FedNowcoin: The Latest Cryptocurreny Lie

When it comes to money, cryptocurrency is populated with people who are completely full of it when it comes to money, banking, and what really takes place.

As I said in the past, I don't discuss coding or astrophysics because my knowledge in those areas is zero. Well, to be accurate, it is near zero since I know Python and Javascript are programming languages. That is the extent of it and do not ask me to explain the difference between the two.

When it comes to money, people think they know what they are talking about. Sadly, the online world is full of ideologies, untruths, and outright misleading information

Then there are the down and dirty lies.

One that is going around now is that Fednow is going to have a CBDC.

FedNow

Above is a screenshot that shows the interaction. I asked a simple question and this is the reply.

Is this for real? Evidently it is.

So what is FedNow?

From the website, this is what FedNow is:

The FedNow Service is a new instant payment service that the Federal Reserve Banks are developing to enable financial institutions of every size, and in every community across the U.S., to provide safe and efficient instant payment services in real time, around the clock, every day of the year. Through financial institutions participating in the FedNow Service, businesses and individuals will be able to send and receive instant payments conveniently, and recipients will have full access to funds immediately, giving them greater flexibility to manage their money and make time-sensitive payments. Consistent with the Federal Reserve’s historical role of providing payment services alongside private-sector providers, the FedNow Service will provide choice in the market for clearing and settling instant payments as well as promote resiliency through redundancy. Financial institutions and their service providers will be able to use the service as a springboard to provide innovative instant payment services to customers. We will update this page as we have more information about this new service, which is under development and will continue to evolve.

The bolding is mine to highlight what it is. Notice how it says financial institutions and service providers and then going on to refer to payment services to customers. This is targeting the banking system (and associated financial service providers).

FedNow is a payment network offering to the banking system. This is no different than FedWire which is a service provided to the banks. When you wire money, it is not you doing it. The service is offered only to your bank.

The difference is that FedNow is going to be an instant (or near instant settlement time). This should be a clue if you understand how depository institutions settle.

So how does this all work?

We are fortune to have a picture.

Notice the people in this equation. They are outside the box. Why is that?

Because FedNow does not apply to them. Notice how it says settlement "within seconds" yet it shows from bank-to-bank. That is who the service applies to. Those are the ones who use FedNow.

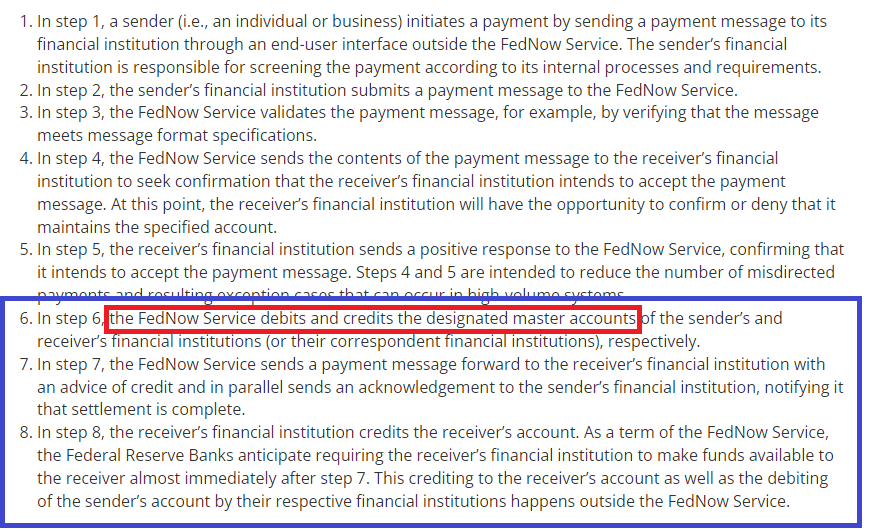

Here is how it works written out. I highlighted something that is very telling.

the FedNow Service debits and credits the designated master accounts...

Master accounts are given to those who are authorized to interact with the Fed. Individuals do not have master accounts with the Fed. Neither do most businesses, even within the financial sector. For example, insurance companies, pension funds and hedge funds do not have accounts like this.

Do you know who does? Banks.

So why does anyone think that this is a CBDC? It is a payment system like what they had before with FedWire, only faster and providing gross settlement instead of net at the end of day.

Settlement

In step 1, a sender (i.e., an individual or business) initiates a payment by sending a payment message to its financial institution through an end-user interface outside the FedNow Service.

Here again, we see the user is outside the FedNow system. This is an individual who using a bank app to access the service and make a payment from his or her commercial bank account.

If we follow the above, we see how USD is pulled from the customer's account and ends up put in the receiver's account. These two individuals deal in USD, i.e. commercial bank money.

What about the transfer between the insitutions? How to they settle and what do they use?

This system uses the same thing to settle all transactions between depository banks within the Federal Reserve System: reserves.

Do you remember all those reserves that were put on bank's balance sheets during quantitative easing that most think is USD? Well, he is an actual use case for them.

Settlement between banks is done with central bank reserves, which are bank instruments that are pegged to a dollar but not legal tender. They can be redeemed for bank notes so we can say they are cash backed although that is of no use to banks.

So the idea that FedNow is a CBDC is laughable. A couple clicks revels what the system is.

Why would the Fed create a CBDC to transact between the member banks? They already have a stablecoin called reserves. They were using them for over 100 years.

Don't fall for this one. The Fed is not bringing out a CBDC, not anytime soon.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I saw this a little while ago with someone posting it but thinking it was likely the case. I feel a little better reading this, I think it definitely makes sense that this is a settlement system not a CBDC.

Australia has had a system like this for a few years now. It honestly works really well. I can send money from my bank in Australia and the receiver using a different bank receives it instantly. Amazing for businesses to reduce cash flow issues.

Yeah it is a superior network to what the Fed has in place.

I am sure the commercial banks can charge a nice fee for using the service too.

Posted Using LeoFinance Beta

I'm sure they'll consider it. The Australian banks don't (at least for retail) - I do have to say that it is wild when someone sends you money from any bank and it's just there instantly. It's honestly an incredible process.

The FedNow is definitely not a CBDC and I agree that your research is right. It's just a settlement agreement that the Fed created because they didn't want the banks to lose out to things like Paypal and other payment processors.

Posted Using LeoFinance Beta

I saw a tweet about the FEDNOW but I didn't understand anything about it even after Googling it. Thanks for the insights

Once again, spot-on. The only thing I've ever said, in regards to FedNow & CBDC, is that the institution of the FedNow system will make it easier in the future to force the adoption of a CBDC, but not that FedNow IS the CBDC or has a CBDC in its current state.

Since all FedNow amounts to is a bank-to-bank payments system that settles instantly, this is a way for the Federal Reserve to prop up any financial banking institution on the verge of failure, whether due to insolvency or a bank run, to further obfuscate the activities of the Fed and the financial system.

It might actually lead to LESS transparency, rather than more, in terms of regulatory oversight.

Posted Using LeoFinance Beta

https://leofinance.io/threads/@junior182/re-leothreads-2dbymkpda

The rewards earned on this comment will go directly to the people ( junior182 ) sharing the post on LeoThreads,LikeTu,dBuzz.