Fear Grips the market as investors sentiments shifts

Over the week Investors' where having anxiety about the financial market starting from forex market too the cryptocurrency as turbulence has approached an extensive levels associated with heightened fear as the S&P 500 and dollar index blooks which is set to wrap up its worst weekly showing in three months.

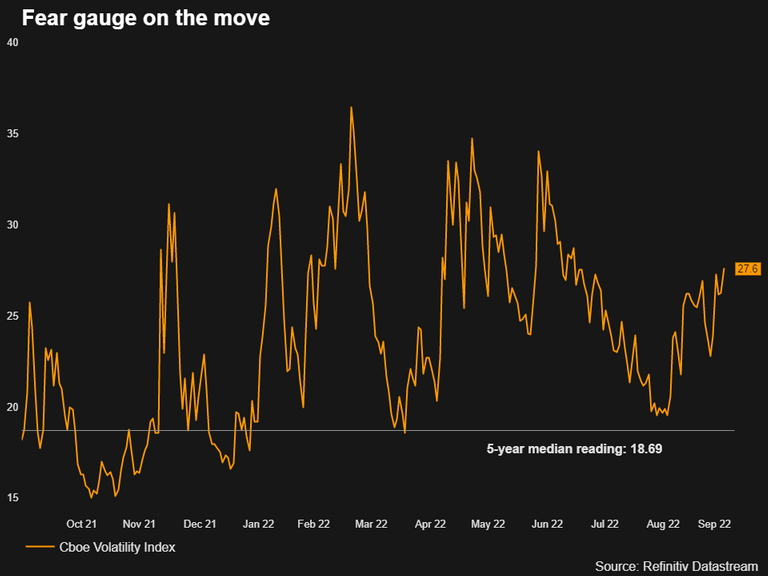

GRAPHIC: Fear gauge on the move

The Cboe Volatility Index - which has been known as “Wall Street's fear gauge” and which helps too measures the expected price reaction of the stock market volatility as expressed by options prices - was up 1.38 points to 27.65, after hitting a two-month high of 28.45.

VIX readings above 20 are generally shows that there is elevated sense of investor anxiety about the near-term outlook for stocks and financial market, while readings north of 30 or 35 point to acute fear and have been accompanied by steep losses in stocks.

"The market is showing a much better recognition of the current and potential risks coming down the pipe," There haven't been numerous shortage of reasons for investor to be concerned about the condition.

The U.S. stocks' volatile run this year has shows no signs of abating as stubbornly high inflation data makes it likely the Federal Reserve will continue to raise U.S. borrowing costs faster and further than previously expected, boosting the chances that the U.S. economy will run into trouble.

The latest blow to investor sentiment came late on Thursday after FedEx Corp withdrew its financial forecast, blaming an acceleration in a global demand slowdown.

That helped send Wall Street's main indexes to near two-month lows on Friday, with the S&P 500 on pace for a weekly drop of about 5%, its worst fall since mid-June, but October still has some more days for the market too balance of its self.