Preparing for the Long January: Managing Crypto Investments and Festive Budgets

The current state of the cryptocurrency market requires caution, as it has become increasingly unpredictable. It’s challenging to determine whether the market will experience a significant surge or a major dip. Recently, Bitcoin (BTC), which often serves as a key indicator for other cryptocurrencies, surpassed the $100,000 mark. However, an interesting observation is that despite Bitcoin's rise, most altcoins have remained stagnant, with only a few showing slight gains.

As the market grows, we are also in a festive mood, which could influence the dynamics. Many people may be looking to cash out their investments during this period, potentially affecting Bitcoin's price. However, this is merely speculative and may not have any real impact. My advice is simple: don’t put all your eggs in one basket. Diversification is essential to avoid losing everything when you get carried away by short-term gains. Even if the market dips, you can recover your losses as long as you don’t panic-sell and have invested in solid, credible cryptocurrencies. On the other hand, some projects are doomed from the start, so thorough research is crucial before investing in any altcoin. The rise of fake coins and unreliable projects makes vigilance even more critical.

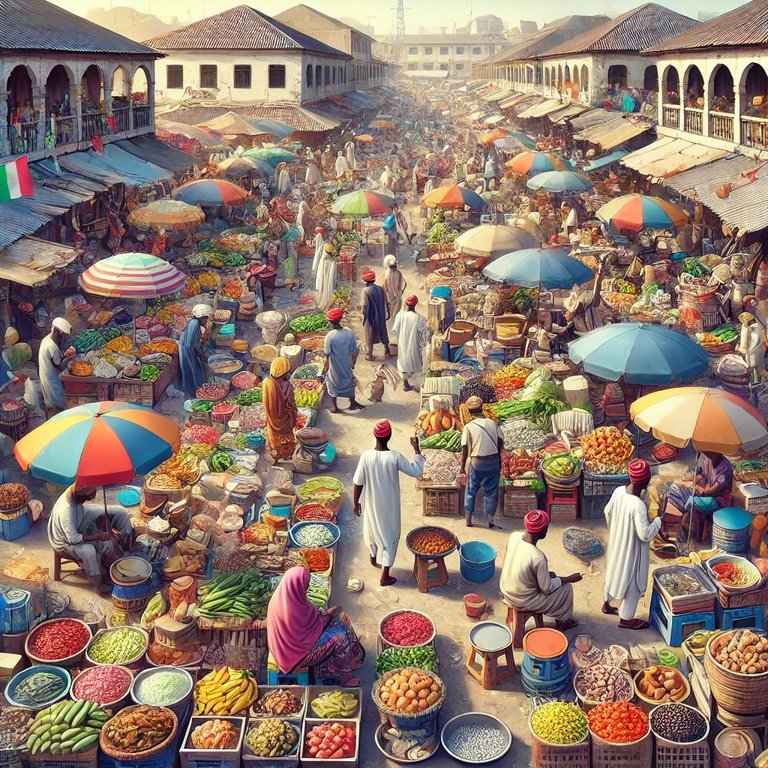

Moving beyond the cryptocurrency market, it’s worth discussing the festive period. In this part of the world, Christmas and New Year are significant celebrations, and people often spend a lot of money to make them memorable. Families use this time to visit loved ones, give gifts, and create beautiful experiences. While this is a wonderful tradition, it’s important to be mindful of our finances. Overspending during the festive season can lead to regrets in January, a month often described as long and financially difficult due to the money spent in December.

I recently spoke with a friend about her plans for the holidays. She mentioned that if her $100 cryptocurrency investment yields $500 during this bullish market, she might consider travelling for Christmas. Otherwise, she would likely stay home. This conversation made me reflect on my own situation and the importance of earning additional income outside my primary assignment as a teacher.

Although I have a small garden I tend to, it isn’t enough to cover the rapidly increasing cost of goods and commodities. Prices are rising so quickly that even people with stable jobs are struggling to keep up. For those without regular employment, the situation is even more challenging. This raises the question: What can we do to manage these tough times?

In conclusion, It’s clear that being financially responsible is essential, especially now. Balancing the excitement of the holidays with the reality of our budgets is key. We need to spend wisely, save where possible, and avoid unnecessary expenses to ensure we don’t find ourselves in difficult situations later. It’s also important to look for ways to earn extra income, whether through small businesses, investments, or other ventures.