Bond markets react negatively to the UK budget

The Chancellor of the Exchequer, Rachel Reeves, tried to leak most of her budget in the weeks leading up to it, so that both markets and voters had a chance to digest it in bits and adjust. "Pitch rolling", the politicos call it (so that when you bowl your ball it bounces cleanly).

Still, when she gave her budget speech yesterday, it was a bit of a shock. £70 billion of increased spending, paid for by £40 billion in tax rises and £30 billion in borrowing.

The markets started out calm, but yields started to spike as they digested what she was saying.

The most impactful was a £25 billion rise in Employer National Insurance; the rate went from 13.8% to 15%, and the threshold at which it kicked in was lowered from £9,100 to £5,000. It's a tax on jobs, and employers who have a lot of part-time workers will be suddenly paying a lot more tax.

It will likely lead to hiring freezes and increased automation. Some businesses will restructure and make people redundant.

The bottom line is it will increase unemployment and reduce payrises, which will have a knock-on impact on growth. Which makes the increased borrowing much more dangerous, especially as the UK's debt is 98% of GDP.

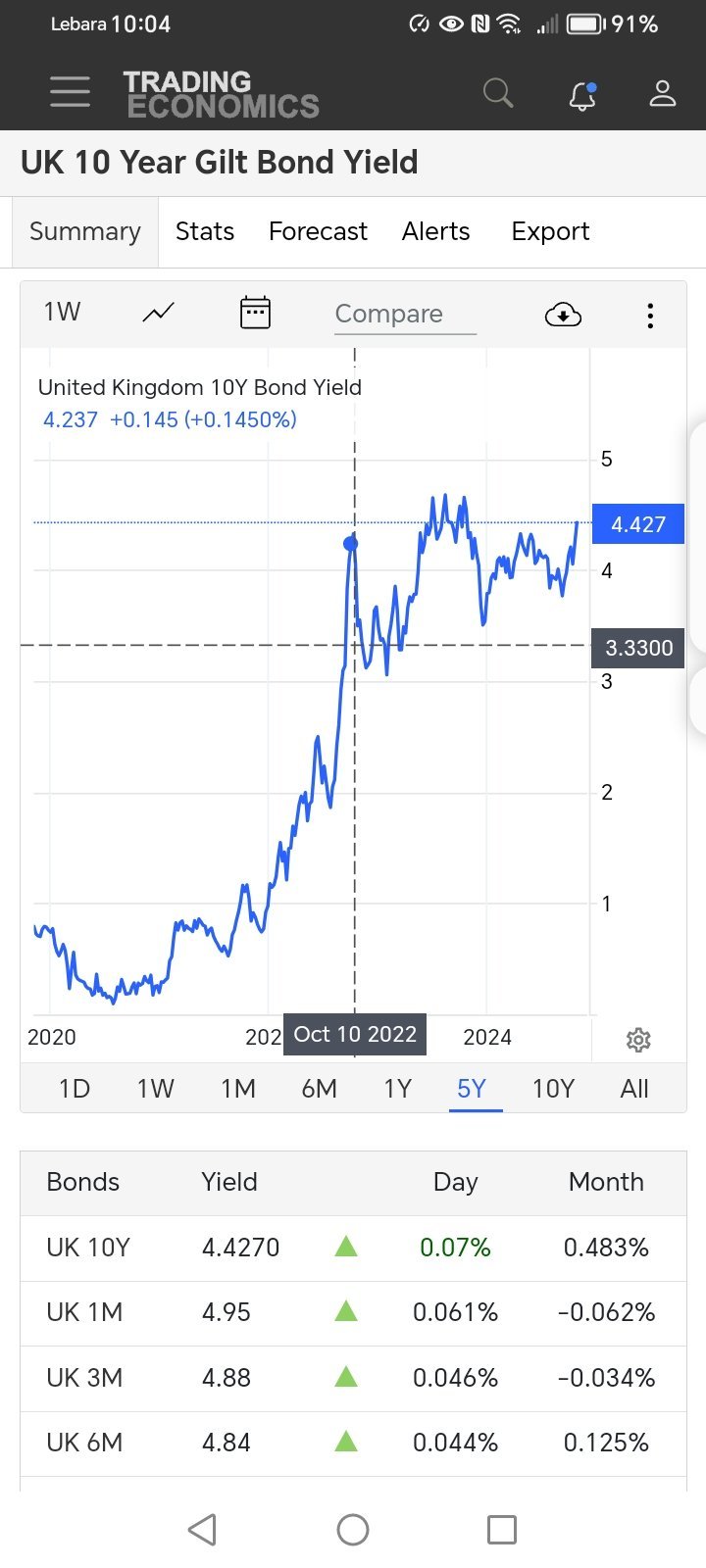

Here is what is happening to the UK's gilt yields:

Yield's are higher than they were in the after-math of Liz Truss's diastrous mini-budget on Oct 10th 2022 (where she borrowed to cut tax). Is Rachel Reeves a left-wing Liz Truss (borrowing to spend)? Markets don't care why you are borrowing, they just hate you are borrowing when debt is nearly 100% of GDP.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thanks

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

Thanks