What the end of the current reserve currency could mean for the USD....

SOURCE

The United States Dollar (USD) has been the world's reserve currency for decades and has served as the backbone of the international financial system. It is widely used for international trade and investment, as well as being the primary currency held by central banks and financial institutions. With US dept rising faster than my blood pressure and many countries now looking for alternative ways to trade, could the death of the USD be just over the horizon? In this blog, ill make a few bould assumption, all of which are plausible mind you, and see how this watershed moment can and will change our lives forever.

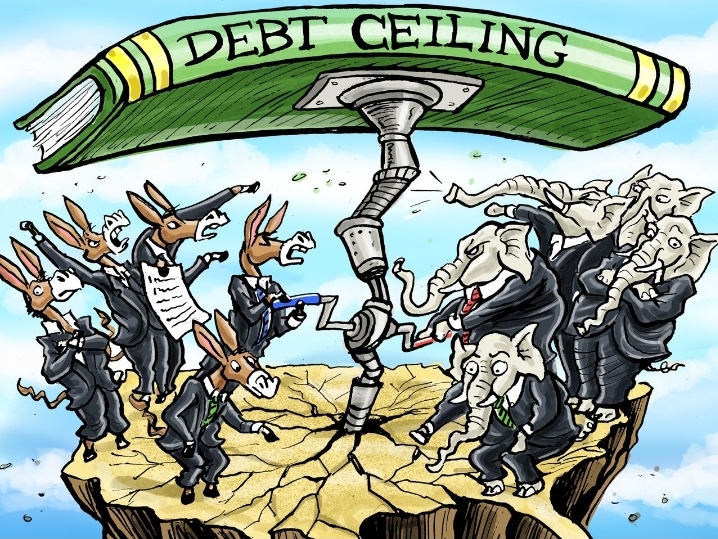

There could be several reasons why the USD is no longer the world's reserve currency. The most likely cause is a decline in the economic and political power of the United States. This could be due to factors such as a prolonged period of economic stagnation, increasing government debt, and declining confidence in the U.S. government's ability to repay its debts.

SOURCE

Another possible cause is the rise of alternative currencies such as the Chinese Renminbi (RMB) or more likely a mixed bag of currencies proposed by the BRICS nations. These currencies have become increasingly prominent on the international stage as their economies continue to grow and become more integrated with the global financial system.

SOURCE

If the US dollar were to lose its status as the world's reserve currency, it would have a significant impact on the global economy. Here are some of the key ways in which the world would be impacted:

Decline in demand for US Treasury bonds: The US dollar's status as the world's reserve currency has made US Treasury bonds a popular investment for countries around the world. If the US dollar were to lose its status, demand for these bonds would likely decline, causing interest rates to rise and the value of the dollar to fall.

Increased competition among currencies: With the US dollar no longer the dominant currency, other currencies would likely gain in popularity and become more widely used as a reserve currency. This could lead to increased competition among currencies and greater volatility in exchange rates. Central banks and financial institutions that once held large amounts of USD as a reserve asset would likely seek to diversify their holdings, leading to a rise in the importance of alternative currencies

Shift in trade patterns: The US dollar's status as the world's reserve currency has made it the dominant currency in international trade. If the US dollar were to lose its status, trade patterns would likely shift as other currencies gain in popularity and become more widely used in international transactions.

Changes in the global financial system: The US dollar's status as the world's reserve currency has made it the centerpiece of the global financial system. If the US dollar were to lose its status, the global financial system would likely change as well, with new financial systems and instruments emerging to replace the current system. This could result in higher inflation and interest rates in the United States, making it more expensive for the government to borrow money

Impacts on US economy: The US economy would likely be impacted by a loss of the US dollar's status as the world's reserve currency. The decline in demand for US Treasury bonds and the fall in the value of the dollar would likely result in higher interest rates and inflation, which could slow economic growth and lead to increased debt levels.

It doesnt take a genius to see that things are currently in play and that one if not all of these factors could come home to roost pretty soon, and when just one of them does, in the words of Porky Pig - "Th-th-th-that's all, folks!"

SOURCE

The loss of the USD's status as the world's reserve currency would have a profound impact on the global financial system and international trade and investment. The decline in the value of the USD would likely lead to higher inflation and interest rates in the United States, as well as a reduction in U.S. economic growth. At the same time, the rise of alternative currencies such as the RMB or BRICS option would likely lead to a shift in the balance of power in the global financial system and an increase in demand for exports from these countries.

SOURCE

It is important that for future wealth preservation and any potential investor to carefully consider the possiblle consequences of such a scenario and to take steps to prepare for the possibility of a changing international financial landscape. Bonds, shares, stocks basically any investment holey contained within the United States will suffer immeasurable losses. Basically you can kiss goodbye to your money.... but there is a very simple solution that is accessible to you right now, still at a reasonable cost.

GOLD and SILVER specifically offer a decent hedge against the collapse of the dollar. This is because foreign banks, particularly the likes of RUSSIA, CHINA and the likes have been hoarding the shiny metals preparing for a switch over. Gold and silver should hold their value, measured in any new reserve currency, and could be sold at incredibly inflated prices when measured in USD.

Im not saying sell the house to buy precious metals just yet, but would it really hurt you financially to go and invest in an ounce or 2 of gold and a few tubes of silver?? Youll thank me later I promose......

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

Hi @welshstacker,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

You received an upvote of 95% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

The current situation of the whole world seems to us that in the coming days the Chinese dollar trade will be around the world. Because the situation in the USA at that time is also very bad. If it turns out that way, it will be very bad for the USA. This will put all the command in the hands of China. At this time, if one has gold silver, then he should not save it at all, because in the coming days, his prize will be increased.

!PIMP

Posted Using LeoFinance Beta

You must be killin' it out here!

@summertooth just slapped you with 1.000 PIMP, @welshstacker.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

No worries at all 🙃

And they keep passing those insane $trillion bills fueling the fall.

Modern monetary theory is about to hit a brick wall.

Posted Using LeoFinance Beta

America's economy is in a downward spiral because of government failures. Moreover, a country cannot maintain its hegemony for long

Whole world is about to blow. But indeed dollar will loose reserve currency status the next ten years. Millions will perish. It’s horrifying how many don’t understand how any of this works!

The US debt is increasing at a rapid pace, I have heard that it has reached the value of 31 trillion $, some are saying it's more than that, but no one knows about it. this thing will put immense pressure on the $ and that's not a good thing in my point of view.

Countries trade. The simple truth is that the US consumes a lot of products/imports a lot. It is very complex. The US incurred so much trade deficits because we were not taxing incoming products, or not taxing them nearly enough. Lots of help to other countries has gone out, and these countries couldn't pay. So complex...

Why don't you write about Great Britain's economy? I'm interested!

Posted Using LeoFinance Beta

Because its screwed!! Were in an even worse state than the US. Our debt:GDP ratio is climbing constantly. We have the worst economy in Europe and a stand alone currency used only by some 68million.

Ill be more than happy to write about the UK shitshow thats unfolding st the moment but most members on hive are from the US and those that aren't understand more about rhe USD$ than the GBP£. So it appeals to a wider audience. If you want jucy upvotes you got to play the game hahahaha

Oh, I understand!

Posted Using LeoFinance Beta

I wrote the "what is a recession" post just for you.

Any other suggestions? Im wuickly running out of ideas.

I read your excellent article!!!

I think USA is far worse off. When u count state debt also we beat u guys. Plus reserve currency status will destroy us. But it will be horrifying for entire world indeed. The populations don’t know what’s coming. It’s horrific!

The US Treasury bonds will be in less demand, as BRICS can be a serious competitor to the Us dollar. I think already they owe nearly $7 trillion !

Not me looking at the first picture of your post over and over again

dollars on fire?, that aptly describes everything that is currently happening to the USA dollars

Nice piece @welshstacker👍

The shit show continues, if the USD lost its reserve currency status it would hit many people that are not prepared, I agree precious metals are a great way to protect wealth especially in this case

Even with the clear signs

It’s insanity how many don’t get it!

When it loses reserve status (I believe by 2031) it’s going to be total insanity!

How you get that date ?