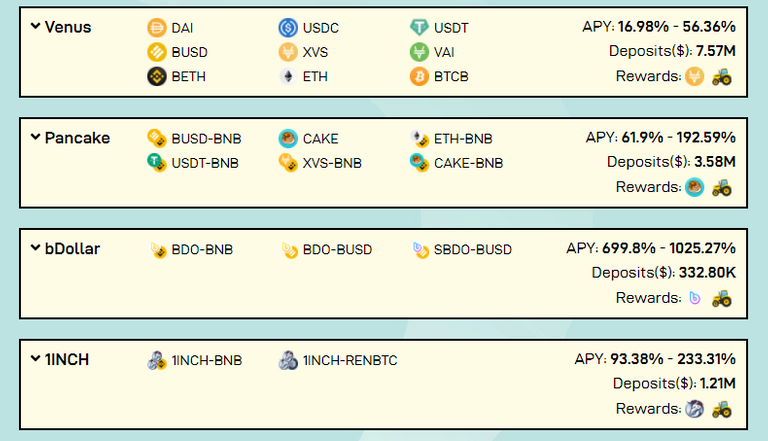

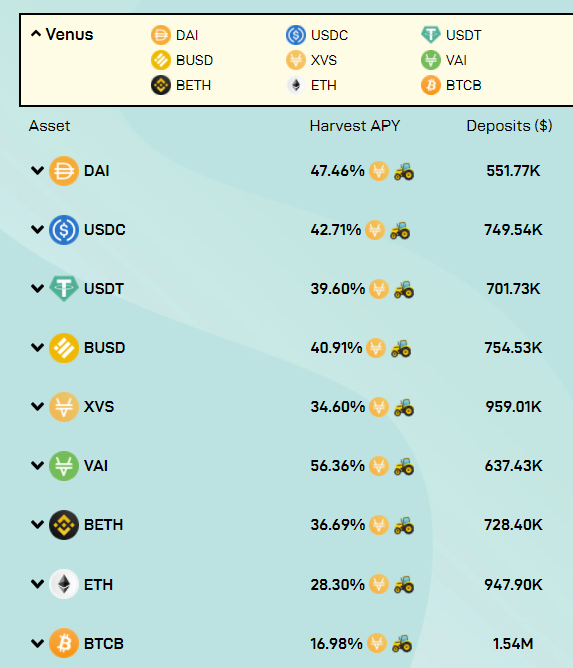

So, taking a quick look at the Venus single asset pools, we see that there is a nice spread of stablecoins, XVS/VAI and the old favourites of ETH and BTC. There are more variants on the Venus protocol itself, but these are the perfect ones for me! This is definitely somewhere that I'm happy to park some tokens to make sure that they are earning their keep.

Currently, the deposits on each of these pools are relatively small, but the APYs are pretty decent. In fact they do beat the APYs on Venus itself... which does lead me to wonder how they are calculating and denominating the APYs (in the "native" asset token or against USD?). I always am a little bit wary of headline numbers like this, but at least I know of Harvest Finance from Ethereum and I'm more happy to trust them over any number of potential rug-pulls that spring up everyday.

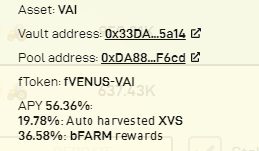

Taking a quick look at the APY breakdown is unfortunately not really making things clearer as to whether it is the underlying asset token that is being compounded or if the gains are in the bFARM rewards. Either way, it doesn't really matter to me... most of the bFARM I will likely sell into CAKE or BNB, or teleport over to Ethereum to stake in return for the interest bearing iFARM. I really do hope that they bring the iFARM functionality over to BSC though... the thought of dealing with Ethereum sized fees after playing around on BSC really sticks in the throat! Either that, or wait and hope that ETH 2.0 (or 1.5) manages to sort out that scaling roadblock.

Conclusion

So, if you are a regular safe sort of guy like me and not a crazy hot-headed DeFi degen apying into the latest and biggest numbers, Harvest Finance might just be the place for you on BSC. A familiar name from Ethereum on a low fee chain like BSC is the best combination of usability and trust.

The single sided asset pools for Venus are what brought me to investigate Harvest Finance on BSC, but now that I've been sucked in by the low fees, I might even just park a few of those double sided liquidity tokens from Pancakeswap and 1inch over here for that little bit of extra earning power!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Account banner by jimramones

Posted Using LeoFinance Beta

Congratulations @huz402! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Congratulations @huz402! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Congratulations @huz402! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking