The Fed's Own Research Shows It QE Doesn't Achieve The Desired Outcome

The Fed keeps following the path of destruction. We are fortunate that the central bank keeps rolling out failed policy, one after another. We have QE to the moon when, in reality, if they knew what they were doing, once would be enough. Yet they keep going back to the same well, hoping this time it will work.

Of course, the US is following the Granddaddy of QE, Japan, down this path. That country is nearing 30 QE programs since it was invented around the turn of the century. We should count our lucky stars we are only at 6.

So, for a while, we are going to have Quantitative Tightening (QT) until Chairman Powell realizes, once again, he is on the wrong path.

Central Bank Liabilities

We see people pointing out how the central bank balance sheet increases. The focus is, of course, on the asset side. However, few realize what truly takes place.

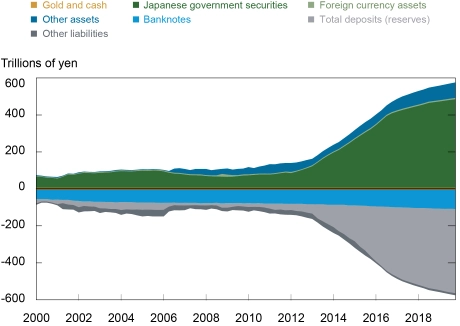

Here is the Bank of Japan balance sheet. All the major central banks mirror it in effect.

Notice how the assets increased due to the QE programs. However, there was an equal increase in the bank's liabilities. Anyone who understands simple double-entry bookkeeping knows that when as asset is added, it has to be equaled out on the other side of the balance sheet.

With these central banks, the corresponding move is liabilities.

Thus, when people say the central bank is expanding its balance sheet, it is vital to understand that both sides grow.

Reserves

When this happens, what are the liabilities on the balance sheet? Most understand the "buying" of securities adds to the asset side.

The liabilities are what the Fed prints. Unlike common thought, this not the currency. The major central banks do not create the currency. What they do print is reserves, which is really just bank money. This allows the banks to interact between themselves. In a swap arrangement, which is what QE is, the central bank owes the commercial bank for the security it "purchased".

This is where the reserve comes in. It is on the Fed's balance sheet. We can think of it as an IOU.

From the New York Fed itself:

In engaging in QE operations, central banks purchase government bonds, financing the purchases by issuing bank reserves—thus increasing both the central banks’ assets and liabilities

Notice how the Fed does NOT make these purchases using USD. This is not part of their structure.

Impact Upon Inflation

The goal of the Fed, and other central banks, is to get money into the broad economy. However, since they do not deal in the currency directly, they need to come up with "creative" ways to make that happen. If so, then inflation should show up.

It has not.

Here is where we get textbook compared to real world results.

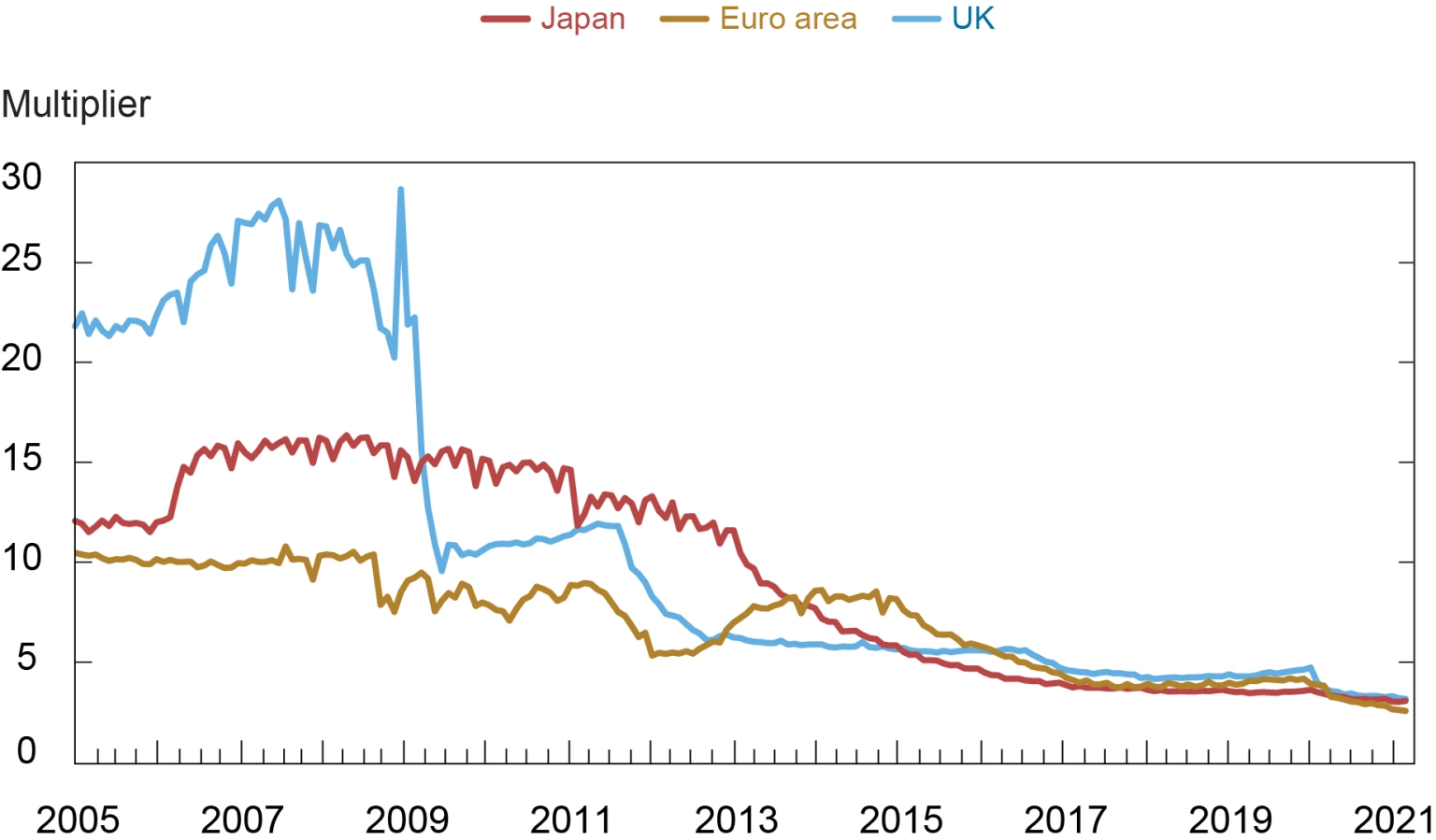

Now, according to the textbook narrative there is a fairly stable money supply process driven by the actions of the central bank. The key assumption is that both banks and the money-holding sector respond in a predictable way to an increase in the monetary base. The volume of broad money supplied to the economy is then determined as a multiple of the monetary base. According to this framework, therefore, the increase in reserves prompts banks to make more loans and create additional deposits equal to a multiple of this increase. The creation of additional deposits stimulates spending and drives up prices. The more massive the scale of asset purchases programs, the argument goes, the more upward pressure on prices.

Here is what where the fantast starts to roll off the tracks. The belief is the banks will start to lend simply because there is more flexibility as presented by the additional reserves.

What happens in reality is both borrowers and lenders (the banks) operate in their own interest. The Fed can try to push, prod and do what they think will get lending going, but the reality is it does not work.

But the international experience is that the large volume of reserves did not lead to a corresponding increase in broad money. Indeed, the evidence points to large declines in the money multipliers (see the following chart).

Source of quotes and charts: New York Fed

Of course, it is interesting that the research was for other central banks and not the Fed itself. But their track record is no different.

Policy Of Expectations

So why does the Fed (and other central banks) engage in these policies when they are proven not to work?

The answer is simple: they have to keep up appearances.

It is impossible for someone like Powell to step up and say, "we truly have no control over the economy like we profess and the fact that we don't even do money is a major part of the reason".

Since the Fed doesn't do money and can't control interest rates, what does it do?

Ben Bernanke, who led the US Federal Reserve during the global financial crisis, observed that the art of setting monetary policy was 98 percent talk and 2 percent action.

It puts on a show. That is all it does.

The Fed's own research proves that all the QE programs do not attain the desired outcome. Yet they still keep doing it, hoping that, at some point, it will magically work.

How soon until the public realizes the ruse?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450le, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.No action, all talk.

Surprise, surprise.

Posted Using LeoFinance Beta

Well when you do not do broad economy money, what else is there to do.

The Fed does not manage the economy, only tries to influence expectations. When people realize this, the mystery of the Fed disappears.

Posted Using LeoFinance Beta

Ha Ha Ha

True

I hope they don't cause a depression.

Posted Using LeoFinance Beta

I'm curious what our inflation numbers look like this next run a part of me feels they are going to remain high and will stay high no matter how much they increase the rate as that's not the root of the issue at the moment.

Posted Using LeoFinance Beta

It depends upon what you define high as.

We are already seeing signs of disinflation. There are many sectors where there are holes in the inflation story. Economic headwinds are going to kill demand in some areas. Energy and food remains elevated, and that might be the case for a while. However, that will affect other sectors so they will see a serious drop off.

One key is where commodities go. Will they keep the bull running or is there a reversal on the horizon. It is no surprise that things like Steel and Copper are already dropping. This is showing what industrial production and construction might look like.

Posted Using LeoFinance Beta

I think it will take a long time before the public understands but what do you think about the Japanese's plan of trying to keep rates low by their own fiscal policy? I have a feeling it could show a collapse in the faith when it starts to crack.

Posted Using LeoFinance Beta

It is a tough road for the Japanese (and in indicator of what is ahead for most other countries).

Their currency is under attack which means that they should tighten to stabilize. The challenge is the Japanese, moreso than the rest of the world, is addicted to the QE. They simply cannot get away from it since their economy is in pullback due to demographics.

It is the proverbial rock and hard place. A move on the scale of the YEN was not the markets but that was orchestrated by the government. I havent uncovered the reason other than I believe it has something to do with China.

Posted Using LeoFinance Beta