HBD: Stablecoins Need More Than Financialization

We see stablecoins garnering a lot of attention these days. This is being led, to a large degree, by UST and LUNA. The fact that it was attacked so violently is making waves. Of course, this has everyone uncertain about the future of this class.

In this article we will discuss some of the overriding dynamics and where these projects are going wrong.

What we saw with UST was an eye-opener. While nothing is definite, it does look like an inside attack of some sort. Either way, we see someone made out very well in this endeavor. At times it pays to be smarter than everyone else.

This is especially true when things expand rapidly without a solid foundation. Here is one of the areas UST might have gone wrong.

Do not misunderstand, expansion is good. It is also needed. However, we should have a clear focus about what we are trying to accomplish and some different ways it can be done.

)

)Financialization

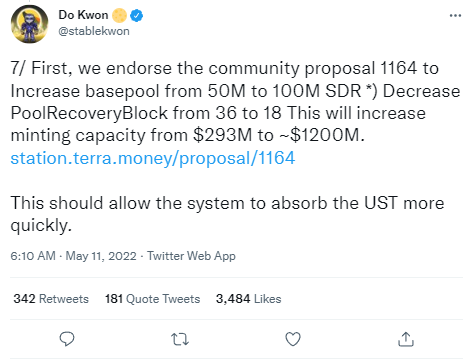

Here is where the sole focus is. Everything revolving around stablecoins appears to be the focus upon financialization. Now, with this attack, we see Do Kown turning to the same measures.

Obviously, at this point, there are few choices. This arena is probably the only place to turn, at least in the short run. The question is, if this is successful, are they going to turn to something else longer term?

We have to acknowledge that financialization is a good thing. It allowed for massive economic growth globally. The innovations in this realm over the last 40 years was stunning. We do see the results all around us.

Nevertheless, there is a danger to this. We often overlook the obvious.

With the situation around UST, what applications are people using? This is a common sense question which few seem to ask. Instead, the main focus is on what is the APR. Even Justin Sun in the game with his stablecoin and 30% APR.

We have to keep in mind that UST could regain its peg. The losing of a peg is not uncommon. After all the Chinese YUAN has de-pegged quite regularly over the past 30 years, often at the bequest of the CCP. So we will have to watch this one play out.

Here is the other major question which emphasizes the entire discussion: other than staking for an APR, what else can you use UST for?

This is something that few are discussing.

Commercialization

The overlooked aspect to all of this is the commercialization of the stablecoins. It is great to have an option for parking money while also earning a return. Nevertheless, to truly have value one must focus upon utility.

Why is everyone dumping UST? The short answer is there is no reason to hold it. Without any commercial use cases, people have little incentive to other than to dump.

Here we see the major crux. People look at UST in price of some other currency, in this instance USD. How much is it worth and is it dropping?

However, is this how people treat USD? Or EURO? Or YEN?

Think about it this way. Do you care what happened to your currency, the USD or CAD, against the YEN? Does the fact the YEN collapsed against those currencies mean anything to you?

Unless one is a FOREX trader or traveling to Japan, the answer is likely no. The reason for this is the commercialization of your currency. People use what they have to buy things and pay bills. That is where the major difference is. Individuals are not going to dump their currency for another due to need.

What can you buy with UST? For that matter, what can you use HBD for? Here we see a major area of focus opening up. Without that option, the need to hold is diminished.

Enhancing the commercial application of a stablecoin is vital. This is not as sexy nor as quick as financialization yet is a foundation that has to be constructed. Unfortunately, this takes a lot of time.

The Hive Economy

It is crucial, in my view, to look at all of this within the context of an economy. What we are truly looking to build is the Hive Economy. We use terms such as community and ecosystem to describe Hive. That is fine however, when monetized, it becomes an economy.

Notice the above had the word "built" in it. Here is where the desire for shortcuts is really challenging. When it comes to growing and expanding an economy, a lot has to go into it. This is no easy task. Therefore, the organic growth that resembles a complex system is necessary.

When something is going in a lot of different directions, that provides resiliency. Here is where HBD can have a solid foundation.

One of the most powerful aspects to the USD is Treasuries. What are US bonds and T-Bills? When you think about it, they are nothing more than future dollars. Someone puts up USD to get a bond (or T-Bill) and in return they get a stream of payments. From the moment the bond is purchased, the return is known. Hence, formulas such as the future value can be used to determine what it will be worth down the road.

Some puts up $10,000 to buy 10Y bonds at 3%. Each year the payouts are $300. At redemption, the person will receive the $10,000 plus have received $3,000 in interest. That means the bond, from the second it is issued, has a known return.

And while the bond is debt to the issuer, it is an asset to the purchaser. Therefore, it has value on the open market.

Hive Savings Bonds looks to model this. By having the ability to lock up HBD for a period of time, with a certain rate of return, we can see how this debt instrument suddenly becomes an asset. That has value on the open market which can be utilized for greater growth.

One of the easiest ways to do this is to collateralize it.

Here is the key: what collateral is backing the US Treasuries? This is the wrong question to ask simply because Treasuries are not backed by collateral, they are the collateral. In fact, this is what is the highest form of collateral to the banking and financial system.

Thus, one of the steps forward for HBD is to build the value by making it the collateral. Of course, the future HBD are supported by the commercial applications that are tied to it.

In other words, the more expansive the commercial use cases, the greater the value (not price) of HBD. People have reason to accumulate more since it can be used to generate real wealth.

As we can see, developing a strong, resilient stablecoin requires a lot more than financial gaming. We have to focus upon building an economy where the coin itself has the value. Since it is responsible for so much wealth generation, through its commercial and financial applications, people will see to utilize it.

This is a lot different than we seeing playing out in the existing stablecoin market.

What are your thoughts? Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

!1UP

Was thinking about exactly this this morning. How within Hive, there's at least this interesting ecosystem (economy) of social media content, gaming, etc. (compared to just financialization). HBD can be used to buy things or boost things, or converted into HIVE itself which has a ton of other use cases.

In trying to develop utility for a writing project here on Hive, I've been toying with the idea of providing content editing services (fiction only for now) in exchange for either our token or HBD. A long term vision is to expand this service to be more wide reaching and formalized, and having a smart contract involved. I think things like this will help contribute to the ecosystem idea—does anyone else know of similar projects? Where individuals or small group are looking for ways to offer services for HBD? I think of something like Listenerds, which is tied to HIVE vs HBD. Indirect, but contributing!

I dont know of a similar project but sounds useful.

Plus I would agree it is a smart idea to accept HBD as payment. This is what we need to do. Have HBD as the currency of choice for payments.

Posted Using LeoFinance Beta

HBD is my preference for payments. The stable value it holds makes payment for services consistent and fair for all parties involved.

Perfect example is the PsyberX founders crate. they accept either 100 HIVE or 100 HBD as payment for it, but one of those is obviously worth more, especially right now. Paying them 100 HIVE right now would be in the buyer's favor because they're "paying less" for the item. however, if HIVE were to uptick the next day and 2x out of nowhere, the buyer experiences a LOT of loss of value because the trade was poorly timed.

HBD provides a stable value for both buyers and sellers, ensuring equitable exchange of services/goods.

There's no loss on either, your eye is on the time...

It's a win-win using both simultaneously, cryptocurrency and stablecoin, that's a safe haven.

perhaps it's just my relative newness and ignorance speaking, then. I just see a lot of value in using the stablecoin for payments where I treat HIVE more as an investment

Your newness and ignorance speaking got a grip on of the hammer hitting the nail on the head.

wow, thank you! I suppose the time I'm spending here isn't in vain after all! I'M LEARNING, MOM! hahaha

Hahaha, learning is growth, SON, lmao...

Interesting choice

Interesting comment.

Care to elaborate? I'd love to hear your thoughts!

They decided to rather get HIVE instead of 100HBD, which could buy more than 100 HIVE at given times. That's a political statement.

They actually accept both, but they advertise the HIVE primarily - which I agree is a very interesting choice. I mean, there IS greater opportunity for financial gain in accepting 100 of a more volatile coin, but there's also a LOT more risk that they might be simply accepting a "loss". I believe in the project, so I opted to pay for my crate in HBD. Felt it was a better way to support them.

How is it political, may I ask?

Yeah well, they could stick to 100HBD and just buy 200 HIVE today. Holding 200HIVE has even more potential upsides than having 100.

But they refuse the let HIVE be worth less than 1$ for their product, which is priced at 100HBD / effective 100$. Right? That is a statement against the markets and about their convictions.

Ah, I see. I really like that take, gives off this feeling of dogged determination and defiance of what the market says or does - as well as a confidence in their product and the token they've chosen to build it on! Love that, thanks for sharing your thoughts! !PIZZA

Exactly

Shops that utilize HBD would be great. Who can we get that done?

The use case of each stablecoin is a question one should ask him or herself when trying to find a better choice to invest in.

Hbd is a big part of Hive.

We can't say the same for other stablecoin out there, but it is rather too early to speculate how things will turn out with Luna for example in the future.

But we'll come to see that focusing only on the finance part of stables would simply bring more vulnerability and show less confidence.

Posted Using LeoFinance Beta

Hive has users which is a bonus. There are apps and games on here that people partake in daily. At the same time, we see how more people are looking to have HBD incorporated more into the ecosystem.

Posted Using LeoFinance Beta

A whole lot of other innovations are even still yet to come that would bring more value to the ecosystem.

Sooner or later no one would be able to ignore what's going on.

Posted Using LeoFinance Beta

We are fortunate to be on a chain that naturally offers use case of its base tokens and even extending to some of its second layer tokens. That is something we shouldn't forget when looking at investing on projects outside Hive.

Posted Using LeoFinance Beta

There is a lot to benefit from the second layer token here on hive.

We sure are fortunate to be given such great opportunity.

Posted Using LeoFinance Beta

We are really fortunate considering what we have here, we just have to use it efficiently to our advantage.

Posted using LeoFinance Mobile

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curator, @neoxag-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

I have couple of questions, what is the difference between HBD and UST as they are both algorhytmic stable coins? What use cases HBD has compared to UST? To me it seems similar to UST right now with all the staking aspects and being backed by crypto.

Asides savings, you can use HBD to buy game assets, with all the games on hive, HBD has a couple of use cases, and there are even more games to come that will be using HBD. Also, you can buy items from hivelist store with HBD as well, so that makes it not just an algorithm stablecoin, but a currency with actual usecases. Of course, this isn't to compare the two or talk down on the other, it's more about looking at the bigger picture which is utility, which at the end of the day, is the Only reason people will want to hold on to your coin regardless of market fluctuations.

Thank you for replying. Still, it's just... within Terra ecosystem you could do all the things you mentioned with UST or LUNA if there were dapps for that, ok, I guess they don't have anything compared to Splinterlands but I would imagine one could buy NFT's on Terra with UST? So I'm not actually seeing the big picture yet..

UST has some utility. Google "chai terra luna payment rail". Unfortunately it didn't help in preventing Luna's market cap collapse though...

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Utility is an important piece of the puzzle, I am quite surprised how things went bad real fast for Luna ecosystem. UST losing its peg wasn't even bothersome, but LUNA crashing really left a mark!

We have seen a minor increase in HBD being used as a payment method for things however I believe the core issue is that the dang thing just doesn't hold the peg well and until it does it wont be taken serious as a form of payment for many things.

Many of the applications offer HBD as a way to buy things but to be honest I know myself if HBD is under $1 by more than 2% I'm very iffy about letting go of it to "buy" something.

I think there is a lot to be learned here about what is happening right now and how it very well applies to Hive and HBD and learn and make adjustments. I know that will take time but it's best to start putting things into action now instead of later.

Posted Using LeoFinance Beta

.

Well, all stable coins are in the picture right now, in a bad way. But doesn't have to be necessarily a bad thing. We have the luck, that it didn't happen to "us". So we can learn from what happened here. One sure thing is that the lack of liquidity due to a big sale, played a huge part in the downfall. So, liquidity is the first part we have to focus on. Then indeed, a market in which HBD is accepted as a means of payment, where the dollar value is actually never an issue.

I think the market will learn from this, and it will strengthen the other stable coins on the market. After the dust has settled of course.

Posted Using LeoFinance Beta

According to different influencers the USDT for the 'Big Sale' was sold OTC right before the drop, making it a coordinated ~~700M USDT instant drop off.

Not that the other points in this post weren't good, but I think this one is probably the best for me:

It's a very important question that I have never really bothered to think about before. I typically hold everything to that USD unit of measure when in the end it really doesn't matter.

Posted Using LeoFinance Beta

It is sometimes better we are still under the radar here, we get to learn from those attracting they hype. The situation with UST is something we can analyze and strengthen the system here.

While working on placing HBD as one of the top stablecoins out there, creating use cases around it further strengthens it. We have lots to work and I believe we have the capability

Posted Using LeoFinance Beta

For some reason I feel like this was calculated attack on UST. But what the hell I know about network attacks. Then again, I wonder if only UST was attacked and no other coin was as damaged as the UST. I think in near future we are going to see a lot of interesting changes of the stablecoins for the market attention.

If I'm reading right, use case is the most important to have an

The need to hold the currency because you use it on a daily, it simply becomes the reason to hold someone somewhere is also using it.

The chance for fast and certain recovery.

If that's the case HBD still needs a solidified foundation as we build forward taking notes of the doughnuts.

I agree with you. !HBITS

Success! You mined .9 HBIT & the user you replied to received .1 HBIT on your behalf. mine | wallet | market | tools | discord | community | <>< daily

I think the use case will be the most important. As you stated, no market has really created that just yet and most trading pairs are done versus USDC or USDT. Then we also need to figure out how people will buy things online and we need more of a focus on getting people to both buy and spend HBD. If that works out, then the protection mechanisms should be enough to guarantee that HBD will do well.

Posted Using LeoFinance Beta

Maybe I am somewhat stuck in a rut, but when I think about stablecoins, my mind always drifts back to my initial hopes for crypto: Utility.

When I have a stablecoin, I am either looking for it to be a store of value, or I am looking to use it for something. Hence my years of harping on about the need for crypto-based decentralized peer-to-peer marketplaces for pretty much all the things we do and use in life.

We talk about crypto as an alternative (or replacement, even?) for the legacy systems, so let's start with "where can I USE this stuff?" Yes, I know, "these things take time..."

Unfortunately, utility keeps getting lost in the mix because it is far sexier to tempt people with piles of "free and easy money" and skyhigh yields. And so, 99% of the focus and energy is poured into that.

From where I am sitting, that feels a LOT like using the "Free beer and BBQ!" sign to fill your restaurant with people to show the world "how busy" you are... rather than learning to fill your restaurant with paying customers because your actual food and service are SUPERB.

=^..^=

Posted Using LeoFinance Beta

You are spot on.

The fun part is the key section (Commercialization) has nothing to do with stablecoins. It applies to HIVE coin itself.

A lot of U.S. people talking about HBD miss that most people do not buy bread with USD. HBD is nice for trading purposes but that is it.

A few decades ago, cheerleadres of EURO were all about: "Imagine going abroad and paying with the money you use at home." Guess what, I live outside the Eurozone and when I go abroad I can pay with the same piece of plastic I use at home. Sick timing.

Even if you do all your business to people within your physical proximity (which can still easily mean two or three bifferent base currencies) you can easily do your pricing in HIVE/BTC/Gold/Oil because their browser is supposed to tell them the price in their currency. It is no longer your job.

Thankfully HBD is different in many ways to other stables for hat it could offer. The bond idea I really like as it is so different. I have looked up stable coins as I invested in COTI who provide stable coins and they are unlike all the others in how they keep the peg. I do think the market is looking to a stable coin that can do everything it is supposed to do and they seem to have the answer with DJED. I am not holding my breath for UST as it failed miserably and just the way it folded within hours it all wrong.

Posted Using LeoFinance Beta

I like to think of it as a social economic community, but yes, a economy, but more than just economics.

Watching LUNA and UST has been a little terrifying, so many projects haven't been bear market tested yet. And there are so many more stables everywhere...

Hang on tight..

I'm not totally sure how HBD works now days in a bear market either, but I like that we made the interest rate adjustable by the witnesses.

Posted Using LeoFinance Beta

It seems to be holding up rather well.

The internal exchange had it near a dollar with near $400K of 24 hour volume. pHBD did the same on lower volume. The external exchanges saw come variance but there is almost no liquidity there outside Upbit but that is closed to non-Koreans.

Posted Using LeoFinance Beta

While it isn't exactly pegged it does seem to be working to keep it close! That's great.

Posted Using LeoFinance Beta

Many individuals are excited in the dip. However, it is here as a wonderful chance for others to enjoy as well. When it comes to developing a greater hive community, I believe that now is the perfect time to gather more hive power while others purchase adequate hive. Thank you for providing this information @taskmaster4450 .

Without a doubt, it is an opportunity for all. We are going to see more people adding stake and growing their influence by adding more HP.

Posted Using LeoFinance Beta

Thats very true.

Ust is a eye opener it's got attack pretty hard

Posted using LeoFinance Mobile

It did show the points of vulnerability.

Posted Using LeoFinance Beta

Agreed now terra support are working on solution

i'm hoping! was gunna move ust to hbd but seemed all to hard with little benefit at the time 😂

That didnt age well it seems.

The Terra chain was halted.

Posted Using LeoFinance Beta

That really opens up lots of doors. But it‘s a third layer 1 token you talk about right? A bond token, well at least one, maybe a variety of different ones.

Bonding is very important in my opinion because it allows us to create strong collateral. That is going to really generate a huge use case for HBD.

Posted Using LeoFinance Beta

Great, but I'd not sure if you want them on layer1 or on layer2s. Is there a good case to be made that we might be able to receive rewards in the form of bonds?

The fact that HBD is stable is one of the reasons why I feel many of us in the hive community are still raising our heads up high despite the drama that is playing now in the crypto world.

We keep hoping for the best and I hope it comes soon.

Posted Using LeoFinance Beta

We just have to keep building and expanding. Having conversations about what is happening in terms of vulnerabilities is important.

But HBD is holding up rather well with all that is taking place.

Posted Using LeoFinance Beta

Yeah that is what we need to do now to make tomorrow better.

I'm really happy HBD is still where it is.

The hive economy and its community make is stronger. At times you cannot buy your way in work has to come first then money solidifies. Terra went the other way round hopi g those that bought into it make it stronger

Posted using LeoFinance Mobile

I agree. There is a lot of variables that Hive bring to the table. The fact that we have a community that is active and doing stuff really helps things.

Posted Using LeoFinance Beta

Definitely a coordinated attack. I worked with many sports books in Costa Rica and to see numbers being manipulated for big scores to be made. These guys are pros.

Posted Using LeoFinance Beta

HBD is definitely superior to UST. There's so much backing HBD with the entire Hive ecosystem... UST is just a token used for staking.

Posted Using LeoFinance Beta

I m trying to get what differences are there,between financialization and collaterization. They sound same.

Posted Using LeoFinance Beta

Sorry. Commercialization.

Adding commercial use cases, ie payment methods, for HBD.

Posted Using LeoFinance Beta

Oh yeah.. Thanks

It makes send. Sorry I took the wrong word.

I now understand very well.

I believe giving HBD a use case is way to go in other to make it be in more hands. So far I have only seen it use for the psyberX land sale, even tho most people will glide towards the alternative of hive.

I think a specific use case may be preferable.

Really great thoughts you shared in this post. It's high time every stablecoing move from financialization to commercialization.

Amazing that Hive is gradually creating usecases for our HBD. beyond the price, we have many other reasons to HODL HBD.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@thinkrdotexe(3/10) tipped @manniman (x1)

Learn more at https://hive.pizza.

I wish I understood everything you said better. But, I did understand that there were lessons to learn for those experiences. Hopefully, the powers to be, learned their lesson.

I do tell people, investing in stable coin is the best for now especially now we are facing heavy bear market, Even LUNA is Selling heavily.

But I know is well.

Posted Using LeoFinance Beta

Great point! I don't think UST had any use case other than yield generation and its former pegging to USD. The last one will be hard to recover. It's about restoring confidence as well.

Stable coins are like debts for issuers. Issuers have to guarantee that they will change it with another valuable asset when requested. In Terra's case, colleteral was Luna. But Terra ecosystem did not have an economy of a size corresponding to UST in the market.

In the case of DAI or HBD, there are coins with bigger economies that support issued stable coins.

Posted Using LeoFinance Beta

Use case brings value to the currency.

I never knew that I could be repegged actually I didn't follow up with Yeun even though that's where I came from.

i should go get some updates on how it runs to get a better understanding of it.

Posted Using LeoFinance Beta

Reading your posts and the posts of others I noticed a big difference. Your posts are always calm and filled with facts and historical documentation. The other posts are filled with fear and panic about investments being lost.

Those with the knowledge stay the course and shift accordingly, but those without tend to panic and give way to the herd mentality of panic selling.