The Future: Tokenization Of All Debt

Over the last couple months, the discussion surrounding the tokenization of real world assets (RWA) has accelerated. This is something that has led to even higher forecasts in market capitalization for cryptocurrency. This only makes sense as we see some big numbers start to roll in.

By now, everyone involved in crypt heard of Bitcoin ETFs (based upon spot pricing). That sent off a wave of funds flowing in. At present there is roughly $50 billion in these ETFs. If we back out Grayscale's $15B, which they had as a trust, we are looking at roughly $35 billion.

This is a healthy sum.

Naturally, this does not figure into market cap since units in an ETF is not crypto. None of this is tokenized. The benefit is the need to buy more BTC (and soon Ethereum) as these funds get larger.

That said, this is a drop in the bucket. When we look at the debt market, we can see how things will change quickly.

Tokenization of Debt

We are already starting to see the tokenization of debt. This applies to bonds which are financial instruments that are sold into the market. This is how companies (and governments) meet some of their obligations.

The largest issuer of debt is the U.S government. There is roughly $14.0 trillion in outstanding bonds.

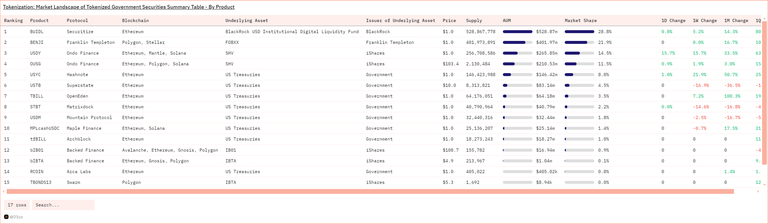

A number if institutions are starting to tokenize U.S Treasuries. To date, there is roughly $1.6 billion.

An article appears on Cointelegraph forecasting this number to reach $3 billion by the end of 2024. We have to keep in mind this is mostly for institutions.

Why tokenize?

Like most things in the traditional financial arena, transactions are slow and not exactly clear. The lack of clarity poses risks as there are a number of financial intermediaries involved. When dealing with US Treasuries, the settlement time is a day or two.

Tokenization offers immediate (near) settlement along with transparency. These funds are not actually trading the Treasuries but, rather, a token backed by them.

Hence, we see the appeal.

An institution can buy $50 million on BUIDL tokens and receive then in their wallet in a few minutes. The same is true on the sell side where the money is received and the entire transaction settled in moments.

This is only going to be the start.

We are going to see the much of the market move in this direction over the next couple years. While it is possible for companies to eventually issue tokens as a form of the bond, the system, for the moment, is not set up for this. We are seeing how it can handle the tokenization of existing assets.

How big is this?

According to The Fed, the total amount of commercial paper outstanding is $125 trillion.

We can see how the $1.6 billion is a drop in the bucket.

What About Stocks?

Could the same thing happen with stocks?

While it is possible, they would likely have to be structured with a few modifications.

With debt, there is a schedule of payments. This is what entices investors. They purchase the BUIDL token, as an example, and that provides a daily income based upon the payouts from the Treasures (or Repo contracts). Since these are yield instruments, it is rather straight forward.

Also, there is a timeline until maturity. That means, even if the price drops, it doesn't matter since the underlying assets are held. Only the token is traded.

With stocks, things are not the same. Even with dividend stocks, it is possible for the price to go down and remain there. This will not preclude the tokenization of stocks, just a bit different investment.

Over time, it is possible we see entities that offer tokens instead of stocks. Once again, we are lacking in the ability from the traditional system standpoint. However, it is likely this is built out in the next few years.

Non Real World Assets

Wall Street brings a lot of money. This is why the numbers can get so large in a short period of time.

Do not be surprised to see the U.S Treasury funds that are tokenized surpass hundreds of billion in the next few years. It will grow rather quickly as more institutions get involved in crypto.

How will this compare to the non-real world?

We are talking about hundreds of trillions of dollars in assets in the traditional system. When we consider art, real estate, intellectual property, stocks, bonds, and commodities, we get some really big numbers.

However, it is possible the non-real world, i.e. digital, actually surpasses this. Here is where the concepts many discuss come into play.

Consider for a moment the idea of the Metaverse. Leaving aside the timeline, let us just look at the path heading there. We are certainly going to see multi-world environment created, utilizing some type of mixed reality. What is the potential of this?

Many of the same financial structures can be put in place. This means we will have virtual market places engaging in trillions of dollars worth of transactions. It will be tied to gaming, entertainment, finance, and a host of other industries.

Every digital platform can evolve in such a manner, creating its own economy.

What is the value of this? At this time, it is impossible to guess. Over the last 40 years, we saw the explosive growth of gaming. That is a correlation since it saw a massive shift in the physical (board games) to the digital.

This is why you see some, including myself, putting enormous numbers on the eventual market capitalization of crypto. It is not necessarily a run of the existing assets. Instead, it is going to be a continued move towards the tokenization of everything.

Posted Using InLeo Alpha

I think tokenizing U.S. Treasuries could streamline transactions significantly. The immediate settlement and transparency are real game-changers. I'm just hoping everything goes smoothly without anyone taking advantage in a negative

As blockchain and crypto technology advance, the potential market capitalization could indeed reach enormous figures due to this continued move towards tokenization. It's an exciting time with many possibilities for innovation and growth.

My views on this is can be simply put as;

The tokenization of debts in terms of bond but this time crypto bonds and treasury bills it's a very fascinating capitalization of cryptos, all though I quite don't get how this works even after you explained it;

The crypto market is well known for its volatility as it is affected by demand and supply a lot more than most business (the effects are more visible to an average human who doesn't understand the workings of the business world) which make me think isn't that more suitable to stocks, like to me hive is a dividend paying stock, the only difference is you have to still do work than it just being passive to get dividend aside that percentage increase per share still occurs here in HP like in stocks. Isn't it more suitable?.

Bonds on the other hand are fixed and crypto isn't, is that really not a problem as the safety net in bond will be altered ?.

Stablecoins are crypto and are not volatile...not those with any any volume.

When you have a token tied to a treasury then you are following the underlying assets. Naturally, even bond prices can go up and down.

So stablecoins will be created or used in terms of treasury bills and bond that will be awesome, investment is becoming more approachable by the common man.

No I was using stablecoins as an example of a crypto that isnt based upon volatility.

As for the use, a stablecoin could be used to buy the Treasury tokens. Since it is on a blockchain, USDC or some other coin could be used for purchase.

I get it now, treasury tokens will be another form of crypto that can be purchased by other coins

Exciting times are coming 🤩

I do think that a lot of things that are available to the public will be tokenized. The ease of access, and faster transactions are already huge reasons for it. I think security is another reason. A big reason why the purchase and trade of these are centralized is for the security of the buyers. But if the assets are tokenized and in the blockchain, it is easy to check the validity and ownership of the asset.

It is going to change things. There are a lot of things that need to happen first. Regulation is a big one.

Still can't convince my pops to buy some BTC and this is the third cycle! He continues to tell me he won't invest in assets he doesn't understand, while at the same time complicitly staying oblivious to the real-world use case for BTC. Oh well... I guess I'll just have to wait for that wealth to pass on before making it take the orange pill!