Is the American economy really that strong if the Fed cuts rates in two consecutive meetings?

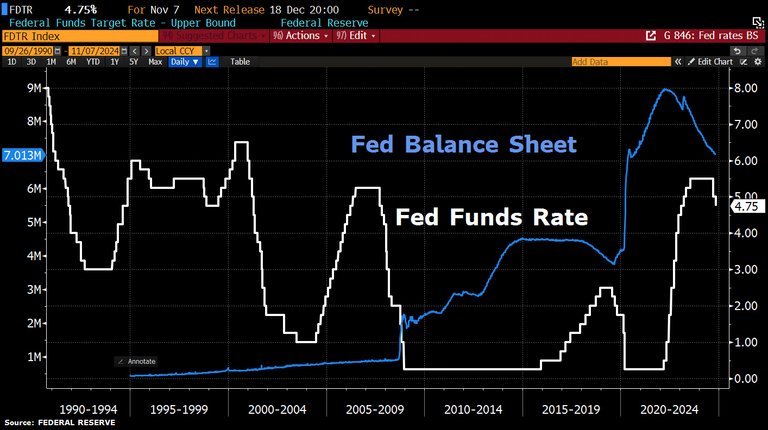

So the Fed cut interest rates by 25 basis points following the 50 basis points cut in September. That's a cumulative 75 basis points. The last time we saw cuts like this was at the end of 2007, as the Fed got inkling something was wrong. Here is the chart:

The official economic indicators (unemployment, economic growth) look fine. And bond yields are surging, indicating inflationary pressures. So why is the Fed cutting rates?

It feels like there is some hidden distress in the global financial system.

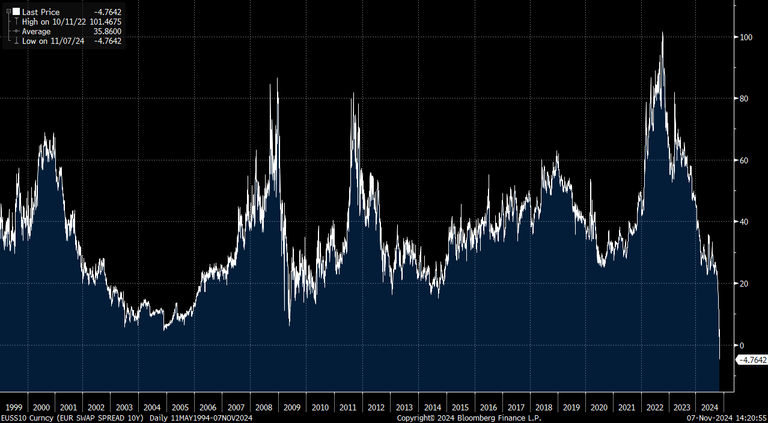

As the Fed was cutting rates, weird stuff was happenning in the Euro Swap Cash market - it's negative for the first time since 1999:

Remember, the Euro was created in 1999...

So what does this mean? The Euro Swap indicator is the difference in cost between borrowing money in euros and the cost of swapping it to U.S. dollars. It's gone negative because people are struggling to do it - either too expensive to borrow in euros, or lack of dollars available.

Eurozone interest rates are 3.4%, well below the Fed funds rate of 4.75%.

So the culprit must be lack of dollars to swap into.

So maybe the Fed cut the Fed Funds rate to ease global dollar liquidity.

This has eerie echos of what happened at the start of 2023, when not only did small American banks like Silicon Valley Bank and First Republic go kaput, but a very large Swiss bank, Credit Suisse, also went bust.

The distress in the Euro Swap market indicates another European bank is in trouble. Time will tell if the central banks can prevent another bank failing.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thanks

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .

Thanks