The Sustainability Of HBD At 20%

There seems to be a consensus among some that the 20% APR on Hive Backed Dollar (HBD) in savings is unsustainable. Many are claiming that it has to come down. The view is tied to returns that we get from other investments and how the Fed's interest rates are radically different.

Hence, 20% is unsustainable, or so goes the thinking.

Of course, to draw any conclusions, it is imperative that we drill down to see exactly what is taking place. This is what we will do in the next series of articles.

Image by @doze

What Is HBD Interest?

This seems like an odd question. Naturally, everyone knows what interest is.

When we go to a bank and deposit money, the bank (in many instances) pay us interest. We deposit currency, which results in more being returned.

It is the same thing with HBD being placed in savings. The coins are moved into that account and the wallet is paid interest on a monthly basis.

The same holds true for bonds. When we purchase something as a U.S. Treasury, money is paid in (as a loan) and we get that back plus interest.

Overall, it is a very easy concept to grasp. Or is it?

Here is a question: where does the money come from to pay the interest? Now compare that to HBD.

The difference is that interest in the existing system is paid with existing currency. With HBD, we are seeing new coins created as payout.

Therefore, the interest on HBD is actually inflation.

This means the question is not whether the interest rate is sustainable but, rather, the inflation rate.

We also have to keep in mind this is only part of the rate. The payouts in HBD for posts and comments is factored in. We also have to look at the conversions which can expand the inflation or, even, turn HBD deflationary. Of course, this is all against the backdrop of the market capitalization of $HIVE, which is a free floating rate priced in USD.

HBD As A Foundation

We can see latest HBD in circulation (minus the Decentralized Hive Fund). There are just short of 12 million floating freely. Part of this is the HBD in savings which has a 3 day lock up period.

In this article we will not go into the specific amounts along with the growth rate. That will be the subject of an upcoming one. However, what we need to focus upon is the total is a miniscule amount in proportion.

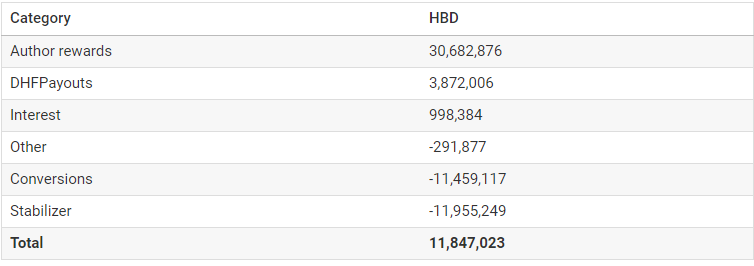

The other thing to highlight from this chart if the conversions and stabilizer rows. Notice how they are a negative 23 million between the two of them. This obviously can fluctuate based upon the needs of the community along with present market activity. Here we see many ways to alter the inflation as well as exciting supply of HBD.

Finally, at present, there are few use cases for this stablecoin. Many often discuss utility in reference to cryptocurrency. Unfortunately, they are often referring to value capture tokens. The true utility should be on stablecoins since that is a viable medium of exchange.

For this reason, HBD has the potential to be a foundation for Hive. With so many new projects arising on this blockchain, we can see how having a built in stablecoin at the base layer could be an advantage.

Going forward, the focus should be upon developing commercial and financial utility for HBD. Here is where the equation shifts completely. In fact, in the next article, we will cover how that impacts the amount that is required.

Larger Pie

This is a bit of a tangent but it is an important piece of the conversation. We are looking at a pie that is likely to be much larger in financial terms.

There are a number of reasons for this. Two of the most important are:

- life in the digital world

Unlike the physical economy, which is constrained by atoms, we live in a world of bits. Expansion in the digital realm can go much faster and to much higher degrees. This is why the likes of Facebook and Google achieved high valuations.

As we keep expanding this realm over the next decade, with more advantaged technology, the pie is going to grow in a major way. Just consider the impact of something such as artificial intelligence (in the different forms) and how much economic production that can bring to the table.

This is another subject worthy of its own article. However, the point here is not only will DAOs alter the ownership share but it also captures another layer. Whereas present corporations deal with equity and debt layers, DAOs incorporate the social layer. This is vital when looking at the digital realm.

We often mention the combining of social media and finance. Here is an example of where the network effect from social media activities have a direct impact upon value. Without tokenization, it is arbitrary how much is captured. Certainly, there is no way to financialize this.

With cryptocurrency, that goes out the window. Not only can that value be accumulated, it can be harnessed as an asset. This is the value of tokenization and what we are developing.

This is how the numbers can ultimately get into the quadrillions of dollars. Value is going to be not only created to a much greater degree but is being captured. This is a radical transformation.

It is also part of the reason why the 20% HBD is a baseline that we can operate from for a long time.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/905866971157217280/status/1639283724104679427

https://twitter.com/1331330355513745413/status/1639284912451715075

https://twitter.com/716646750602309632/status/1639298457729916934

https://twitter.com/1884771912/status/1639311978257588225

https://twitter.com/1415155663131402240/status/1639595820143247360

The rewards earned on this comment will go directly to the people( @mcoinz79, @taskmaster4450le, @ferod23, @shiftrox, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Was this inspired by @dalz recent post about the blockchain debt ratio? :)

Seems like perfect timing on your part to discuss it separately.

After reading all of this I clearly have a dumb question on my mind: is the 20% APR sustainable or not?

I think I know the answer but I wanted to be rest assured anyway.

There are many pieces to the equation. I will be delving into them.

Posted Using LeoFinance Beta

I see it like this. When I put money into a legacy bank savings account, I get around 3% interest. HBD gives me 20% interest. The 17% difference is what the banks skim off the top to pay for their plush HQ buildings, bankers bonuses and flashy company cars and private jets.

I only have two concerns with the 20% return rate on HBD. First, that it might make it too attractive to outside investors who want to make money but don't care if they adversely affect the Hive ecosystem. Secondly (and more importantly) that it could act to inhibit use cases of HBD as an actual currency - there's a big incentive to save it rather than spend it.

Given that we also can convert it to a little more than 2 hive per HBD right now, and we can assume that the price of hive is going to go higher in the future... we could argue that right now is the best time we'll ever have to convert and stack hive.

(I'm not, but like, some folks might see it that way!)

Good point ! I think my trouble is, I like seeing that lovely HBD interest figure 😁

It's crazy that my HBD makes me around $15 a month interest, and a business reserve bank account with nearly 10 times as much in makes me about £3.

Even prior to buying my house when I had like 30,000 in my savings I didn't make in interest what I make now on 1k. Banks are taking us for a ride and they don't even have to care because they don't have to compete. It's such hogwash.

It's going to be cool to see all the use cases that start coming to light for HBD. If what we are currently looking at is any indication, it is going to be pretty awesome. I'd love to see more people doing stuff with it like they are doing down in Cuba.

Posted Using LeoFinance Beta

Utility is vital, that is for sure. We are dealing with a situation where the stablecoin being used is crucial to expansion.

With a currency, economic productivity is what is necessary. We have to build out the utility of HBD to capture that. Both commercial and financial applications can meet that need.

Posted Using LeoFinance Beta

I'm looking forward to seeing how the economy in Ragnarok is viewed by the community after it has been up and running for a bit. That should give us a partial indication of how things could look in the future.

The way I play it, I only want HBD which I earned. Treating it like the NFT that will gain an extra 20% p.a. perpetually.

Posted Using LeoFinance Beta

I believe that by the time we create more used case for hbd the question about sustainability will be the thing of the past

Posted Using LeoFinance Beta

Exactly. With more projects launching and the wider adoption of Hive it will sustain the 20% APR I think.

Hive can develop into a largescale economy and what if organizations start adopting the blockchain to build thier projects and businesses? The phase were in is just the top of rhe iceberg.

Posted Using LeoFinance Beta

I prefer 50% APR

😀 not bad . Only problem is....who would fund that? I guess those who keep it while it would be worth $0.70

We need a lot more HBD to be created. A long term savings account with higher interest is a solution. Maybe a 1 year CD.

The change in these digital assets like this are going to be wild. I wonder what it’s going to look like, looking back 10 years from now.

Posted Using LeoFinance Beta

Just about to read till the end and my question still the same I had on top of post lol

It is sustainable at 20% or not?

Second question if you don't mind.

If yes, great!

If not, what could be the consequences? Let's imagine a scenario, as we know and already saw, crypto (BTC), can hard dump in one day and remains there for weeks, let's say what happens if we take 1 week to adjust the Apr?

I guess...for that week its price would be everything but $1

We need more liquidity so 20% works out and 20% will only be an issue when there is too much HBD out there. At that point, I think it would be a long time in the future. Even expanding by 100x wouldn't be an issue for the 20% to work out.

Posted Using LeoFinance Beta

You didn't mention the mechanism that @smooth created to react to the price of HBD and how it brings the value up or down in reaction to the market. It's not just inflation that allows for the stable value and I think we on Hive should know more about how this Algorithm works.

The way I understand it is that the proposal needs enough funds to both buy or sell for HBD to keep its peg and it's because of the earnings from this mechanism that allows for the higher returns. If BTC dumps really hard for a sustained period of time, which results in the ALGO having to buy more HBD than it can afford the earnings go bye bye? On top of this, when HBD loses its peg and payouts come exclusively as Hive, the inflation stops, correct?

So, from what I understand, you barely touched on how 20% is sustainable and we need to know more. These are all just how I understand it from the minute amount of info we are given, so these are more questions than they are knowledgeable statements.

@taskmaster4450 so, you just want to create a false sense of security so others don't want to dig deeper or is it just for a topic to throw out a quick blog for the earnings and the hard real questions are just too much for you? That's the problem with the average human these days; they love sound bites of big topics that they learn very little to nothing from. As long as a senior popular member says it's sustainable it's good enough? Fun... Sorry I'm not the average ass kisser you all expect here. Thanks for a whole blog of nothing really...

Now, that changes the focus of that sustainability question.

Posted Using LeoFinance Beta

I think the 20% interest on HBD in savings is quite sustainable because the ecosystem is growing. It's also a good way to attract outside investors to the ecosystem.

The sustainability of Hive itself from the genesis till date is amazing. The algorithm and metrics are perfect. I am working on a system and I an using a similar concept as Hive as it is a clear working system. The consensus voting and all. Plus, the 20% APR for staked HBD. That is the aspect that got my attention on this post. I want to be sure that the 20% is really sustainable but considering the value of HBD, everything still looks fine but what would happen if the ecosystem grows exponentially? That is another factor to consider.