Friktion Tutorial (Volt 1 & 2)

Built on Solana, Friktion is a protocol that offers DeFi Option Vaults.

We cover Friktion in detail in our Pro article, but before we get started with this tutorial, here are some key points to note...

First off, what's a DeFi Option Vault (DOV)?

DOVs essentially democratise the process of selling options. An option gives the holder the right, but not obligation, to purchase an asset for a predetermined price at a specific point in the future. Option buyers pay a premium, an amount up front, for this right.

Selling options is a complex process requiring specialist knowledge to decide on different metrics. Such strategies are used by market makers and sophisticated traders in TradFi, but are reserved almost exclusively for the ultra rich.

With DOVs, users simply deposit into a pool, which the protocol (i.e. Friktion) uses as collateral to sell options. In other words, they do all the hard work for you!

The two types of options that most DOVs sell, and the ones that we will focus on for this tutorial, are Covered Calls and Cash-Secured Puts. Friktion offers these via their 'Volt' products.

NOTE: Deposits into DOVs can suffer losses. If the options the pool is selling (i.e. the options you are selling) expire 'in-the-money', it means that the buyer will profit, and you (the pool depositor) will lose out.

Tutorial

Head to https://friktion.fi/ and click 'Launch App'.

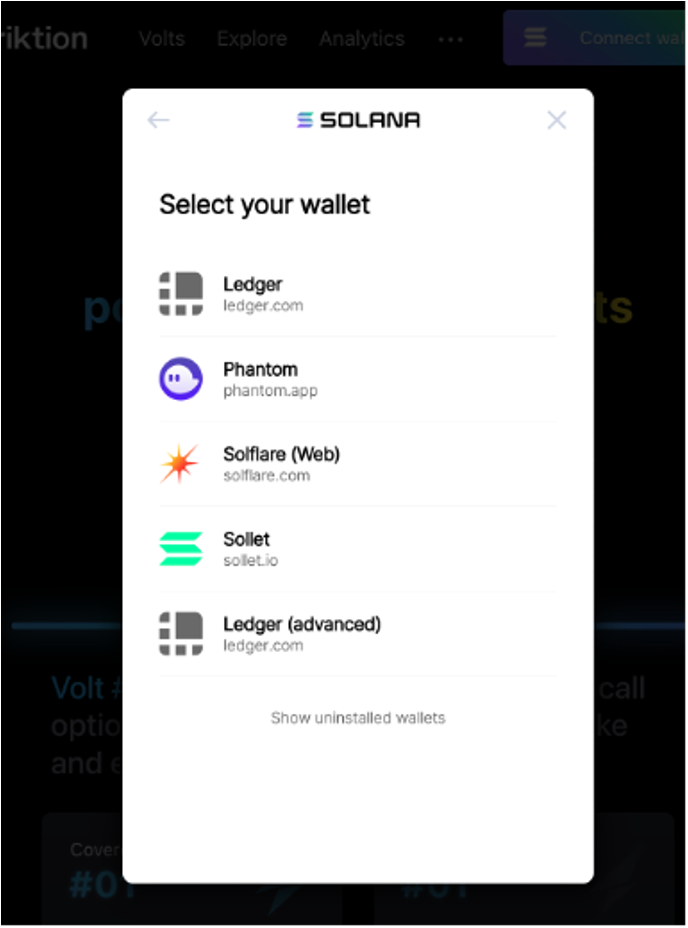

Next, you'll need to connect your wallet. Friktion currently supports the following wallets:

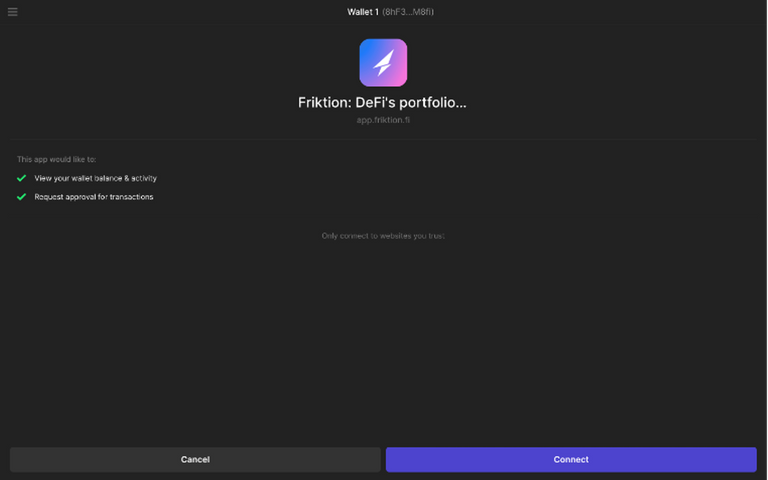

Once you select your wallet, you'll be prompted to unlock your wallet and approve the connection.

Your connected wallet should now be visible in the top right-hand corner of your screen.

Volt 1 – Covered Calls

To start, click on 'Volts' at the top of your screen, followed by 'VOLT #1: Generate income'.

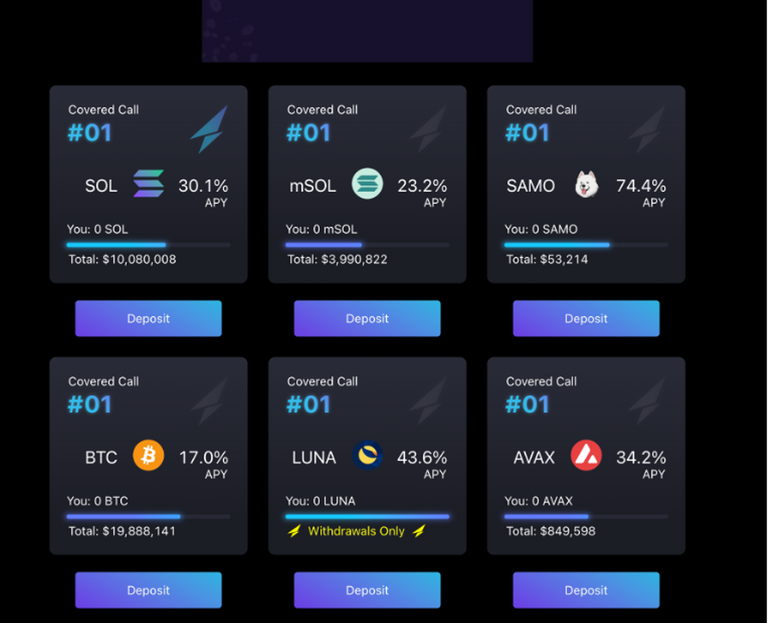

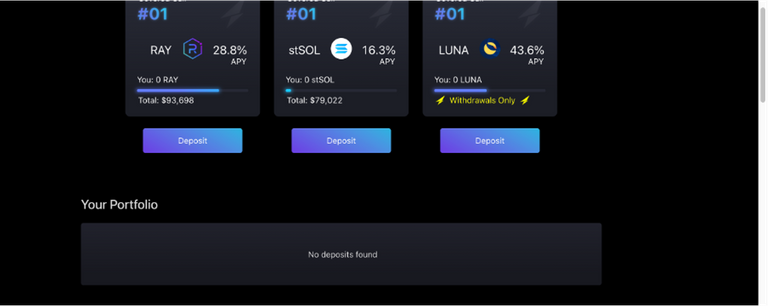

On the following page, you'll see the list of the different covered call Volts available.

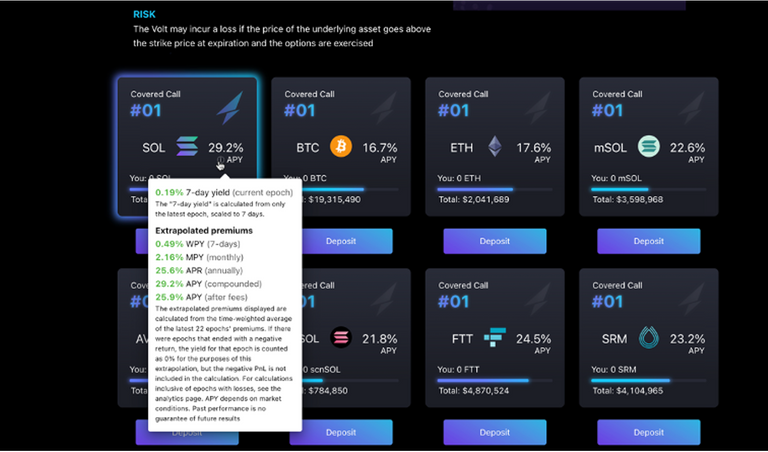

You can hover over the 'i' icon next to the APY to get a breakdown of the estimated rate of return for each Volt.

It's important to be aware that the APY you see here is based on the last few epochs (the technical term for the time window during which the Volt strategy is running, which for Friktion is weekly on a Friday) and is subject to change, i.e. this rate isn't a guarantee but an indication of what's possible.

As with any investment, you'll need to do your own research into what token / Volt you would like to go with. Friktion supports a wide and ever-growing range of assets. You can check out their analytics page to see the full list and search for the top-performing Volts. (https://app.friktion.fi/analytics)

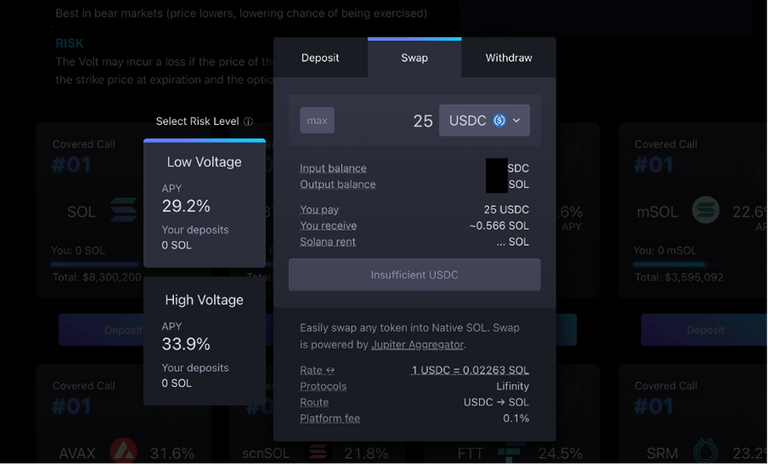

Click 'deposit' to proceed with your chosen Volt. If you don't have the necessary tokens in your wallet, you can use the swap tab. This tab gives you the option to exchange certain currencies for the currency of your chosen Volt.

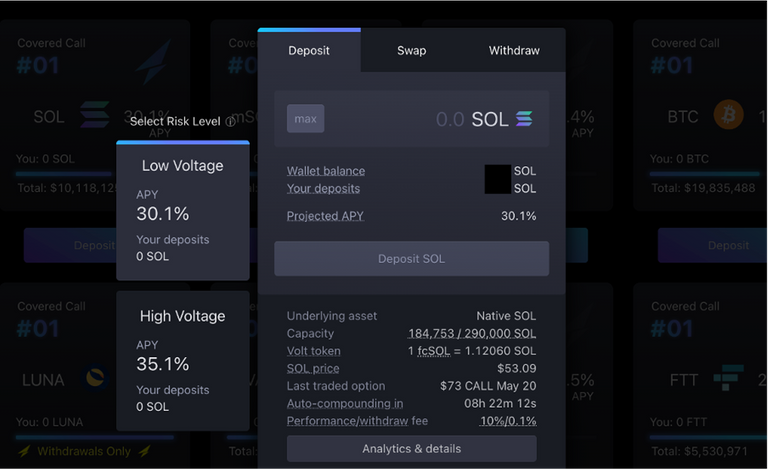

Next, enter the amount of the token you want to deposit.

Before you go ahead and finalise the deposit, let's take a quick look at the 'analytics and details' section.

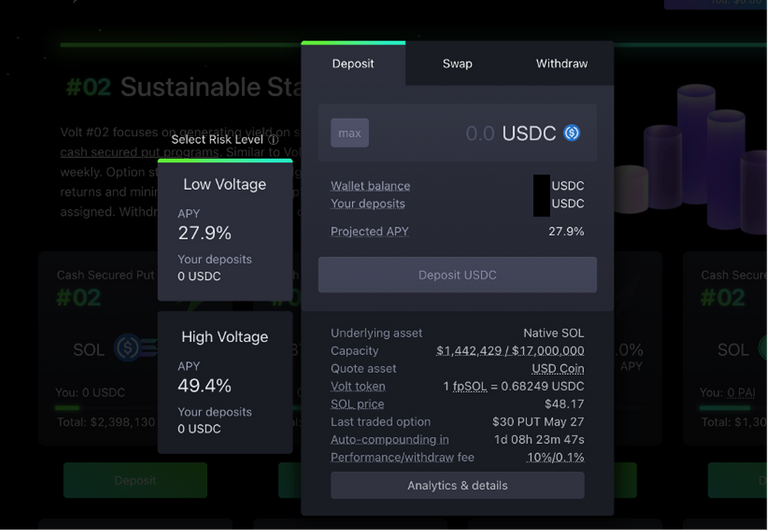

Volt token: once you deposit, you'll have the option to mint fTokens (in this case, fcSOL tokens), which represent your share of ownership in the Volt. This can be compared to stETH (liquid staking ETH through Lido). These tokens will be visible in your wallet once the deposit is processed. There are plans to give the fToken a range of use cases, the first being collateral for borrowing.

Auto-compounding: Volts run in epochs (technical term for cycles), which currently last one week for Volt 1 and 2. When the epoch ends, your returns will automatically be reinvested, unless you request to withdraw before the beginning of the next epoch.

Performance fee: a 10% fee is applied to any yield you earn, note, not to the initial deposit, only profit

Once you click 'deposit', you'll be prompted to confirm the transaction in your wallet.

After refreshing the page (you may have to reconnect your wallet), your position should be visible in the portfolio section of the Volt 1 main page

Withdrawals

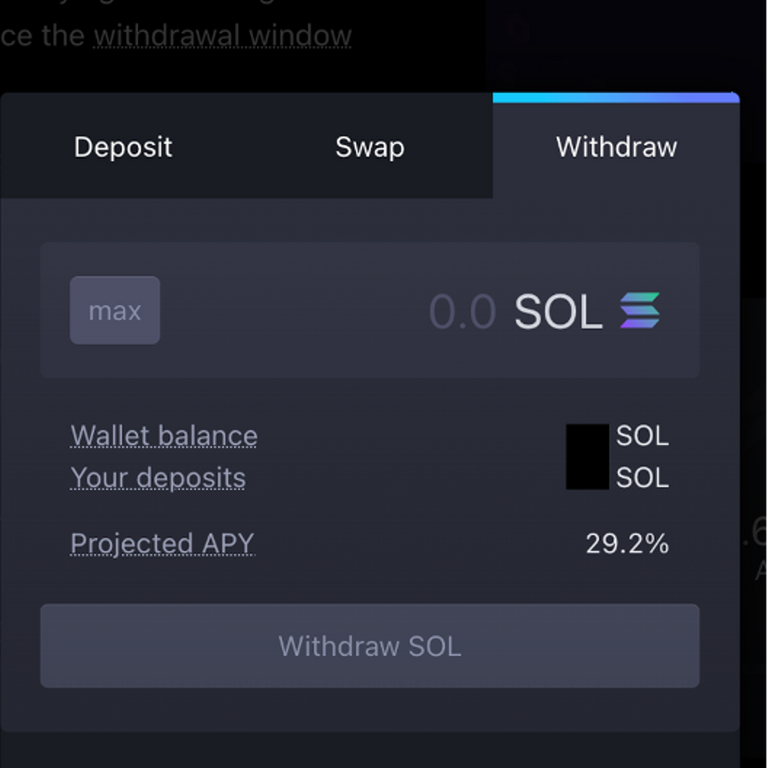

To make a withdrawal, click on your position followed by the withdraw button in the withdraw tab.

Next, simply enter the amount you would like to withdraw and approve the transaction in your wallet.

Friktion charges a 0.1% standard withdrawal fee. The small withdrawal fee is great to see when compared to some other protocols, as it means Friktion only really earns when you earn (due to their performance fee of 10% of profit). Once the current Epoch (in which you are participating) has concluded, your withdrawal will be processed. Note that your Volt tokens will be burned when the withdrawal is processed.

Volt 2 – Cash Secured Puts

First click on 'Volts' at the top of your screen, followed by 'VOLT #2: Sustainable Stables'.

Same as for Volt 1, you'll see the list of the different cash-secured put Volts available. For these, you will deposit stablecoins, and sell put options.

Again, you'll need to do your own research into what Volt you would like to go with (https://app.friktion.fi/analytics).

Once you've decided, click 'deposit'.

From here, you can follow the exact same steps as outlined for Volt 1.

Note that in the 'Analytics & details' section, the 'quote asset' is the token that you deposit (and the token you will earn yield in) and the 'underlying asset' is the token that Friktion uses in options trading to generate the returns.

Posted Using LeoFinance Beta