The Screw Up Elon Is Generating Another $22 Billion For Tesla

Unless you are living under a rock, you can't help but to notice Elon Musk is everywhere. He is far worse than the Kardashians at this point. You can't flip on anything without seeing his ugly mug.

As a fan of Elon I say that with the utmost of honesty. He is a very smart guy. George Clooney...he is not.

Nevertheless, he doesn't need to be good looking to be effective. So while he is conducting Twitter polls, he is sending the shareholders of Tesla stock into a frenzy. Of course, most of them are Wall Street parasites who deserve what they get. They always play their game which is on a quarterly basis anyway.

For all the attacks he took, along with the stock, there is something happening that is very interesting.

Let us take a closer look.

Source

Tesla Is Only A Car Company

This is one of the dumbest things said about Tesla ever. We hear this from the naysayers, mostly people on CNBC who are fools to begin with. If you believe Tesla is a car company, you certainly are not paying attention.

Maybe it is tough to swallow Tesla as a technology company. Okay, I get that. However, it is far more than a car company and one where anyone who talks about a decline in demand is foolish.

The technology part keeps emerging on a regular basis. For some, it might be tough to see. What should be crystal clear is that Tesla, at a minimum, is a battery company. This is an entity that puts batteries on the market.

Over the last few years, the company admitted it was battery constrained. All batteries were first slated to go into vehciles simply because it is more profitable to wrap a car around them. Whenever there was excess, that was then sent to the energy division (for stationary storage).

Thus, we can see how Tesla is a lot more than a car company. This is something that is going to become evident in the next couple years.

100%-200% Annual Growth

If you thought the 50% annual growth for the car division was absurd, wait until you see the energy division. Musk stated on the last earnings call that he believes the energy division can grow at 100%-200% annually for years to come. In the past he stated that it will likely be larger than the car segment.

He is right on the target size but might be underestimating the annual growth.

Tesla energy will far surpass anything the company does with cars. This is a certain due to the total address market for energy along with the penetration that Tesla is going to be making over the next couple years.

So while everyone is watching how many cars are being produced, mixed in with whatever Musk is doing with Twitter, they are overlooking this tidbit

According to the last earnings report, the energy division did $1.1 billion in revenues. This is a bit over $4 billion on an annualized rate. The profit was minimal, like $100 million.

Keep these numbers in mind when we talk about this one project.

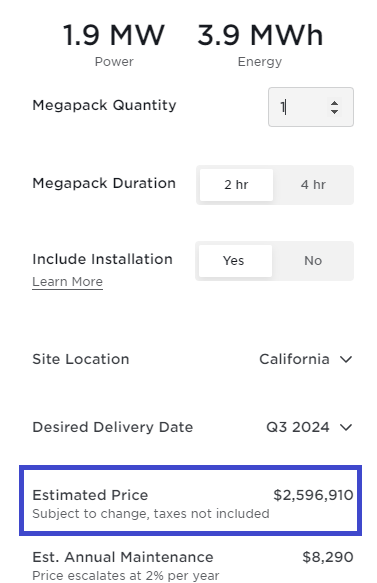

The Tesla Megapack is the flagship stationary storage device. This is for utilities to install to assist the grid. These things do not come cheap.

As you can see, they run over $2 million apiece. They are 3.9 MWh batteries.

Then we have this headline:

This works out to roughly 10,000 Megapacks coming from this facility each year once it is scaled up. At a price of over $2 million each, that is bringing in around $20 billion in revenues per year.

Not such a small number anymore. Of course, this is one factory and does not include the other product, the Powerwall. We saw recent run rates announced where they are now capable of producing 6,500 per week. That equates to over 70,000 per quarter.

With a selling price between $8K-$10K, we can figure that running into another $630M per quarter. Again, this is out of one factory.

Additionally, Tesla has increased Megapack output significantly at the factory. The manufacturer reported a weekly production capability of 42 giant Megapacks, up from 34 during the previous quarter. The automaker also stated that it produced 37,600 Powerwalls in the second quarter, but now it is capable of manufacturing over 6,500 Powerwalls each week, which would bring Tesla’s quarterly output of Powerwalls over 70,000 per year.

This is Giga Nevada. That facility pushed the Megapacks to a run rate of 42 per week. This equates to another billion dollars in revenue each year.

Not bad for a car company.

Perhaps this is why Elon is spending time on Twitter. He knows he had tens of billions in revenue coming in simply by scaling a plant that is already built.

Watch the numbers from the energy division over the next year. If we see the triple digit grow rates hit, it is game on.

This article is for information purposes and not financial advice. Author is a Tesla shareholder.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

That was a brilliant analysis of something that is so easily overlooked. Thank you for sharing. 😊

Heck of a provocative title too!

I laugh when I hear demand problems. Do people really think that battery demand will decline?

The idea that this is going to reverse course is laughable.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I remember reading a Wall Street Journal article five or six years ago suggesting that the data a car collects will someday be worth more than the car itself.

We are rapidly approaching that reality and Tesla will be leading that charge.

That is not surprising. Data ia very valuable. Tesla is training their autonomous unit by the data provided by cars. How much is that worth if they bring it to market?

Posted Using LeoFinance Beta

HUM HUM 🙂🙃🙃

Getting some #tesla shares are not a bad ideas during the bear drama.

!PIZZA

Posted Using LeoFinance Beta

I cant tell anyone else what to do but I have been adding to my holding during the drama.

Posted Using LeoFinance Beta

I gifted $PIZZA slices here:

@pouchon(3/5) tipped @taskmaster4450le (x1)

Join us in Discord!

Tesla is expanding quite fast but I feel that it's being drown out by Twitter. In a way, I think the price of the stock will drop because the stock holders are very concerned about the actions of Elon.

I am interested in seeing how it goes but I am just wondering about the price efficiency of it versus gas/coal. In a way, I wonder how things work out in terms of energy production across the US.

Posted Using LeoFinance Beta

Musk needs to remind holders of TSLA that the company is about more than "just cars" made for sale. Even if share price is dropping, that's true for much of the stock market. Retail investors in TSLA may be ignorant, but institutional investors should know better.

Posted Using LeoFinance Beta

The institutional investors have to face the ESG scores and other influences. So I think they want to avoid Tesla right now due to all the outrage that Elon is causing.

Posted Using LeoFinance Beta

Doesn't Tesla also make money from the sale of carbon offsets? Whatever we think of them, they are real and "people" buy them.

If necessary, the company can move to make the Tesla Phone a reality. This would be yet another stream of income (not to mention a superior phone).

Posted Using LeoFinance Beta

Solving The Money Problem has been a great channel full of Tesla related content. The person behind the channel has good research and his has put his own money in the line. Give the channel a look if you have time. You may find good information for more articles like this.

!PIZZA

Posted Using LeoFinance Beta