Cryptocurrency And The Business Cycle

Understanding what is taking place in the world as opposed to the mythology being promoted is vital. With cryptocurrency, we see a lot of the latter. Some people have a failure to understand money, business, and how things intertwine together.

For example, we were sold on Bitcoin by the fact that the USD was going to collapse and Bitcoin was the solution. At the same time, we were promised that Bitcoin was the perfect hedge against inflation (hyperinflation).

What happened?

We saw 40 year prints on the CPI while many developing countries are see double digit interest rates. Yet, in spite of that, the price of Bitcoin dropped almost 70%.

Another interesting factor is the USD going on a multi-decade run. For all the "money printing", how would the USD go higher if there was an enormous supply of it hitting the market? Anyone who understands supply and demand would quickly realize this is not the case. Hence, there must not be an oversupply of USD.

This can be traced back to the fact that, for all the talk about liquidity, the Fed does not print dollars. It creates what can be described as a bank token that is placed on the balance sheets of depository institutions. The money does not get into the real economy because only those with master accounts with the central bank can even hold it (only a specific few of them can hold the reserves). They might as well be printing up laundry tokens.

Another vital factor is the business cycle.

In this article we will discuss how it applies to cryptocurrency.

The Business Cycle And Money

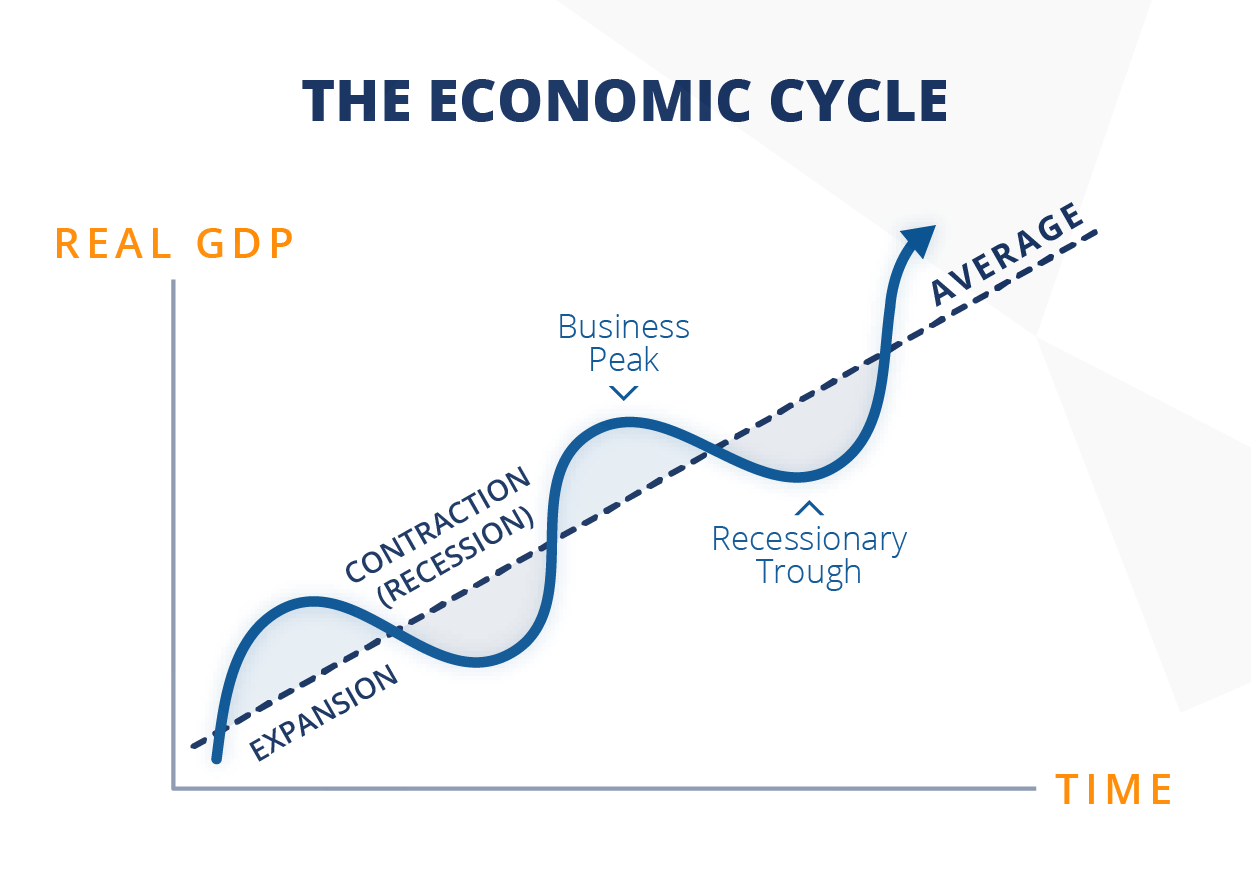

The business cycle has been around forever. This is something that, regardless of the financial engineering, cannot be eliminated. We often hear central bankers or, worse, politicians espousing how we are now able to do away with recessions. The newer array of products means that we can alter the business cycle.

It never works.

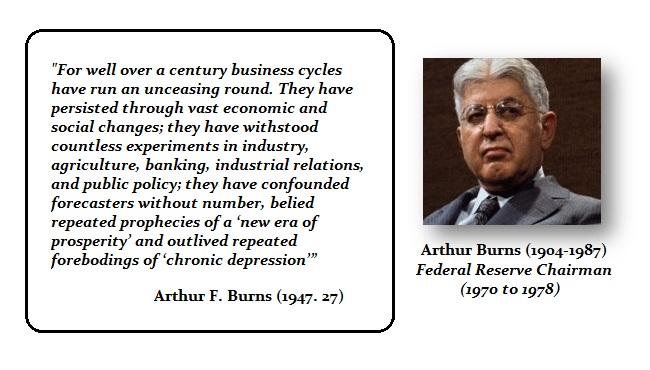

Here is what the Chair of the Fed, Arthur Burns, said at the collapse of Bretton Woods.

The reality is that, no matter what the form of money, the business cycle always occurred. There were periods of expansion followed up by contraction. We have no way around this yet many believe in the mythology that it is possible. The only way, perhaps, to prevent it is to eliminate freedoms yet even that failed when Marx confiscated private property.

As a side note, this is one of the promises they make for selling a CBDC. Do not fall for it.

Another important factor to consider is the value of money always rises and falls due to the business cycle. This is why different countries have results that vary as compared to their peers. It is also why commodities such as gold move up and down. Money always has a free floating rate. If not, it collapses everything.

Money Is Not Wealth

Wealth is business activity that leads to economic output. It is not just the accumulation of money. Many confuse the two.

One of the reasons the USD has the most value today is because the economic activity tied to that currency is off the charts. Nothing else in the world comes close. Since we are in an era of a ledger based monetary system (and have been for a few hundred years), the dollar is mostly a unit of account. What is used as money varies greatly.

Nevertheless, when you look at the size of different markets, we see how this is the case. The Eurodollar system funds more than 90% of the short term lending around the world. This is mostly USD denominated and accounts for tens of trillions in economic productivity. Roughly half the global debt is denominated in USD. There are probably somewhere around $1 trillion in derivatives based on dollars, assets that are used to hedge financial balance sheets all over the world.

Yet having all of this would mean little unless something was produced. There is where the wealth of a nation (or the world) comes from.

This is the transition that cryptocurrency needs to make.

Cryptocurrency Needs To Be Used To Generate Wealth

Another way of phrasing this is that cryptocurrency needs to get on the business cycle. It actually already follows it since markets are aligned with this. However, for it to serve as a vital role for money, this requires true economic productivity.

In other words, cryptocurrency has to be tied to the building of something. This is why we often discuss development. Without that, we are just creating something to HODL which, in the end, has little value.

Fortunately, cryptocurrency is, by its nature, linked to activity in some ways. Through those coins or tokens that are used as incentive, we see how this transitions.

Bitcoin, as an example, is used to incentivize people to operate, monitor, and make sure the network is secure. Those nodes are responsible for maintain the monetary ledger, a service that has extreme value.

The question becomes, however, what else does it offer?

This is what cryptocurrency has to answer. The business cycle is on the downward slope right now. Economic contraction appears to be taking place. This means that when it bottoms, crypto could be positioned to offer up some solutions.

We saw the value of cryptocurrency dropping since this is what happens when the business cycle starts to reverse in a negative direction. Contraction means the value of the money starts to diminish. Fortunately, the opposite happens. When we start to move into the expansion phase, cryptocurrency will benefit.

The key is going to be what each does in terms of the economic productivity. Is there anything of value tied to that coin or token? With so many producing so little, we know that the majority of what we see is not going to have much value.

Monetary value does not drive the business cycle. It is the exact opposite: the business cycle drives the value of money.

Elasticity is a crucial concept, one that is often misunderstood. We have to gain an understanding of how this all interacts so we do not fall victim of the false claims.

Sadly, we get the people like Peter Schiff out there spreading the same misguided notions for decades. Them screaming louder is not going to make it any more true.

Whatever the monetary unit, it is the business cycle that is in charge. Cryptocurrency needs to align with this. To operate in the world of fantasy is not going to serve us well.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This is lit!!!!!!! Please continue to write thought provoking articles like this.... if Crypto does not follow the business cycle, then what economic cycle does it follow? If the crypto market does not follow a economic cycle , then what economic structure or model has it build? What is it called?

The question is whether it can avoid following the business cycle. However, if it were not aligned, it could follow the credit cycle which resembles the business cycle yet operates on a different time frame.

Posted Using LeoFinance Beta

Wow! Business circle? This is interesting and informative, Learnt something new today.

Cryptocurrency is still in its early stages and I believe it will get on business circle as time goes on.

Posted Using LeoFinance Beta

https://twitter.com/wheelly_dope/status/1568979677141962753

https://twitter.com/RinaldiCosimo/status/1568988447020384256

https://twitter.com/RuelChavez5/status/1569124455003332611

The rewards earned on this comment will go directly to the people( @mcoinz79, @arc7icwolf, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Cryptocurrency has a lot to offer if it's introduce to business cycle and this will help to reshape the economic structure and source for wealth

A very great definition of wealth in my opinion.

It just makes me feel that if you don't produce something you can't be wealhy

As it applies for crypto currency, it also applies to individuals.

As an individual, if you don't produce a product or service, you can't accumulate wealth.

I really look forward to see crypto have that much value based on what it has to offer and not speculation.

For example, imagine if running ads on Facebook requires a crypto currency, you will notice that people will be attracted to holding the coin.

Great post

Individuals can generate wealth by investing and taking the profits and putting into wealth building assets. This would not be possible without the builders but we have the ability to latch onto their efforts.

The more we step back, the more this definition. If a country doesnt produce anything it is not likely to get very far. I believe the same is true for a blockchain network. That is why we have to build on Hive.

Posted Using LeoFinance Beta

I totally agree

The wealth creation part hits home base for me.

We need more HBD, Bonds, and maybe the LEO Reputation could be changed into something else that can be influenced by On-Chain fiscal analytics to signal others something like a credit score.

A lot of possibilities. For now, we need a lot more infrastructure built and people to understand how powerful cryptocurrency is.

Posted Using LeoFinance Beta

Generally, that is always true and might turn out to be impossible. Maybe just have more great products which are blockchain-based and people usin' it without extended knowledge.

That's pretty cool to know thanks for the tips by the way :)

If the economic cycles will continue to exist forever, we must also always be attentive, since even if we do not want to, it will happen in the same way.

Hi

It is sad to see how btc has still not decoupled from the USD

BTC and crypto can be the perfect replacement for fiat and yet its price action is governed by fed talk.

It is the mindset of people that needs to change and there is the need to see hodl and use btc and crypto for what they are

CBDC is proof that the traditional institution fears the crypto to take center stage and that might indeed replace in a time scale of 50-100 years. So they want to position themselves with CBDC so that they can hedge themselves as opposed to fiat, it's just hogwash, and not going to help them in an internet era.

Posted Using LeoFinance Beta