LENDING & BORROWING CRYPTOCURRENCIES: ITS RELEVANCE.

In recent times, there has been massive improvement in the awareness of cryptocurrency across the globe. Most especially with the introduction of DeFi, which allow Fintech and crypto savvy to carry out financial transactions without third party intermediation. The innovations within the DeFi space have already shown how utilizing blockchain technology for financial services can offer an alternative to conventional bank products. From insurance to savings accounts and securities trading, DeFi technology has opened up a variety of services that fintech startups can offer.

One of the fastest growing areas of DeFi is the flexibility around borrowing & lending which involves cryptocurrency-backed loans between the investor and the other party who is in need of this digital asset to quickly consummate transactions. Just as traditional financial institutions offer secured fiat currency loans against a car or house, a crypto loan is secured using cryptocurrency as collateral. When it comes to crypto lending, borrowers also have the chance to stake their cryptocurrency as guarantees of loan repayment or as security. Thus, the investors will be able to sell the crypto assets in case the borrower doesn’t pay off the loan anymore, meaning that they can recover the losses.

Some of the DeFi platform that offers lending & borrowing includes;

https://www.kava.io/

https://www.mantra.finance/

https://lendabit.com/

https://www.cakedefi.com/

https://ledn.io/

https://www.matrixport.com/

Crypto lending is a way for you to earn some interest with cryptocurrency if you have it sitting in your wallet and don’t plan on selling your assets. This way, your digital currencies can offer you some value in return. So, it is a great opportunity to make some money, especially if you need extra funds to cover different expenses or pay debts.

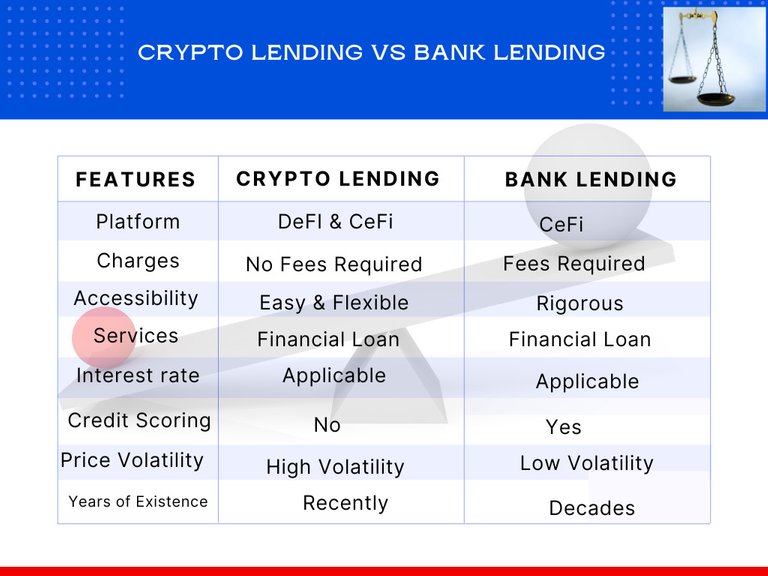

it’s clear that cryptocurrency lending has the upper hand when it comes to loans. The pros far outweigh the cons, and the cons aren’t actually that big of a deal. Even though cryptocurrency lending is relatively new in the industry, it is technologically superior to traditional bank lending in many ways. Crypto lending offers more flexibility, more options, and more security than bank lending.

Conclusion

Conclusively, Cryptocurrency lending is an innovative option in comparison to bank lending. However, cryptocurrency loans are not just new methods for anyone to get their hands on crypto-assets. On the contrary, they also offer a promising tool for increasing the value of crypto assets rather than letting them sit in the wallet idle. The popularity of crypto lending has gained momentum with the DeFi revolution and will continue to soar in the future. This innovative has come to start and more Defi are being launched to have their own share in the ecosystem.

References;

https://cointelegraph.com/explained/defi-lending-and-borrowing-explained

https://www.stilt.com/

https://101blockchains.com/crypto-loans/

https://twitter.com/DapoOla81/status/1578565254954598400

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @tolbeu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 600 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!