The Power Of Cryptocurrency And The Major Problem It Solves

Investing and funding is going to be one of the biggest changes we see coming from cryptocurrency. This is something we discussed in the series of articles pertaining to the Hive Backed Dollar. If we step back a bit further, we can see how radical the changes can be.

One of the use cases for HBD is for the coin to be used for investing and funding purposes. This is where cryptocurrency can achieve real world impact.

In this article we will discuss how we the power of cryptocurrency spread among billions of people could impact things. It also will show how limited we are within the present system.

For the sake of this discussion we will operate on a single idea: spending $2 per year on 10 different causes. In other words, we each us $20 worth of cryptocurrency for funding purposes.

Money Shortage

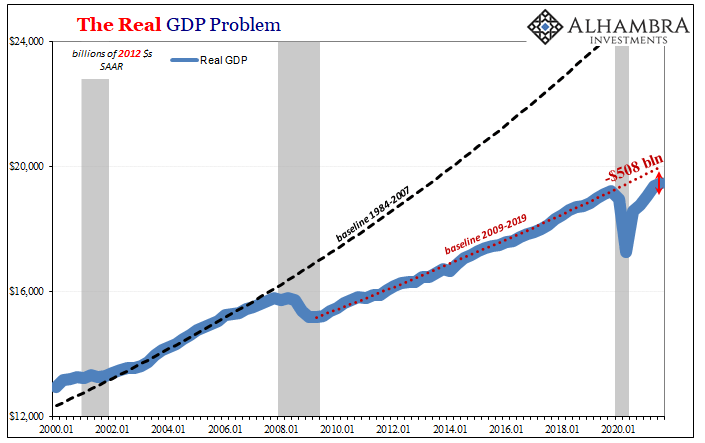

People do not realize how severely limited we are at present with money. There is a shortage of both USD and quality collateral within the international financial system. This is causing a great loss of productivity. Since the Great Financial Crisis, the breaking of long-term trend lines.

Source

Without the necessary tools to fuel the economy, we end up with a chart that looks like this. The US alone has lost trillions of dollars in output. Consider all the ideas that did not get funded due to the absence of resources.

As society progresses, the expectation is that it will keep expanding. This makes sense since we tend to want the standard of living to increase for all of us. Would anyone like to revert back to the days before the Internet and mobile phone technology? How about a life before anesthesia? Novocain? Cars? Planes?

You get the point.

What all this has in common is money was required to research, design, develop, manufacture, and market these items. Today, we are glad we have them but, at one point, they were just ideas.

As the size of the problems grow, so does the money needs to find a solution.

$20 Per Year

Here is where we will do a bit of a mental exercise.

There are 5 billion people on the Internet. If each of these was involved in cryptocurrency and utilizing Web 3.0, we could see where everyone had $20 for this purpose.

Imagine taking $20 and splitting it among these 10 different fields. With 5 billion people, that would be $10 billion for each.

- Cancer Research

- Asteroid Mining

- Battery Technology

- VR/AR

- Quantum Computing

- 3-D Printing

- Rocket Technology

- Geo-Thermal Technology

- Decentralized Cloud Provider

- Robotics

Do you think we would make a difference with $10 billion annually placed into those fields? We could fund 5 start ups, each having an annual budget of $2 billion.

The choices were selected at random to illustrate the point. With this much money flowing in each year to the specific area, we surely would see a difference in some of them over a 5 year period of time.

Obviously, this is focusing upon the "moonshot" projects. We can apply the same concept on a smaller scale. Take the same $100 billion in total and spread it across 10,000 different projects. We are not likely to cure cancer with this approach yet we can solve a broader range of problems.

Trillions Of Dollars Required

When we factor the advancement of technology with the money shortage, we can see how much is being lost. Looking at the above chart, we can see the US, since COVID started, is $508 billion behind where it the 2009-2019 trend was. It is easy to see how this just keeps getting worse.

Cryptocurrency solves this problem.

Many talk about "money printing" without truly understanding how it all ties together. Even if the major Central Banks were printing money that actually got into the economy (they don't), we can see there is an enormous need for it.

According to some simple calculations, to get back on track and keep up with the funding of the different technologies, we are going to require more than $100 trillion in additional money this decade. The difference in the global trendline going into the Great Financial Crisis is already in the tens of trillions of dollars. To make up for that is going to necessitate a lot more capital.

The present system generates money through the commercial banking system. Here we see where loans are how a credit based monetary system expands. The question is do you see banks adding another $100 trillion to their lending?

Of course not. That will not happen especially since banks cut back on their overall lending since the GFC.

Here again is where we see the opportunity for cryptocurrency to step in.

Find A Problem And Solve It

Many ask what problem does cryptocurrency solve? In light of this article, the answer is clear.

Cryptocurrency has the ability to make up for the extreme shortfall in money that is operating within the general global economy. Through the creation of trillions of dollars worth of cryptocurrency, we can use that money to fund what the world needs. It is likely this is the only source that it is going to come from.

Most do not see the funding shortfall the world is operating under. We understand there is a problem because we do see the results. Economic growth rates are slowing and workforce participation rates are declining. Large sections of the population are not advancing, at least not at the pace they were before.

Of course, politicians will point fingers while telling you who is to blame. The media will pile on, usually promoting some type of agenda. In the end, no matter which party is in control or what ideology is touted, the result is the same for the masses.

Cryptocurrency is something that radically alters this picture. The major problem it solves is the issue with monetary elasticity. The present system simply cannot keep pace with the expansion of money that is required to keep things growing as we need, especially in the realm of technology.

Here we see the power of cryptocurrency. Many ask what is the value in it? By now the answer should be evident. Cryptocurrency can simply be the funding mechanism the world needs. Since there are tens of trillions of dollars in lost productivity we have to make up for, accessing the capital to get things back on track if vital.

Many alluded to the Great Stagnation that we see with technology. Even though things are advancing, the pace is slower. What most overlook is that it is not entirely a technological issue. It is equally, if not more so, a monetary situation. The lack of funding is causing major stagnation in technological growth rates.

And this is something that cryptocurrency solves.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

I know that crypto does offer a solution because the current system in which QE locks up money with the Fed causes a shortage of dollars. However, do you think that the new system in place should be stablecoins? I don't really see many people using anything besides the large cryptos and stablecoins for transactions because most people value things in dollars right now.

Posted Using LeoFinance Beta

Stablecoins are the only option for developing an alternate system since volatility is a danger to commerce. How those coins are created or structured is still to be determined.

Posted Using LeoFinance Beta

I am currently using that 20 dollar distributed type of strategy with dividend stocks. I think it is working for me though my investment is small but it does give some returns though nothing big as of now. But I feel diversification and distribution approach always works. I would be surprised to see if Hive gets adopted in places outside gaming, content, video and audio.

Who knows maybe used to post the regular research data on hive chain? as a historical ledger report or something? You never know where the Hive could get used if it gets noticed by the right people.

True. People do not realize how much $20 per year spread over 5 billion people is and the impact it can make.

This was a mental exercise to help people understand how far behind the curve we are with money in the system. It is resulting in a huge loss of productivity, seriously altering the standard of living (or at least the increase in it).

Posted Using LeoFinance Beta

One of the parts of cryptocurrency elasticity. as a source of financing, this is the absence of intermediate banks between the buyer and the seller, which speeds up the time for transactions, simplifies the return of funds if necessary, abolishes customs control over payment for imported goods, sometimes 100 days of such control run out and crazy fines begin, because the dollar or the euro was not marked in the customs declaration. I think that it is possible to list for a long time what can be called elasticity, reliability and efficiency.

Posted Using LeoFinance Beta

One of the biggest advantages to cryptocurrency is the short term lending capabilities. When you discuss matters such as inventory, this is crucial. Having collateral unavailable for short term borrowing to pay for inventories is fatal.

This is just one example of what we can develop with cryptocurrency.

Posted Using LeoFinance Beta

This is a great perspective in illustrating how cryptocurrency can solve the current stagnant pace we're in by unlocking the money elasticity. We will be able to fund 'moonshot' projects that could have massive impact and 100X returns. Eventually, it will be a cycle whereby the more projects are funded, the bigger the returns which would fund much more projects.

Or we can fund much smaller, local projects.

Or a combination of the two.

Either way, we can fund a lot of what is presently being missed by the existing financial system.

Posted Using LeoFinance Beta

Yes, that can happen too. Both can generate huge impacts. The question is how to implement the funding with the current state of the financial system.

This is a simple precise illustration of what can be achieved funding via cryptocurrency, not long ago you shared a post on how borehole was created for a community in Ghana, obviously that was where government failed to provide water for its people and cryptocurrency stepped in to make provision.

A lot to still achieve and develop making use of cryptocurrency.

Posted Using LeoFinance Beta

Yeah there are different ways of going about it, both large and small..

The key is we have useful resources in cryptocurrency that can help to accelerate the production as well as technological breakthroughs.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator, @neoxag-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 170000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Definitely a worthwile article. I never really thought aboutupscaling things to billions.

!1UP

Some great points. I never considered there was a shortage of USD when the central banks seem to be printing like mad and inflation is rising.

Interesting projects you propose, love the asteroid mining!!

Posted Using LeoFinance Beta

Regarding the shortage of USD, I've been aware of it for quite some time even prior to my entry into the crypto space. But as for the lack of quality collateral, this is something new that I learned only here at LeoFinance and has now been confirmed by my initial reading on the Eurodollar market. Thanks for the guidance.

Posted Using LeoFinance Beta

Except a blind eye is turned to cryptocurrency on purpose , one can’t just help but notice the great merit this blockchain technology plays in refining the world economy especially as regards long term investment and funding . We all saw how crypto came to the rescue to affected Ukrainians during the Russia-Ukrain invasion through crowdfunding via crypto bitcoin donations in particular. This just shows the unique abilities and capabilities of crypto. Of course it might have it shortcomings but it’s potentials sort of outweighs its deficiencies.

Hi !

Since the creation of Bitcoin in 2009, crypto-currencies have exploded in popularity and are now collectively worth billions of dollars.

While they can offer benefits to consumers and investors, they can also be exploited by bad actors and pose economic risks.

In response, many governments are considering introducing their own digital currencies.

😉