As Nations Default On Debt, New Collateral Is Needed

Many are concerned about the amount of debt that exists globally. At the same time, we are headed to World War 3. The leadership of the West is pushing it.

But why and how are these two related?

What we have is a classic misdirection. The gig is up. We are seeing the end of the Keynesian model that has been in place for decades.

Basically, most of the world is realizing the debt levels are unsustainable. There is no way they are going to pay it back. This is being highlighted by New York City which we are will get to in a moment.

So what does this have to do with World War 3?

Simple. The West needs the war to default on its debt. This is what always happens during war. When countries (more accurately governments) fall, they do not honor the debt.

Ultimately, even the United States will fall into this category, although it might be the last one.

So while many focus upon the potential of bank failures, it is the sovereign debt crisis that everyone should be concerned about.

As Nations Default, New ollCateralLike Hive Bonds Will Be Required

Since the Great Financial Crisis, we operated in a period of balance sheet constraint. This means that the banks do not have enough on their balance sheet to fund the need for money that is required for global trade.

This comes from the tightening of collateral .

As we exited the GFC, mortgage-backed securities (MBS) were nuked with regards to their viability as high quality collateral.

What we were left with is sovereign debt. While this worked for a few years, the decision to go negative with the interest rates by many countries took their bond markets out. This essentially removed this collateral from the table.

Hence, we were left with basically US Treasuries. It is easy to see why The Fed is at the center of everything when we are discussing the global financial situation.

Outside a few isolated German, British, and Italian notes (mostly short term), the game is Treasuries. Even there, we have a lot off-the-run making it unusable as collateral, a situation exemplified by Silicon Valley Bank.

Since 2008, the world was desperate for another form of high quality collateral. Unfortunately, not only has that failed to materialize, as we will see, things are about to get a whole lot worse.

Kevin O'Leary Hates New York

Did you see the remarks made by Kevin O'Leary after the Trump civil case?

Now, it doesn't matter what you think of O'Leary, or Trump for that matter. What is important is the conclusion he reached.

He does not trust New York. This is a problem. When trust do to a failure in the rule of law (real or imagined) occurs, major issues arise.

New York City had a total debt amount of $125 billion at the end of 2020. There is no way this is going to be repaid. The State of New York is over $200 billion, with assets totaling $106 billion.

The problem is not only trying to sustain these debt loads, the incentive to invest is rapidly diminishing. O'Leary is an example of that. One of the companies he has is building out data centers all over the United States. Bet the ranch he is not entering New York even though it has hydro-power from Niagara Falls.

We already saw a number of financial firms leaving New York City and Wall Street. This will be taken to another level when the justice (he is not a formal judge, only acting) sentences Trump.

Some will be happy about it, others will be upset.

Whatever happens, this will not be good for investment.

This example of debt will be extended out further to the national levels. Emerging markets likely get hit first, followed by Western Europe. Eventually, the United States will be confronted with the prospect of nobody buying its debt.

Debt levels mean nothing as long as someone is buying it. Here is where the balance of the entire system rests. When the buyers dry up, it is game over.

Replacement Collateral

For a couple years, we discussed the idea of Hive Bonds. This is a market that needs addressing.

Over the next decade, we will see a lot of what is forecast here playing out. Much of it is already in motion.

The major question confronting the financial world will be where to find safety with collateral. If even T-Bills are not trusted, where are entities going to turn?

To answer this, it is helpful to remember that debt is simply a matter of perspective. Many say debt is bad. They view it as a liability. Debt is only a liability to the entity issuing it (when referring to bonds). That is who is responsible for paying it back.

Debt is also an asset. This is something that cannot be avoided. double-entry accounting means each asset is offset by a liability, and vice versa.

The international system uses assets to fund global trade. Even the $15 trillion in Treasuries is not enough to keep up with the historical growth rates.

When dealing with such a large animal, it takes a lot to feed it.

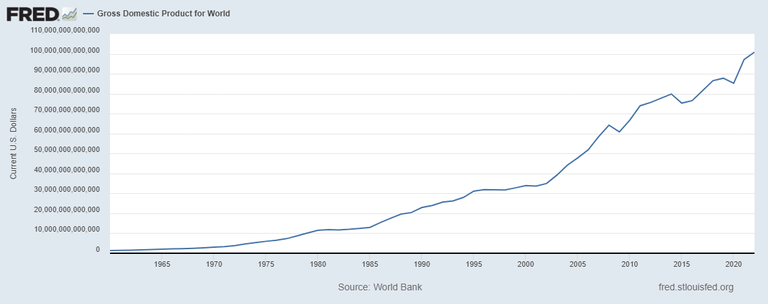

We are looking at just over $100 trillion.

This means we will need tens of trillions in collateral, simply to meet short-term needed. Things get even crazier if we consider remaking other forms of lending which can come through a transition to a new model.

Hive Bonds

Hive Bonds provide a clear path of ownership. They would allow buyers to understand the parameters with regards to payment in a transparent manner.

Since all this is tied to blockchain, at its core, the trust requires no third party. Naturally, there could be applications or businesses built on top that provide different services that could introduce counterparty risk. That said, the asset itself is not subject to this.

As stated, there is going to be a need for tens of trillions in collateral. It is likely to grow as the needs of world expand. Fortunately, in my view, cryptocurrency offers the potential to expand in a manner that can help meet the needs, especially as technology expands.

What happens in the case of default on a significant portion of sovereign debt? Obviously, this is going to be serious implications across the world in ways far beyond this article. However, when we look at the funding mechanism, we are back to the situation since the GFC, a need for collateral. The difference is, this time, it will be on steroids.

For the last 17 years, we have balance sheet constraint due to a lack of quality collateral. This is only going to get worse as sovereign debt situations arise. Even if a country doesn't default, the confidence level in all government assets could wane, pushing demand towards the private sector (good for crypto?). This would affect all countries regardless.

When it comes to this system, we are still dealing with the fact, after MBS were exposed, the private sector has yet to put up a form of collateral that can fill in the void. If it did, we would not even know the phrase "balance sheet constraint".

Find a problem and solve it.

Here is where cryptocurrency offers the potential to step up.

Posted Using InLeo Alpha

It's scary to see how reliant we are on traditional forms of collateral, especially when they're becoming less trusted. The concept of Hive Bonds sounds very very intriguing and I really believe could offer a much-needed solution. I learned so much from just this one blog

Also Taskmaster, the discussion about Kevin O'Leary's remarks on New York City's debt situation is really really eye-opening to me. It's concerning to see such a major financial hub facing trust issues. I believe this could have serious implications for investment and the economy.

The entire system needs a major overhaul unless we do that, we'll be plunged into more wars, more crisis and poverty...

Seeing the high debt really explains the big strain on the people. Some were saying that the West really wants Russia to lose so they can seize assets as reparations. Hivebonds feels like a really good alternative to combat this much debt.