Hive Financial Network: Creating Our Own Money And Making $HIVE Very Valuable

If you want to beat the bankers, it is best to think like the bankers.

Have you ever wondered why they run everything? Their ability to create money is what gives them so much power. This is something that cryptocurrency seeks to replicate.

On Hive, we have the ability to generate our own money.

In the second version of the film Wall Street, Josh Brolin's character says, "Its only money; it doesn't mean anything".

To most of us, this is appalling. We have so many emotions tied to it since we operate at a completely different level.

We covered many idea regarding the Hive Financial Network, Hive Bonds, time vaults, derivatives and building a currency. In this article we will look into how we can created abundance on Hive while sending the price of the coin skyrocketing.

Do you want $100 $HIVE? It is simply a matter of math.

Source

Creating Our Own Money

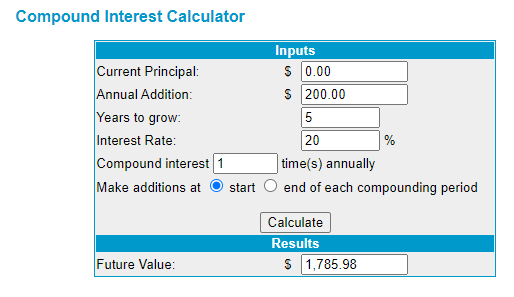

We will go through a simple process along with the returns to show how this works. Before getting started, we are going to keep the math easy. We will use APR instead of APY and round things off. Nevertheless, we will see how this can work.

For our example, we will use 1,000 HBD to illustrate the point.

The process starts with someone depositing 1,000 HBD into savings (or a time vault) paying 20% interest. This yields 200 HBD per year.

A Hive Bond is generated representing that transaction. This is a second layer token that can be traded on a DEX. However, we are going a different direction right now.

The Hive Bond is put up as collateral on a loan, paying 99%. Hence, we are paid 990 sHBD (the wrapped version of HBD).

This loan is paid back using the interest earned from the HBD in savings, meaning 200 HBD per year.

Since it is a loan, our borrower can use the sHBD for whatever is desired. In this instance, he or she buys $HIVE and powers up.

We will use a price of 50 cents for $HIVE, thus we get 1,980 HP.

The inflation adjusted is roughly 2.85% and curation tends to provide around 8% at a minimum. For illustration purposes, we will go with a 10% annual return on HIve Power.

Each year the borrower will get 198 HP, or 990 over the 5 years (we ignore compounding).

So let us look at the numbers:

- Our borrower started with 1,000 HBD; in USD ~$1,000

- After 5 years, the person had 1,000 HBD PLUS 2,970 HP.

In USD terms, the person would have roughly $1,000 in HBD PLUS $1,485 in HP for a total of $2,485. Of course, that is presuming the price of $HIVE was still the same.

It is impossible to know where the price of an asset will go. However, what we have here is the combination of yield and [speculation. The yield comes from the return achieved on the HBD along with the curation. We are looking at a low risk 30% return.

Then we have the speculation. What if the price of $HIVE triples over those 5 years? Instead of 50 cents, it is $1.50. Under this scenario, the total would be $1,000 + $4,455 for a total of $5,455.

If we just put the 1,000 HBD in savings, we would have roughly $2,000 at the end of 5 years.

There is, of course, the chance $HIVE goes down. This is where risk comes in. Under this scenario, with 2,970 HP, the price could go down to 33.6 cents and we would still have the same $2,000 after 5 years.

The point here is what would this do to buy demand for $HIVE?

Empowering The Ecosystem

Let us look at some of the dynamics.

HBD is locked up, basically for a period of 5 years. It is at the base layer so it is creating more HBD which will be needed over time. Keep in mind, what we are discussing here is just one use case for HBD.

Each HBD that is collateralized as a Hive Bond is backing sHBD. Thus, the derivative has a 1:1 ratio with HBD. The only way sHBD can be created is by backing it with a bond.

Over the 5 years, the 20% interest will provide 1,000 HBD, meaning that is still 1:1 HBD/sHBD. The bond will go away, at least as the backing for sHBD, once the loan is paid off yet the treasury has the total accumulated from the interest.

Here is where we need to delve a bit into compounding. The HBD paid in interest is also put into savings. That means the platform are compounding it. Here we have 785 extra HBD created over that time.

Source

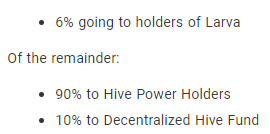

Remember this from the Hive Financial Network framework? It provides a couple options.

One each 1,000 HBD loan, the 785 generated from interest (on interest), using the above model roughly 70 HBD to the Decentralized Hive Fund (DHF) and 630 back to Hive Power holders.

$HIVE is removed from the open market as more people are power up.

The additional HP means more resource credits available along with accounts that can be claimed. This is a very powerful approach for applications to use.

It is easy to see how the demand for $HIVE increases both in the creation of HBD to start the process and because people are buying it off the open market to power up

Vulnerability

Is there a vulnerability here?

What if, instead of $HIVE, an individual went after HBD? In other words, the process is the same up to the point of swapping it to HP. What if the person repeated the process, getting more HBD and dropping it into savings to get a loan?

There are two ways this could happen.

The first would be to buy $HIVE off the open market and use the conversion mechanism. This is how large amounts of HBD can be generated. Of course, that starts the process of buy demand.

Another is to take sHBD and use some type of bridge. That means it is being swapped for existing HBD, just pushing more of it into savings or a time vault. Under this option, no new HBD is being created.

Ultimately, if the conversion of $HIVE gets too great, the haircut rule kicks in. At that point, the mechanism is frozen until the ratio get back into line. We also have to keep in mind the 3 day conversion time will deter those who are looking for an attack vector.

This means that someone who decides to take the loan and place more HBD in savings is actually doing the ecosystem a favor. We see more HBD locked up, a greater amount sent to HP holders, and more going into the DHF.

In Conclusion

It is best to keep in mind this is one aspect to a multi-faceted financial and economic framework being created on Hive. We still have other use cases for HBD being worked upon. There will be gaming and website integration. Offline businesses are starting to accept it. The Cubans will be using it to pay their electric bills.

The main point is the potential once we start to create our own money. This is what Wall Street had done for years. The banks know this secret and use it to their advantage.

It is all part of an expanding ecosystem that is building its own economy.

The best part is infrastructure to construct this is being worked on right now. We see some things are set in motion already.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

It is great that we have the power to create our money economy on Hive.

Looking at the stages we are now and the possibilities discussed in this article coming to life in no distant future will set Hive up a great deal.

Not only are Cubans going to be paying for electricity with HBD, for some it will be a full-time job.

Posted Using LeoFinance Beta

There are many areas to start pushing HBD. It is a feature of the ecosystem that can really clean up.

Posted Using LeoFinance Beta

https://twitter.com/905866971157217280/status/1634614017322012672

https://twitter.com/863912546/status/1634640698929553414

The rewards earned on this comment will go directly to the people( @mcoinz79, @celi130 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I read it all, but I don't think I completely understood everything. I think you need to

"Dumb down" some of your articles. Lol

Posted Using LeoFinance Beta

https://leofinance.io/threads/@celi130/re-leothreads-2vv7zebdz

The rewards earned on this comment will go directly to the people ( celi130 ) sharing the post on LeoThreads,LikeTu,dBuzz.

I think it's great that we can also do what the banks can do but I also think that there are financial lessons that we can learn from the banks. There are a lot of things we will end up replicating through the history of the financial system as we go through it but it will be faster because we have history to look back on.

Posted Using LeoFinance Beta

A lot of it is the ignoring the business cycle. That is where banks and other entities get in trouble. They tend to engage in excess when they should be consolidating.

Posted Using LeoFinance Beta

I have noticed that leasing, renting, staking is sort of the secret of rich people. They make other people rent things and on that they stack up the earnings. I guess banks following this formula on the top of manipulating the market prices says a lot.

The idea is to take an idle asset and turn it into something liquid that can generate a return. This is where tokenization is really helpful.

Posted Using LeoFinance Beta

If my computation is correct that someone will just roll over his $1,000 worth of HBD for 5 years, by the end of the 4th year, that $1,000 will be $2,073.60, and by the end of the 5th year, it will be $2,488.32.

Posted Using LeoFinance Beta

Though my understanding of your explanation is still rough, but it's making a lot of sense. This is a great vision that every Hiver needs to catch up on.

Posted Using LeoFinance Beta

We will see how thing unfold. A lot to do with this.

Posted Using LeoFinance Beta