Silver rally imminent.....

SOURCE

As global economies teeter on the edge of uncertainty, investors are increasingly turning their attention to precious metals as a safe haven. While gold often steals the spotlight, its lesser-known sibling, silver, is poised for a potentially greater rise in prices. With current trends, global political dynamics, and the looming threat of inflation, silver appears to have a particularly bright future.

Many analysts predict that the US economy, and by extension the current fiat system, is on the brink of a significant downturn. When this bubble bursts, the financial repercussions could be severe, and there will likely be no quick fix to stabilize the situation. This impending economic shift sets the stage for silver to emerge as a key player in the investment world.

While gold has long been a barometer for economic health and currency trends, silver has remained in the background, quietly awaiting its turn. This week, we focus on silver, the often-overlooked "little sister" of gold. Silver shares many of the same attributes as gold – both have served as stores of value for millennia, and both are seen as safe havens during times of economic uncertainty.

SOURCE

Silver and gold have different colors and industrial applications, but they have historically been intertwined. Silver's unique properties make it indispensable in various industries, including electronics, solar energy, and medical equipment. This industrial demand, coupled with its investment appeal, positions silver as a versatile and valuable asset.

One of the key factors driving silver's potential for price increases is the imbalance between supply and demand. The demand for silver is outpacing its supply, creating upward pressure on prices. As industries continue to rely heavily on silver for their products and technologies, this demand is expected to grow, further tightening the supply and potentially driving prices higher.

Another critical factor to consider is inflation. With the global economy facing the threat of rising inflation, the purchasing power of fiat currencies is at risk. Historically, precious metals like silver have been seen as a hedge against inflation. As inflation erodes the value of paper money, the value of tangible assets like silver tends to increase, making it an attractive option for investors seeking to protect their wealth.

Given these factors, silver presents a compelling investment opportunity. Its affordability compared to gold makes it accessible to a broader range of investors. Additionally, silver's price volatility can offer significant profit potential, especially during periods of economic turbulence.

Incorporating silver into your investment portfolio can provide diversification and stability. While gold is often the go-to for safety, silver's unique industrial applications and supply constraints offer an additional layer of security and growth potential. By holding both metals, investors can benefit from the stability of gold and the growth potential of silver.

SOURCE

Silver is poised for a bright future, with current trends and economic conditions aligning to create a favorable environment for price increases. As global demand for silver continues to outpace supply and inflation threatens the value of fiat currencies, silver stands out as a promising investment.

Now is the time to consider adding silver to your portfolio. Whether you're a seasoned investor or new to precious metals, silver offers a unique opportunity to secure your financial future in uncertain times. Embrace the potential of this versatile metal and watch as it shines brightly in the investment world.

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

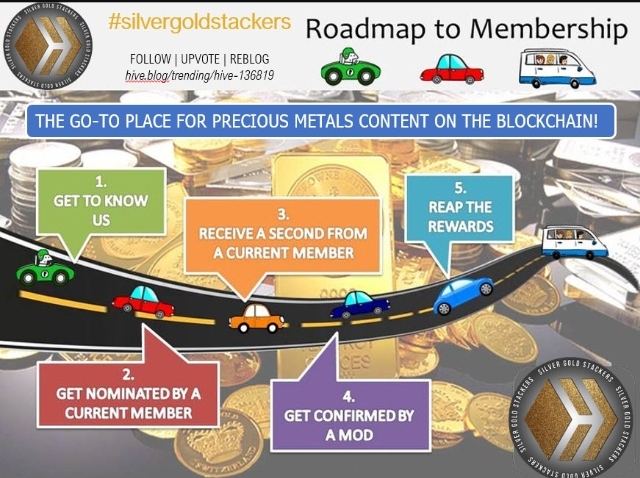

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

You received an upvote of 90% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

You're an awesome writer, the way you put your words together... Anyway... I think the day will arrive, when one ounce of Silver, can be traded, for two ounces of Gold...

Appreciate it buddy. Thank you, but its only what i see as common sense and rhe next logical step.... I know you see "a great coinage monetary reset" happening, but Icant quite get behind that. So for me, the proce of PMs has to increase significantly.

Good thing I am not ready to buy yet. Maybe I can catch a dip!

I dont think we will see a dip significant enough for us to see anything near what wed like as a "buy in proce". Fuck, i remember sub £10 silver, back in 2016, just agter i started my silcer staxking journey.

I felt likeni loaded up then, by by god do i wosh id doubled down back then!! I know hindsight is an amazing thing, but imagine 10yrs from now and silverbis $50/$60+ an ounce..... I bet youd wished youd mortgaged the house to buy at $28/30???

**DO NOT REMORTGAGE THE HOUSE!!! This is not financial advoce. Lol

Haha, no worries on that! There is zero chance I would get an interest rate anywhere as low as the one I got when we last bought! I know I should just buy when I am ready. There is a chance the price will just keep going up and never come back down.

Picked up another two ounces at my LCS this week, Ole!

I haven't picked anything substantial up for a while now... I picked up an ounce from BYB a week or so ago, but that it.

The premiums over here are insane, plus we pay 20% VAT ontop of all of that too.. which is why i love @goldrooster and his flash sales. Hahaha

My LCS gave a great deal on these two, plus picking up a couple of fistfuls of capsules at 50% off retail.