Cryptocurrency Evolution: Getting Aligned With The Business Cycle

We often discuss what the evolution of cryptocurrency will be. How will we know when it is here? What does mainstream adoption look like? When will it all take off?

These questions are unknown at this moment. However, we can look for some signals that tell us things are changing.

At present, the spectrum of cryptocurrency is mostly market related. The majority of participants are wondering when things will moon. There is little though given to business, economics, or other factors of industry growth. Instead, it is all about price.

This is evidence by scanning the headlines of from the crypto media. What are most of them covering? They are talking about the price of Bitcoin or Ethereum. We see titles about the tokens likely to 50x this year. Of course, there is the how to profit off the Metaverse.

The overwhelming majority are simply talking about price. This means that market cycles are the primary focus.

We see this in terminology. What is the most discussed topic within the cryptocurrency world? the bear market

This sums it all up.

The Business Cycle

To truly transition, we need to move away from market focus. This means embracing the moves that are made as a result of the business cycle. Here is where we see an industry that is radically different from the one we are dealing with today.

If you want to know when blockchain and cryptocurrency "arrived", that will be the day where the industry follows the business cycle. That is where the major impact will come from.

Before delving into how this applies to cryptocurrency, perhaps we should explain the business cycle.

For those unaware, this is the cycle of economic expansion and contraction. It is what economies naturally go through. Contrary to the MMT advocates and financial engineers, the business cycle is alive and well. This is most likely due to the fact that human nature is at the core of this.

When economies are prospering, we tend to err on the side of excess. Companies end up hiring too many people. Banks along with other financial institutions start lending in areas they shouldn't. Euphoria takes over meaning people get caught up in the profitability of the time.

Of course, like all cycles, this will end. At that time, the opposite happens. Those that remain in business start to cut. All those layers of extra managers are eliminated. Executives start to look at the different spending patterns. Expansion plans are cancelled.

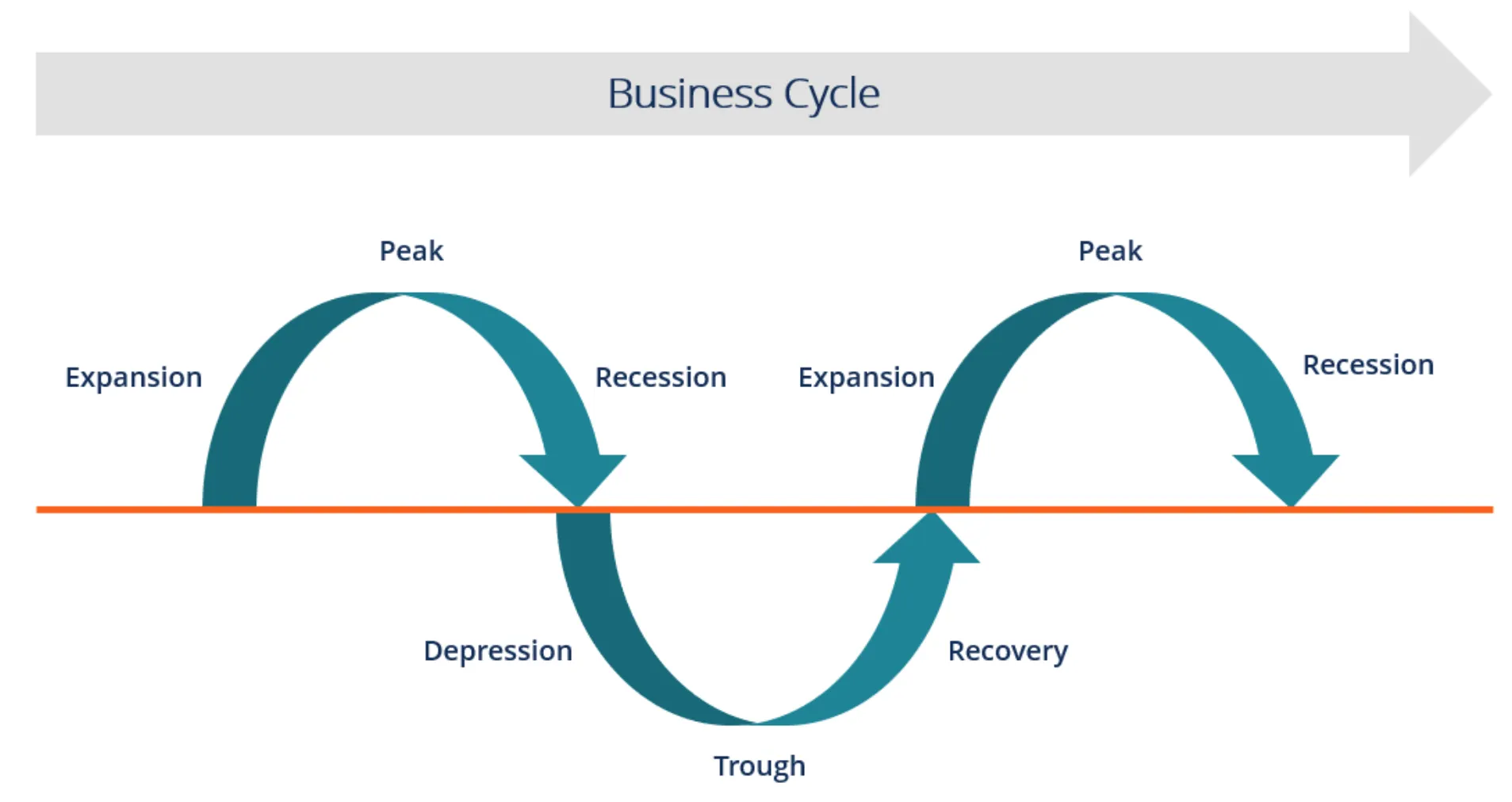

The entire process looks something like this:

Notice the difference in terminology. In market cycles, bull and bear are tossed around. However, bear does not apply to the business cycle. Instead, we deal with recessions.

Moving From An Asset Class

Many call cryptocurrency an asset class, similar to stocks or bonds. Again, this is market focus. This is natural since that is what cryptocurrency represents. Nevertheless, as an industry, there has to be something behind it.

With stocks, we are taught they represent fractional ownership in a company. Their are certain rights granted through this, i.e. a portion of the company's revenue stream and asset base. The same is not conveyed with cryptocurrency.

That said, it is can be representative of what the stakeholders enjoy. While, in most instances, there are no rights granted in terms of ownership or revenues, one does have some influence in certain activities.

Here again, we see terminology indicating what is taking place. Businesses deal in revenues, profits, and expenses. While executives are concerned about stock price, that is not the main focus. Sales, supply chain efficiency, and cost of goods sold are he focus.

How often do you hear those terms applied to the world of cryptocurrency? Certainly, it is mentioned for some of the publicly traded companies such as Coinbase. However, that only exists because they are operating in the traditional financial markets.

Within cryptocurrency, this is rarely discussed.

Once again, this will be a sign of transition. When we start to see the discussion center around market share, profit margin, and revenue generation, then you know that cryptocurrency will be moving from just an asset class. At that stage, we will see the industry aligning itself with the business cycle.

Markets Do Their Own Thing

The business cycle is not exciting stuff. Markets are much more interesting. They move quickly and with power. Even business cycle stuff is truly only discussed in relation to market reactions.

That said, we have to understand that markets indicate nothing more than sentiment. Buyers and sellers engage in their tug-o-war, moving prices around.

Business cycles take years to completely play out. While not exciting, it is a foundation.

This is what cryptocurrency is severely lacking. With growth, we see the shift away from the influence of the markets. Take a company like Coca-Cola. Certainly the price of the stock is important. Nevertheless, do you think that is the daily focus and discussion of employees? The same is true for Facebook (META), Tesla, and Home Depot.

At the end of the day, there is a job to do.

It is doubtful that managers get on the monthly conference call with the different departments to discuss how the stock price did over the last 30 days. Instead, they are bringing up how sales fell, costs spiked, and customer service is waning. Markets are not a consideration since they do their own thing.

Again, how often do we see this discussed by projects? Sometimes we will get some basic user rates but that is about all. Most don't even have roadmaps. Of course, there is little point in putting this information out since few who are involved with the token seem to care.

The only question is "when moon"?

For the moment, speculation dominates cryptocurrency because, quite frankly, there isn't much else. Once we move past this phase, the business cycle will become a great deal more important.

And that is when we will know cryptocurrency made some major strides forward.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Great Crypto post. We've reshared it.

🙏🔁👍

There is need for a product or service.

Almost everyone in crypto talks about how they can profit from the system and most people own a coin just because of the potential to rise.

I guess this is why Warren Buffet was saying Crypto is not a great investment.

I was talking to @ebingo and told him if a crypto currency was incorporated into a game like PlayStation where you need to upgrade using a crypto, there might be a rise in adoption.

At some point, we almost concluded that crypto was almost a ponzi scheme but I guess its too early to judge.

I mean the internet started in 1995 27 years and it's all everyone uses to communicate. We need to give that type of time for the market to grow, but we also need to change our mindset toward production and service delivery within our time of growth

Hive is doing that. We are building applications that have utility with people.

Posted Using LeoFinance Beta

I totally agree. We are yet to see the true potential of hive

There are services all over the place. The challenge is there simply is not enough of them. At this point, most are financially related. So to conclude it is a ponzi scheme when there are use cases if simply wrong.

Look at Hive. You are have a use case right here.

Posted Using LeoFinance Beta

But will hive continue, if there are no investors??

Just a hypothetical question tho

I think the thing with cryptocurrency is that most people are short sighted and are focus only on one angle which is the monetary value. There are many angles to it, from business to governance. Crypto is more than just an asset.

Posted Using LeoFinance Beta

The government doesn't like crypto because of all it represents anyway. It is a new normal that people on the top have to adapt to. Why adapt when they can crush it? So far they are yet to win

Without a doubt there are many angles. The key is to incorporate into what is being built as opposed to building around crypto.

Posted Using LeoFinance Beta

Will cryptocurrency even ever achieve mainstream adoption? Maybe it will, maybe it will not. Maybe we will see it, maybe we will not. Probably it would need a complete change of mindset. Even from its current users. For example using it directly, instead of selling it for fiat currency. It needs actual use cases, and a way to pay for everyday stuff with it. Maybe it is just/only a fantasy, but it could even replace the traditional monetary system. I think that it is possible, if enough people accept it directly as a payment.

Like @bhoa said, it's too early to judge, crypto is still a baby. crypto started in 2009 it is just 13 years old or there about. When the internet was 13 years old, at the time Facebook was just starting (5years in with a volume of about $300 million on NASDAQ), amazon (57 million) had not become such a huge success...everything was still vague. Call me an optimist though, I still feel we have a long way to go.

There are many other factors to a currency than just buying stuff. This is where most people go wrong.

Cryptocurrency being use case might be for its ability to invest in projects that generate real wealth.

Posted Using LeoFinance Beta

I think gaming industry is a big market, if the crypto ties in with the in game app purchase and the various other use case then that sort of the business alignment would make the crypto useful for the everyday life. But I am hoping it all would happen in phases. :)

Gaming can certainly be a huge on ramp. There is no doubt that industry is truly primed for it. The users are accustomed to in game assets and tokens.

Posted Using LeoFinance Beta

Part of the reason we aren't noticing a business cycle is that the crypto market is easy to pick up use and dump leading to the volatility we see. I might be wrong but the stock market doesn't have that type of volatility because it is difficult to pick and dump. t is an interesting concept that was on my mind while reading your post.

Many people can't pass the price of crypto because it seems that is all there is to crypto. But that is what we need for things to change I guess.

The market has nothing to do with the business cycle, hence volatility is not relevant. The business cycle deal with the economic expansion of contract ie all business put together.

Crypto is still market focused, no so much business.

Posted Using LeoFinance Beta

I see. And apparently we don't have many real investors in crypto, we just have people hoping to benefit from the market.

Things will get better once we focus on the business of crypto than the market of crypto.

Without a doubt. We have a bunch of speculators. What we need is more business builders. That is where entrepreneurs are vital.

Posted Using LeoFinance Beta

I have been thinking of building an E commerce site on web 3. I keep stalling on starting but before I go to bed today...I'll start watching videos

For crypto to attain the popularity stage , it’s players just really need find all means of pinning uttermost value on this blockchain technology not only just seeing it as a means to sky rocket or double up wealth holdings .

That is true although money isnt wealth. So the wealth generation is rather low overall. We need to build those things that generate true wealth.

Posted Using LeoFinance Beta

Those are some questions that few can know but surely the market will indicate it in due time. You have to be attentive and not miss any detail of the crypto market

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1460000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

You have said well my friend. But the rate at which shit coins are being introduced to the system has made many people to not believe and hence remain in doubt about crypto currency but then I believe this issue will be cleared in little time to come.

Be very careful. What people are calling shit coins today could be tied to very valid projects.

Many are calling Hive a shit coin.

Posted Using LeoFinance Beta

I do understand your point brother but do you know that many investors use these new coins to rob people? Alright take a look at the doge coin, the safemoon and pitbull. What will you say about them?

Hive is not a shitcoin and those people calling hive a shitcoin are just ignorant.

I think the problems comes also from not having enough crypto philosophers in the field to have their perspective, they are either stuck in ivory tower libraries or crushed like cockroaches by fiat economists

Little do I have to say right now, but I think it is very important that we all take our mind off the fact that this Initiative is all about making money as some many think this days, honestly it goes far from that to the level of governance too.

It's almost impossible to predict prices but things will succeed so long as you have the features that people want. I think crypto can play a valid part of the developing technology and that it will work out so long as we keep building.

Posted Using LeoFinance Beta

It is probably more appropriate to look at cryptocurrencies like one would at fiat currencies. Yes, fiat currencies are an asset class. Their evaluation, however, does not rely on profit or loss. More likely it is the return generated via interest earned. And the attractiveness of the fiat is based on that as well as its stability vis-a-vis other fiat currencies.

Posted Using LeoFinance Beta