Why I Keep Adding Polycub

Since the release almost 3 months ago, I supported Polycub completely. This continued even as the price of the POLYCUB token dropped. This also pulled down the value of xPOLYCUB, resulting is smaller numbers in USD terms.

Nevertheless, when you believe in a team, you keep at it. We are still not out of the woods yet but the crash does appear to be over.

As of this moment, the USD price for POLYCUB is just under 20 cents. It bottomed out around 13 cents, which is still a large move from its all time highs.

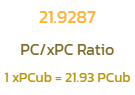

What is still growing is the POLYCUB/xPOLYCUB ratio. This was promised to always go up and it does.

Right now we sit just under 22 POLYCUB in each xPOLYCUB. Remember, this started as a 1:1 ratio.

pHIVE Liquidity

A great deal of focus was placed upon the pHBD-USDC liquidity pool. Obviously, providing that for HBD is vital since we see a massive shortage of liquidity. This pool jumped initially yet has settled down. This is something we will have to keep an eye on going forward.

However, there was an addition that I thought would get a lot more activity and perhaps it is starting to come to life.

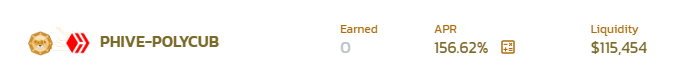

The pHIVE-POLYCUB liquidity pool filled a great need in my opinion due to the fact that HIVE is not readily available in terms of where people can buy it. This is similar to HBD. There is one difference between the two: a lot more HIVE exists than HBD.

For this reason, we could be seeing some growth in the liquidity pool over the next couple months.

As it stands now, there is over a 150% APR on this farm.

There is now over $100K in the pool. This is nothing spectacular but we have to keep in mind the price of both HIVE and POLYCUB was hammered. If we start to see a bit of upward movement, the value of the pool can jump.

This, of course, can help to attract more capital, pushing the value even higher.

Another Halving

We are about a week or so out from another halving. As we enter June, this was always a targeted area for many. The number of POLYCUB released per block is going to drop to .25. This is really starting to affect the amount of new tokens that do hit the market.

We have to keep in mind that we are still without Bonding or Lending. These two features will do a lot of add value to the platform. The former will allow the Treasury (Protocol) to take over parts of the farms by acquiring its own assets. This will increase the amount of POLYCUB that has to be bought on the open market.

At the same time, the lending will allow users to access locked up capital. This could be used to really enhance one's holdings. At the same time, it will also feed more capital into the TVL.

A final point that is vital is to remember that, with platforms such as this, all amounts are in USD. That is the common thread throughout. Hence, when the value of the assets on there increase, the totals start to jump. All numbers are affected which only expands the value.

With POLYCUB being in 4 farms, the price in USD has a big impact. Since the distribution is facing another halving, we are approaching the time when new POLYCUB is going to be scarce. That means the returns are going to have to be achieved through buy pressure on POLYCUB.

This was the entire point of the Protocol.

We might not be there yet but we appear to be closing in. There will come a time when we are going to see this entire platform flip and the supply/demand for POLYCUB will reverse.

Once that happens, the farms will see an increase in value which will only help the entire process.

We are still less than 90 days in. Where will this platform be when it is 6 months old?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I was away when the sps pool started so I missed it. I realized when I got back that I forgot how to get my assets onto poly lol. This stuff takes awhile for me to get it through my head.

Posted Using LeoFinance Beta

It take a bit but you will get there. Just break it down into steps.

There is bridging from whatever chain over to Polygon. Then there is getting the proper tokens. After that getting the LP which then can be added to the pool.

Posted Using LeoFinance Beta

Yes exactly. One step at a time! It should take no more than 20 minutes to do everything you need to do to get into an LP!

Posted Using LeoFinance Beta

The Hive ecosystem is so exciting!

Posted Using LeoFinance Beta

Yes it is. The pHIVE and pHBD pools help POLYCUB to extend further out. This is something that is very exciting.

Posted Using LeoFinance Beta

Wen bHIVE and bHBD?

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.We have to wait and see the surprises that the #Leofinance team with POLYCUB and xPOLYCUB will bring us in the coming months, as well as being aware of projects such as pHBD-USDC will surely bring us many benefits in the near future.

I am not sure there are a ton of surprises as such since a lot of the road map was revealed. What is unknown is what the next pools are going to be.

Either way, we need to get some of the roadmap going.

Posted Using LeoFinance Beta

!PIZZA

!LUV

@taskmaster4450le, @tin.aung.soe(2/3) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

PIZZA Holders sent $PIZZA tips in this post's comments:

@tin.aung.soe(2/5) tipped @taskmaster4450le (x1)

Please vote for pizza.witness!

Which is better between the pHive-Polcub and PHBD-USDC LP or one can just randomly add some LP to both, or probably the APR determines the choice one makes?.

Posted Using LeoFinance Beta

The APR is based on your portion of the LP out of all LP, how much PolyCUB is allocated to that pool, and the price of PolyCUB.

I would say that the PHBD/USDC is fairly stable in fiat value. So it has stability. pHIVE/PolyCUB is riskier because there is IL if the ratio between pHive and PolyCUB changes. At the same time, pHIVE has a boost right now due to the governance vote results. So the APR could drop when the next vote takes place.

Posted Using LeoFinance Beta

It’s interesting to see how the governance has taken shape. I am wondering if we’ll see significant changes in this week’s governance

Posted Using LeoFinance Beta

It depends upon what you have and what you are looking for. The stablecoin pool should be fairly stable. With pHIVE-POLYCUB, there is the ability to enjoy appreciation if you think both tokens are going up.

Posted Using LeoFinance Beta

Thanks for this.

Posted Using LeoFinance Beta

Absolutely - one offers much more stability and the other offers much more volatility. Volatility can both help and hurt - depending on price movements

Posted Using LeoFinance Beta

This is similar to the APR of SPS, when the SPS airdrop was started. Probably it will go lower, similarly to the APR of SPS, so the early adopters can earn much more return on their investment than those, who invest in it later.

Hard to say. Especially with cryptocurrency. Anything can happen.

That is true. However, with the effort being put in, it is likely we will see a great deal more in the future.

I expect the token price to be significantly higher in 6 months.

Posted Using LeoFinance Beta

A month will come when I will add more POLYCUB and CUB as well. As for CUB, I remember that 3 months ago with only $80.00 buying power, I bought 151. Now, with the same amount, I can add 2k CUB. It's really a bargain now.

Posted Using LeoFinance Beta

Down markets are great times to accumulate. This is how we make a huge difference in our wallets.

Posted Using LeoFinance Beta

Yes, rather than be concerned with the price, it's better to focus on volume.

I am still wondering when the lending and bonding mechanism will come out. It just seems like the delays keep coming.

Does the vault only start generating assets when bonding/lending comes out? I thought the fees that were generated so far would end up in that vault and it was already growing.

Posted Using LeoFinance Beta

Coding takes time.

No. Fees factor in also. There are the direct fees in the LP when people convert. Also the bridge fees play into this also as does the staking of HBD and HIVE.

Posted Using LeoFinance Beta

Its another wild ride. I wish I had more money to buy into stuff like this, but learning is a lot of fun too.

Posted Using LeoFinance Beta

We end up running out of resources before we run out of options.

That said, keep building and growing. That is what is important.

Posted Using LeoFinance Beta

Things are bright for PolyCUB :) It's only been a few months and growth is on the horizon. People might still be on the fence trying to see what happens.

It's great to see the interest in pHive-PolyCUB. The last time I checked there was around $60k+ liquidity, now it has more than doubled and the APR is sweet at 150+%.

Posted Using LeoFinance Beta

It helped that both tokens moved up in price. That is the advantage to a pool like that. Of course, if prices go down, so does the value in the LP.

Posted Using LeoFinance Beta

Yes, that's right. Both tokens had their price rose today so it reflected in the overall liquidity of that pool

Posted Using LeoFinance Beta

Yes and if POLYCUB goes on a major run, things will get very interesting.

The TVL will really appreciate. We will see what happens after the next halving which, I believe, is this weekend.

Posted Using LeoFinance Beta

That would be interesting to see. And the halving will make it even more scarce.

Posted Using LeoFinance Beta

It’s gonna be fascinating to watch this unfold.

I can’t wait

Posted Using LeoFinance Beta

Many investors prefer xPOLYCUB. xPOLYCUB is promising, so it's not surprising that most investors prefer xPOLYCUB. If everything goes well, I think it can even go up to $100 in the future.

Posted Using LeoFinance Beta

With it nearing 23 PC/xPC, it is easy to see how it can happen. That will require just over $4 PC.

In another couple months we will likely be at a ratio of 25.

Posted Using LeoFinance Beta

I expect this to happen in the short term. But in the long run, 5-10 years later, I think it can be at an incredible profit point.

Posted Using LeoFinance Beta

It appears that CUB has been abandoned.

Posted Using LeoFinance Beta

Everything being built on Polycub will be moved to Cubfinance in one update.

So that will get an injection like a steroid. The development is taking place in Polycub first then rolled out.

Some are taking advantage of this time to add more CUB.

Posted Using LeoFinance Beta

Good to know. I have a fair bit of cub floating about there, but it has been hammered as it was dumped so people could go into polycub. Seems a bit counterproductive in some way.

I am learning how to use Metamask and the Polygon network to invest in Polycub.

I already got a few cents from Matic to make my first transaction on the network, for a faucet that I made a post on how to use it.

My idea is to invest little by little in Polycub by transferring my pHBD and my PHive to the Polycub farms.

pHIVE-POLYCUB, would it be the best option for the APR?

Posted Using LeoFinance Beta

PHIVE-POLYCUB has the highest APR right now since it was voted to the top in governance. This could change but it looks like it is to remain for the time being.

Naturally, all of us Leo Lion’s are Hive holders, so it makes sense!

Posted Using LeoFinance Beta