Urban Real Estate: Major Market Distortion

Real estate is a hot topic these days. Obviously, it is a vital component to any economy. It is an industry that employees a large amount of people and has tentacles that extend far.

In the developed world, it is not uncommon for real estate to make up for 20%-30% of the overall economy.

Therefore, when we see major run up like we did the past decade, we see a lot of speculation as to where things are going.

Obviously, crashes in the real estate market can wipe out a great deal of wealth. When things start to decline, a lot of jobs are lost. It has a direct impact upon construction also. Between the two, employment loss has a huge impact upon the economy.

We are seeing this right now in the mortgage industry.

This has people questioning whether we are in for a crash. The question is whether something bigger is actually taking place.

We will delve into this to see what is taking place.

Artificial Urban Real Estate Bubble

There is a chance we are starting the globalization of real estate. This is a multi-decade process that will having countries vying for people to become ex-pats. We will discuss that in a bit.

Many are looking for a burst of the real estate bubble that started after the Great Financial Crisis. However, we are looking at something that goes back much further.

Part of the problem is that, since the end of World War II, we watched the artificial urban real estate bubble form. It was something that is now nearly 80 years old. This also created a major distortion in the market.

All of this stems from jobs. Over that time, we saw migration from the rural to urban areas. This accelerated when globalization became popular and manufacturing was moved offshore. It was a shift that really affected rural areas, making it even less attractive than before.

Hence, we saw tens of millions of people moving into the urban areas, being packed in like sardines. While it is true there was urban sprawl, the fact is most cities were limited in where they could go geographically. Many such as NY, San Francisco, and Miami have water, meaning expansion could not go in that direction.

Of course, this was offset by going up.

Whatever the solution, we have a situation with more people being packed into a relatively finite area. This will naturally send prices upward.

Yet, would this be the case if there was not the monopoly on jobs? The answer to this question might be shown to us in the next decade.

Remote Work Busting The Monopoly

The rural areas could get a major boost due to remote work. Over the next half decade, this concept is going to become commonplace, especially with cryptocurrency growing in reach. If those areas are positively affected, that could mean the urban areas suffer the negative impact.

At present, we are seeing a lot of drawbacks to urban areas. Crime is on the rise. The cost of living, in large part due to real estate prices, is through the roof. Taxes are getting out of hand. Congestion remains a major problem. Finally, after 2020, many people fear living in such close quarters.

All of this is showing up in the stats.

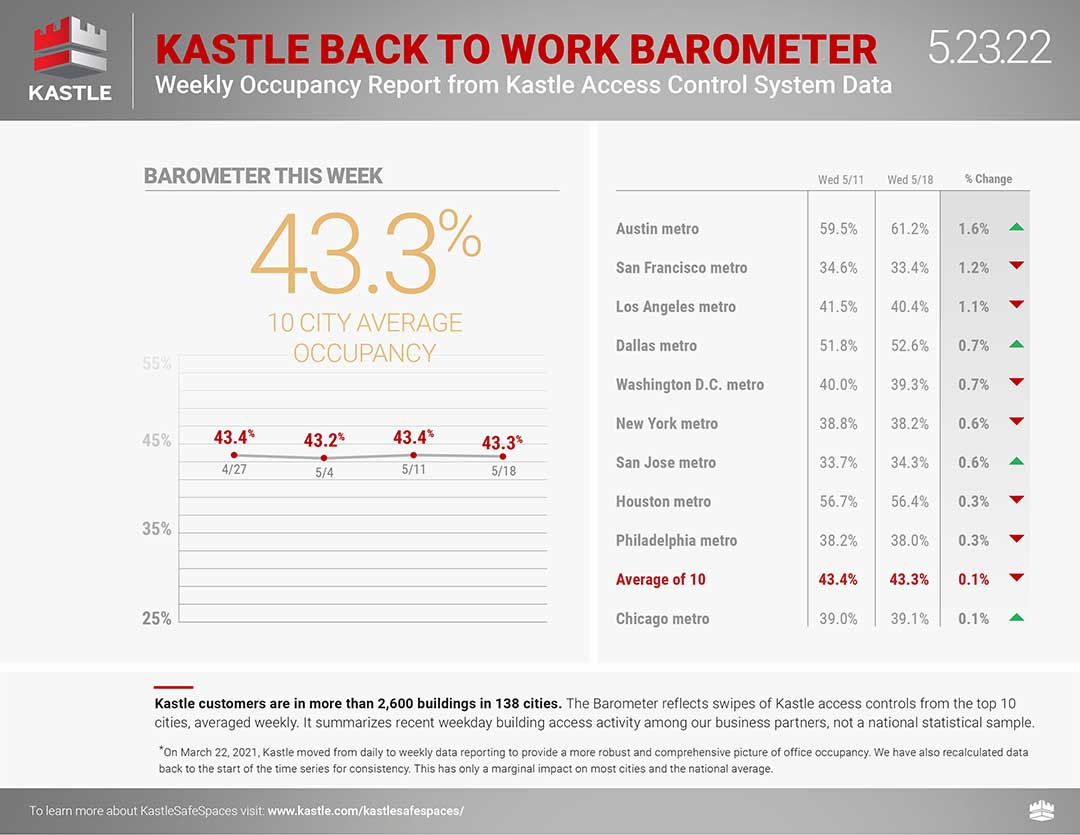

This is a barometer put out by Kastle, a real estate tech firm. As we can see, of the major cities surveyed, we are not even to 50% occupancy.

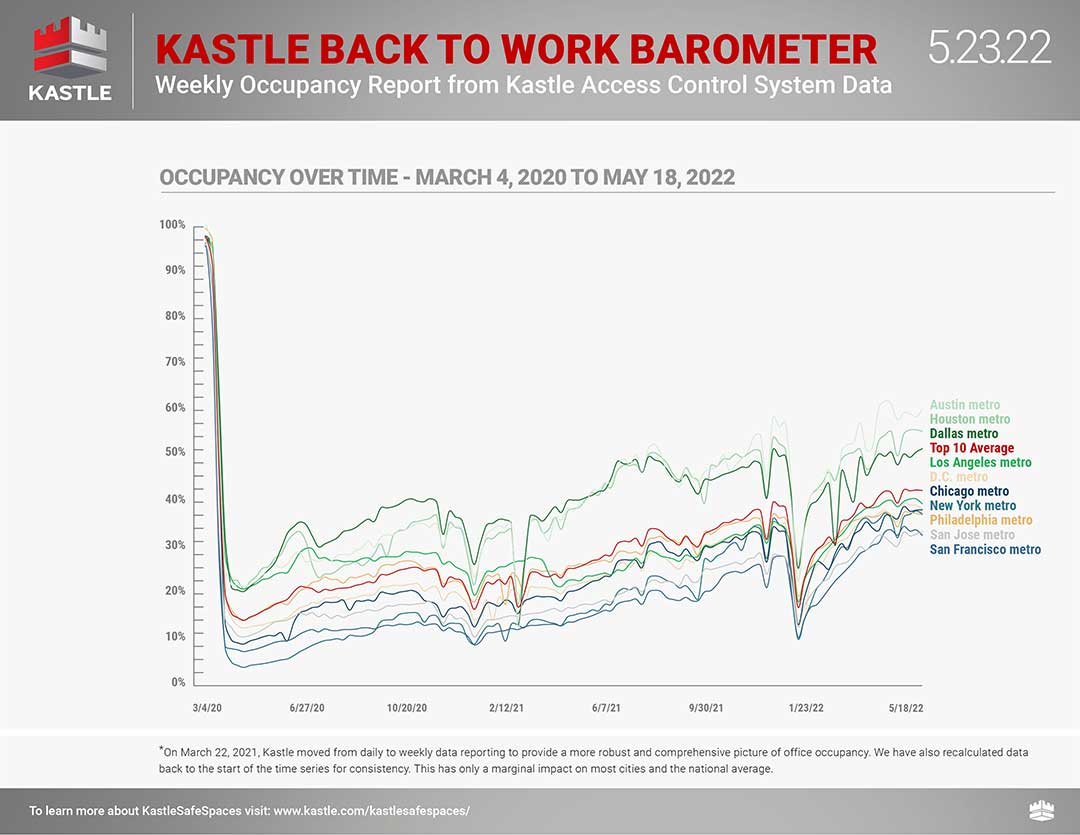

Looking at it compared to 2020, here is what we see:

The longer this transpires, the worse it gets for both, commercial real estate providers along with companies that are debating calling employers back to the office. At this point, habits already are being ingrained.

Simply put, the idea of going back into the office is unappealing to many.

As outlined in the Globalization of Real Estate article, this is phase 1. The fact that occupancy in offices is down means that people can move further out, having a radius of 3-4 hours as opposed to one.

Over time, the work from home mindset will set in and we are going to see the relocation from the urban to rural areas. This could have major effects on urban real estate.

Of course, a case is being made that this is just correcting a decades long distortion.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

It's definitely going to be an interesting thing to watch over time to see how it goes. Many people want remote jobs and will get some sort of remote job but as well, a remote job isn't for everyone. Some things suffer dramatically such as personal and romantic life by being isolated from coworkers. It remains to be seen how this will affect things. I didn't meet my wife at work but I know some who have and the notion of them not having the chance to do that is unsettling for them. We can of course connect virtually but it's not the same. You can't get the subtle hints over a zoom or teams meeting.

I'm wondering if investing in real estate on a mountainside or something would be more attractive to people looking to rent while working remote than buying something close to the city.

You will forget about communication with colleagues if you experience hunger, or the winter cold.

Posted Using LeoFinance Beta

If I was going to invest in real estate now, I would go industrial. This is going to be where a lot of wealth is created as the supply chain adjustment takes place.

Posted Using LeoFinance Beta

Yeah that's a good idea. How do you think it would be available as someone who doesn't have significant capital to put into industrial? As an investor I think that sounds good but I don't have the funds to build a million dollar warehouse.

Its becoming more interesting now, the work from home made it all easy for one to live anywhere and still own an office online.

Are we going to experience an urban to rural migration now, probably a balance to set things right.

Why not live in a spacious rural environment and work from home, having seen some who live in rural places and travel for hours to work in the cities daily.

Posted Using LeoFinance Beta

For those who only deal with the hive, there are no boundaries at all)

Posted Using LeoFinance Beta

A lot of it is going to be driven by finance. This is where it gets real. The household budget has a way of making a lot of decisions.

Posted Using LeoFinance Beta

I'm used to working from home, frankly, I don't plan to go back to the office. Although there are some disadvantages, the advantages of working remotely are quite a lot for me.

I don't think most people with the opportunity will ever go back to the office.

Posted Using LeoFinance Beta

Offices will be overgrown with cobwebs)

Posted Using LeoFinance Beta

Yes, it probably will.

Posted Using LeoFinance Beta

LOL That certainly is a potential forecast.

Posted Using LeoFinance Beta

This has its advantages, lol, you can sell tickets to the offices of arachnologists, who will pay extra for each spider caught). I came up with a new type of business in the conditions of the global crisis)

I dont think the majority are on board with that. Going back to the office might appeal to some but I am not sure the majority.

We will have to see how this all unfolds.

It is going to be interesting to see how quickly this happens.

Posted Using LeoFinance Beta

This may vary according to the profession and working conditions. But I think those who work with computers like me will want to continue working remotely.

We'll watch and see how all this unfolds.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Yes, you need to have time to get rid of an apartment in the city and buy a small ranch, or a farm, as they say in Ukraine. In just one moment, you can expand your home's heating options, from wood to solar panels, at a time when the city may be facing a massive energy crisis. A well, a garden, a barnyard, this is a small part of the possibility of self-sufficiency, even if you find yourself without electricity.

Posted Using LeoFinance Beta

I prefer to do my commenting on Leofinance by candlelight.

It is very 19th century of me.

Posted Using LeoFinance Beta

Why is it so, to exaggerate what has been said, lol, we are not in the 19th century, civilization, you can buy an exercise bike and connect a dynamo to it while you pedal, work at Leofinance)

incredible did not know everything that represents the real estate market within the economy of a country almost a third. Now when it stalls for any reason how to reactivate it in that case

There could be a lot of people who are disrupted because of this.

Posted Using LeoFinance Beta