Sanctions and hyperinflation: The future looks bleak for the dollar.

SOURCE

First off, dont think I havent noticed the attention my recent blogs have been getting, this has put a bit of pressure on me to continue to think up interesting and informative blogs to keep you coming back for more. I really do appreciate your comments and upvotes, and if I dont get everything factually correct, please feel free to correct me. Ive been brought to "task" on a few points in a previous blog, and honestly do appreciate all the constructive feedback. Its how we grow and learn things we didnt know beforehand. So with that said, lets get down to it and try and keep you entertained for the next 5 minutes.....

SOURCE

International sanctions are a form of economic and diplomatic pressure used by one or more countries against another country in order to achieve a specific foreign policy objective. Sanctions can take various forms, including restrictions on trade, investment, financial transactions, travel, and the transfer of technology. The goal of sanctions is to modify the behavior of the target country by limiting its access to resources and hindering its ability to participate in the global economy.

Sanctions can be imposed by individual countries, regional organizations, or the United Nations. They are typically imposed in response to actions such as human rights abuses, proliferation of weapons of mass destruction, or interference in the internal affairs of other countries. The exact nature and scope of the sanctions can vary depending on the specific circumstances and the foreign policy objectives of the imposing countries.

International sanctions can have a significant impact on the economy of the targeted country, as they limit its access to resources and markets, and can result in decreased investment and trade. However, sanctions can also have unintended consequences, such as hurting the economies of the imposing countries and the broader global economy.

SOURCE

Lets take the recent sanctions imposed on the Russia federation after its invasion of Ukraine. We wont get into the who, what, why and where of all that here, we all have differing opinions on that, but what we can all agree on is that the deaths of innocent people is wrong(on both sides) regardless of your views.

For me, and from my perspective, sanctions placed on Russia, by the "West", have only sped up the death of the US dollar. The Russian sanctions may now force the hand of its allieces and its close relationship to Brazil, India, China and South Africa (BRICS) to speed up thier own de-dollarisation. Making up 40% of the worlds population, these 5 countries alone registered a GDP of $24.5 trillion, parable to the US ($ 25 trillion) and more than the EU($16.6 trillion.). China and India have negotiated with Russia to circumvent trading in dollars and the "SWIFT SYSTEM" and trade between these countries is now booming. Sanctions placed on Russia oil to Europe now only hurts the pockets of Europeans, as petrol prices skyrocket. Oil exports from Russia to India on the other hand have exploded (no pun intended), with trade rising to $38billion from $6.5billion a year earlier. With other countries still willing to trade with Russia fornits vast natural resources and with the BRICS's countries GDP predicted to continue to outperform the westernised countries, all hope of forcing Russia to retr through sanctions have all but backfired.

SOURCE

Watching sanctions imposed on Russia, the Chinese government must be wondering that when the invasion of Taiwan happens, and it will, will the US try the same thing with the chinease economy??!!??

China holds approximately $1.09 trillion in US dollars. This makes China one of the largest holders of US dollars in the world, as many countries hold a portion of their foreign exchange reserves in US dollars as a way to hedge against currency fluctuations and ensure the stability of their own currencies. It's worth noting that the exact amount of US dollars held by China can fluctuate due to a number of factors, including changes in the value of the US dollar and changes in the size of China's foreign exchange reserves. Additionally, the data on the exact amount of US dollars held by China is not publicly available, so the figure mentioned above is an estimate.

China's one-china policy means that the invasion of Taiwan is inevitable and the only thing preventing China from rolling over the straight of Taiwan is the possible threat of similar sanctions apposed on Russia.

In order to combat the threat of sanctions, if I were in charge of the CCP, I would get China to strat "cashing in" their dollar reserves and sending them back to the States.

SOURCE

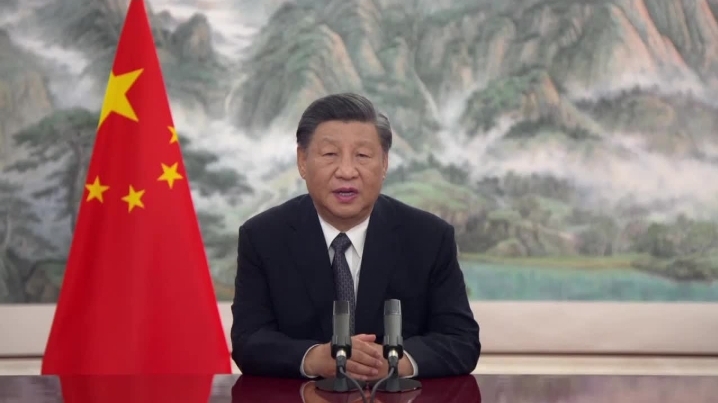

"sanctions are a boomerang and a double-edged sword".

Xi Jingping -2022

Now heres a scenario - Imagine if you would, a time where China no longer requires to hold USD, and an alternative method of payment between somenof the fastest growing nations emerged. Without fear of financial sanctions plaved upon the CCP by the USA for the invasion of Taiwan, notjing can or could stop the Chinease from fulfilling their one-china policy.

$1,090,000,000,000 dollars flooding back to the US, from China alone would send the USD into comllete meltdown. The States would face a hyperinflation like never seen before in the history of "money".

Hyperinflation is a rapid and sustained increase in the general price level of goods and services in an economy over a short period of time. It can occur when the money supply grows too quickly, leading to a decrease in the purchasing power of currency. This can lead to a lack of confidence in the currency and a shift towards holding assets that retain value, such as gold.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.

Hi @welshstacker,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

You received an upvote of 98% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

You are absolutely right the dollar is held in China if they send it to the market or do anything, the common will see the dollar drop a lot in the value. Which is China's dream we will see in the coming days the whole world will be using its currency. The way China is developing and making its way around the world, it will be much more difficult to compete in the coming days.

Upvoted for being well written and well thought out. Sadly, it is completely wrong.

I will answer in a post since it will get too long as a comment.

Posted Using LeoFinance Beta

Im just glad someone reads my blogs. Hahaha

Your feedback is always welcome and always appreciated. Thank you

It's a really good analysis. Well written and explained effortlessly !

Man, Welshie, it sure feels like big changes are coming...

For the good or the bad?? My inner pessimist keeps me buying gold and silver, andnill continue to do so and see how it all plays out

A tsunami of cash... not going to be good for HBD... If HIVE goes to $10,000,000 and USD becomes worthless... Or everyone dumps their crypto like a hot potato to may that extra $1000 on their power bill... this could go so many ways.

Exactly this @ironshield. Who knows anymore?? Lol

You know, of course, how China got most of the trillions of dollars!

It's mostly due to trade imbalances. China received so many breaks in trade under the guise of helping them out. Trump was so angry because of this and tried to correct it.

Although i try and do as much reasearch as i can in to a lot of things, im notnfull versed with US foreign and trade policies. I knownthe US is a massive service industry and no lonfer makes most of the stuff it needs to continue its lavish lifestyle. If it means subcontracting out to foreign countries with trade imbalances, to get rhe cheapet goods for a consumer society then good for China.

China has already begun selling US treasury bills albeit at a trickle so as to get the most out of them without getting too much attention then use them to buy gold and other assets.

Only time will tell who is right @kerrislravenhill. I prepare for the worst, hope for the best, and deal with the shit life gives me head on..

Now thaylts a tshirt slogan

1.09 Trillion $ is a huge amount and no doubt china single handily can leave scars on Dollar face that no one can remove. I have heard that , us is preparing Australia to fight with China, is it true ?

Sanctions are a risk free weapon used by dominant countries to take control over other states. Us led sanctions and UN's are of the few which lay a very lethal blow over the target, but there are examples where sanctions been posited unethically and illegally. Making false claims and only seeking for personal interests and filling up own pockets have surged tragedy and instability over parts of the region or countries.

But, As for world politics, there should be bipolar hegemony and putting just all the controlling button over a single country would bring forth economic exploitation and so far we havent seen yet in a large level, but there are chances of happening such things.

Economic sanctions are dangerous for a country. A country's radical mindset is a threat to the world

I still felt strongly the future is bright for dollar