Over heating the bull market

Trading view

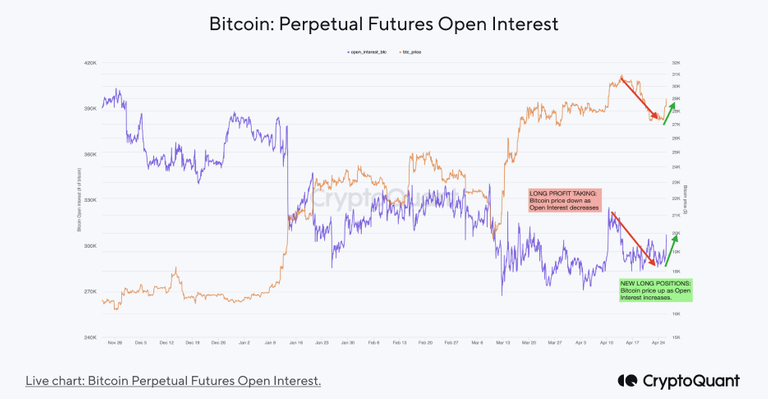

The recent declines in the Bitcoin price has been due to profit-taking by traders in the perpetual futures markets, with open interest falling. The "long squeeze" caused massive liquidations, giving investors an opportunity to " buy the dip." Traders also took profits as the ETH price jumped over $2,000 after the Shanghai upgrade on April 12 and Binance opened Ethereum withdrawals on April 19.

The market participants are witnessing sudden Bitcoin price movements because the bear market is officially coming to an end. While timing the market is a bad strategy, the Bitcoin market has some advantages such as on-chain historical data depicting exact days and patterns after which massive BTC price rallies can be expected. BTC price fell 10% last week after surpassing the $30,000 psychological level, which signals the start of the " overheated bull phase" as bulls takeover bears. The recent BTC price rally from $20,000 was actually supported by Bitcoin entering the bull market cycle in January and crossing the key 200-weekly moving average (WMA) in March.

Crypto quant

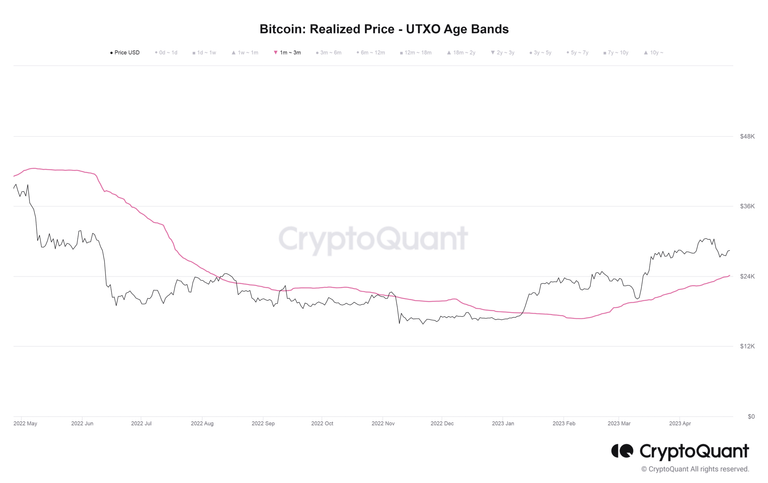

Traders have again started opening long positions and spending activity of whales remains higher. Typically, price rallies occur during whale spending activity with at least 20% of total coins being moved, but Spent Output Value Bands indicate whale spending activity rose above 40%. In fact, whales with over 10k BTC had a spending activity of 25%, the first time since the FTX fallout. This coincides with many dormant whales waking up after 8–10 years. Bitcoin Price Begins Bull Run Bitcoin price currently trading in the $28k-30k range, with volatility rising as the bull market starts. The short-term cost basis or the realized price is at $24,000, indicating the key support level for this bull market.

Traders wait for two key events before a rally can potentially start, Friday's monthly expiry and the U.S. Fed rate hike decision on May 2nd, This could be the last rate hike by the Fed before it looks to cut the funds rate from September. While the global market keeps an eye on the U.S. debt ceiling crisis, Republicans are actively working to increase the debt ceiling amid risks of a recession. The US dollar is also weakening, which will likely increase BTC prices. With Bitcoin halving to happen in April 2024, the BTC price is likely to surpass $100,000 and probably we will never see BTC below $20,000 again in the short term.

Posted Using LeoFinance Beta

Copying/Pasting content (full or partial texts, video links, art, etc.) with adding very little original content is frowned upon by the community. Publishing such content could be considered exploitation of the "Hive Reward Pool" and may result in the account being Blacklisted.

Please refrain from copying and pasting, or decline the rewards on those posts going forward.

If you believe this comment is in error, please contact us in #appeals in Discord.

Noted

Congratulations @topworlds! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 600 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!