The Distress Caused By The Issuance Of New Currency Notes In My Country

Queue at an ATM terminal

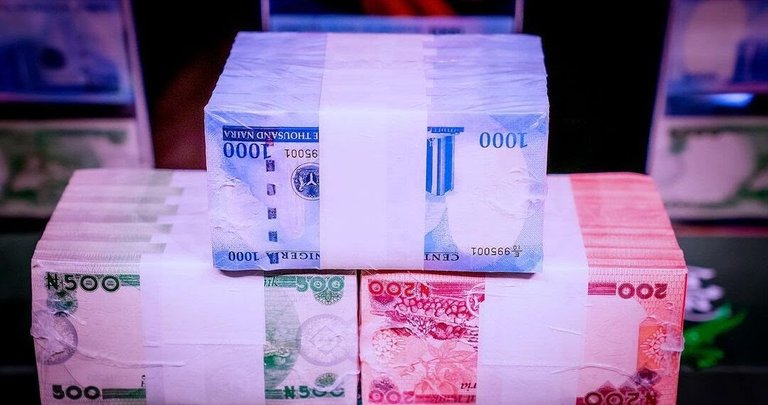

The Central Bank of Nigeria, my country's apex bank, announced its plan to revamp some denominations of the Naira, the country's currency, in the final quarter of last year. The reasons behind this new policy are an overdue periodic review of the local currency, money hoarding, inflation, and a high rate of counterfeited Naira banknotes, as well as a surge in kidnapping because of substantial ransoms paid to perpetrators. The bank claimed that 85 percent of banknotes in circulation were outside the banking system's treasury, which threatened the strength and value of the Naira.

Logo of the Central Bank of Nigeria

The bank stated that the revamped Naira banknotes would be unveiled on December 15, 2022 and January 31, 2023 would be the deadline for the cessation of the old Naira banknotes as legal tender. The news of this new policy was received with mixed reactions, leading to debates among Nigerians , with some supporting it while others disapproved. However, the apex bank defended its new policy by highlighting the benefits that the nation would gain, including the injection of banknotes outside financial circulation back into the banking system, reducing inflation and counterfeiting, and reducing kidnapping through enhanced security features on the new banknotes.

The new policy was implemented as planned, and the new Naira banknotes were launched by the President of the country. The apex bank urged Nigerians to support the new policy by swapping their old Naira notes for the new ones at their banks and assured them that the process would be seamless. Unfortunately, the implementation of the new currency policy was not as smooth as the Central Bank of Nigeria claimed it would be. Nigerians faced difficulty obtaining the new Naira banknotes after depositing their old ones in commercial banks, and the amount of new Naira banknotes given to them was dismal. The short deadline for the currency swap also put pressure on Nigerians and left them at the mercy of their banks.

The implementation of the new currency policy has also provided commercial banks with an opportunity to exploit Nigerians. These banks and Point of Service (POS) operators engage in the illegal act of hoarding the new Naira banknotes and charge Nigerians exorbitant fees to obtain them. This has led to a decline in trading and commercial activities, as well as difficulty in obtaining essential services like healthcare and transportation. There have been reports of patients being deprived of medical care because they could not make payments with the new Naira banknotes, leading to dire consequences.

Nigerians have complained to the apex bank about the difficulty of obtaining the new banknotes and asked for an extension of the deadline. The apex bank received these complaints but insisted that the deadline would not be moved forward, advising Nigerians to continue with the swap. However, the apex bank later yielded to the demands of Nigerians and extended the deadline. The Supreme Court of Nigeria also gave a ruling in favour of the extension of the deadline for the currency swap a few days after the apex bank made its decision . The ruling was the outcome of a suit filed by some state governments against the Central Bank of Nigeria on its new currency policy. Despite these developments, the new Naira banknotes remain unavailable, and the situation is getting worse every day.

The hardship experienced by Nigerians is further exacerbated by the poor online banking services offered by commercial banks, which have failed to provide a solution to the cash scarcity. In conclusion, the new policy of the Central Bank of Nigeria, although aimed at reducing inflation and counterfeiting, and curbing kidnapping, has caused more harm than good, with its implementation being unsuccessful. The apex bank needs to take immediate action to address the issues faced by Nigerians and ensure that they are able to obtain the new Naira banknotes easily and without excessive charges. In any case, financial policies are meant to enrich the lives of citizens and not impoverish them.

Thanks for reading.

See you on the next one guys.

all image source added in photo caption

Yay! 🤗

Your content has been boosted with Ecency Points, by @bhattg.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more