Tesla Megapack Shanghai: Tripling Of Profits

The upcoming year for Tesla is going to stun many people.

Anyone who follows discussion of the company knows that most still call it a car company. Over the last two quarters, there was a significant uptick in the amount of energy storage deployed. The Lathrop Megapack factory is operating at peak capacity. This means the growth will have to come from elsewhere.

Fortunately, China is about to enter the contest. The Megapack factory that is being built in Shanghai is slated to start shipping in Q1 of 2025. Some are reporting the factory will be completed by the end of this month.

We certainly have at "China speed" in play.

This is going to have a huge impact on Tesla over the next 18-24 months. We could see an effect as early as Q3 next year.

Megapack Factory In Shanghai: Tripling of Profits

The last two quarter saw an average of $800 million in gross profit from the energy division. We know Lathrop is capability of roughly 10 GWh per quarter with another 2 GWh in Powerwalls.

While this might seem impressive, it is just the beginning. Shanghai is going to top this, in a big way.

According to the layout of the new factory, we are looking at double the size of Lathrop. This is a minimum. There are additional buildings on the site to which we have no word on what they are for.

Even just using the main building, we are likely to see a doubling of the output of Lathrop. This could, according to Elon Musk, perhaps move to a tripling. time will tell on that but 20K Megapacks is that stated target.

Why is this important?

The percentage on the Megapacks reached 30% last quarter. Using this as the basis, a scaled Shanghai means that Tesla will have roughly $2.4 billion in quarterly profit from the energy division. That amounts to almost $10 billion per year.

To contrast, the revenue from this division over the trailing 12 months was $8.2 billion. Hence, the profit within a couple years could exceed the revenues of today.

Near Unlimited TAM

One of the most exciting aspect of this part of the business is the near unlimited total addressable market (TAM).

When it comes to energy storage, hundreds of thousands of Megapacks are required globally. Naturally, Tesla cannot produce this many nor will they be the only player in the market. That said, it is a rush to get as much out as possible.

It is no secret we need to get more out of existing grids. The electrical burden from data centers alone is enough to keep Tesla Energy in business for a long time. Most are becoming aware of the strain they put on local electrical systems, something many are looking to alleviate.

Battery storage is one of the mechanisms that will aid in this effort. The problem with electricity is that it has to be consumed when it is produced. Utilities waste a great deal of it when more is produced than required.

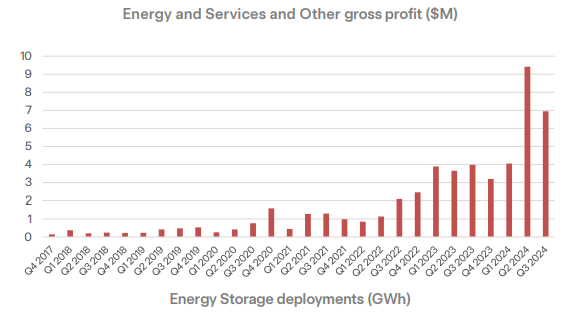

The chart above, which came from the Tesla earnings deck shows the jump when Lathrop got ramped. Of course, with the energy division, there is some lumpiness with regards to when revenue is recognized, having to defer until terms of the contract are fulfilled.

I would expect we are going to see another jump up towards the middle of next year. To start, we have not seen the aforementioned 10 GWh from Lathrop nor have we hit the 2 GWh in Powerwalls. Hence, there is more upside even from their present operations.

With that, we would be looking at $1.2 billion per quarter along with a possibility of $3 billion per quarter from Shanghai.

This alone would match what the entire company did in Gross Profit last quarter.

One final thought: after the Shanghai factory starts producing, I would expect another Megapack factory to be announced. This would be slated to go online in 2026.

Posted Using InLeo Alpha

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP