Price Floors, Soft Ceilings, Arbitrage, and Moral Hazards

Get your trading scripts running, here's an easy way to make trading profits.

None of this article is financial/investment/legal advice, it contains a strategic valuation analysis of speculative assets that can be subject to market fluctuations. You are suggested to seek out a Registered Investment Advisor (RIA) for all investments and the author is not an RIA. Splinterlands' Terms of Service identifies Splinterlands/Steem Monsters as not being an Investment Company. As defined by the U.S. Code of Federal Regulations, Steem Monsters (the parent company of Splinterlands) and the Decentralized Autonomous Organization (DAO) that was published by Steem Monsters can be argued to rise to the definition of being classified as Financial Institutions in the United States. This is a duty to warn and inform given that the actions to be described regard the valuation of assets and speculation of events to take place.

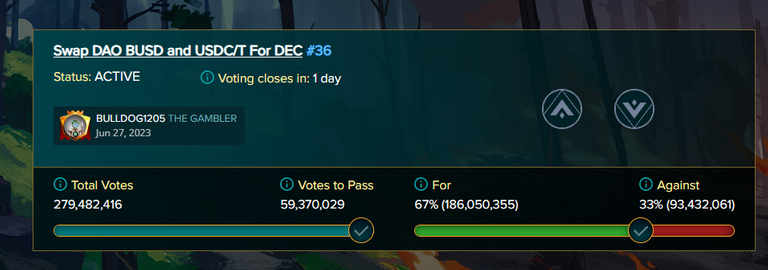

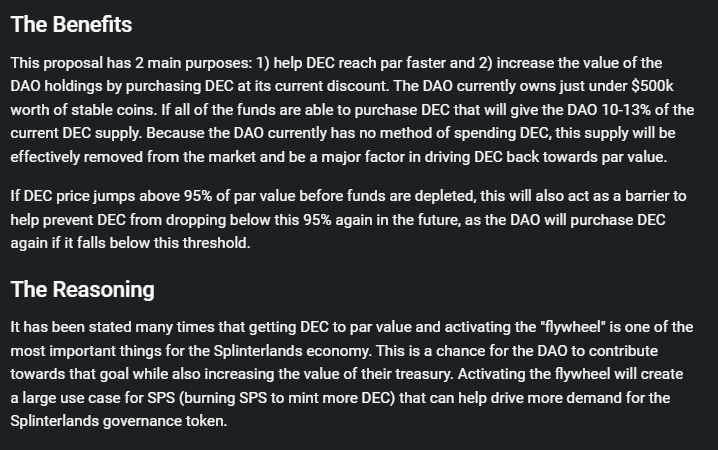

It is a contentious proposal that has sparked bad faith discussions and gaslighting on Discord. For those unfamiliar, it is a proposal that would do a number of things with the Splinterlands DAO that may seem familiar to long-time FX traders. However, it creates problems that those who have the ability to trade DEC will be able to exploit for their own profit and essentially drain the Splinterlands DAO to get their portion of $500,000.

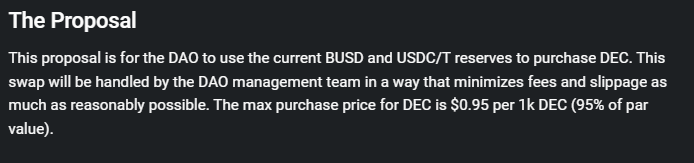

Discussions surrounding the maximum purchase for DEC by the Splinterlands DAO came up concerning a .0008 vs. .00095 price. This discussion is rather irrelevant.

A hard-cap floor on the price of DEC combined with a soft ceiling in the price of DEC (the burning of SPS to generate DEC at .001) would result in trading scripts making buy and sell trades with clear trigger take profit points without ever having to use stop losses. The risk of not using a stop loss with a pegged floor was finally exposed when the Swiss National Bank removed their peg to the Euro back in 2015. Many traders faced margin calls and lost a lot of money as a result.

The arbitrage is very obvious as a script can easily trade in the range from a short or long position and make profits knowing that the price will never escape the range. The downside protection will always be backstopped by the DAO or the ability for people to burn their SPS for DEC (effectively inflating DEC to bring down the price). There's no point to playing the game to generate a return on investment, just trade DEC with leverage as the returns are there.

It's a scalper's delight.

What could possibly go wrong?

Congratulations @crootin! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 4250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Woould you believe I piggybacked that Euro short back in 2015 and could not believe my luck. Good times. It came out of nowhere.

Everyone was stunned. Brokers went under as a result.

Thank you for participating in SPS DAO Governance @crootin!

You can place or monitor SPS Stake Weighted votes for and against this proposal at the link below:

Link to this Pre-Proposal

Updated At: 2023-07-10 01:01 UTC