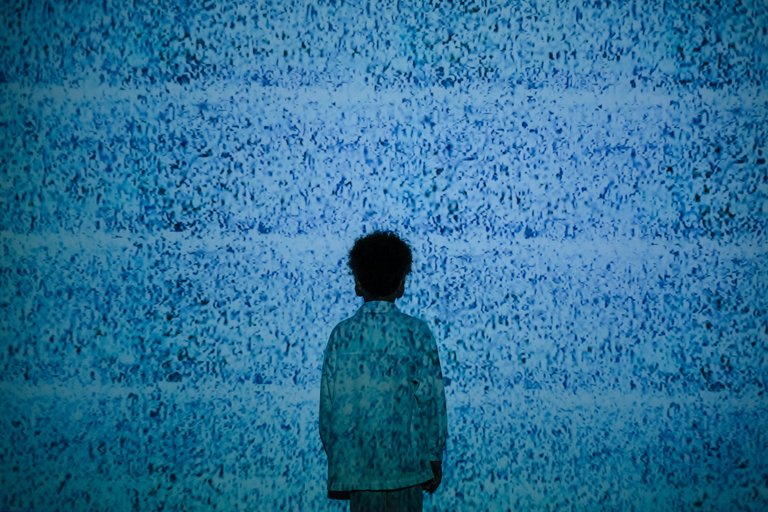

Noise Vs Signal: How To Differentiate Between Them

"All that is gold does not glitter," wrote J.R.R. Tolkien in The Fellowship of the Ring.

In the world of finance and investment, I think this wisdom rings truer than ever. Because on an almost consistent basis, we're bombarded with financial news, market fluctuations, subtle investment advices etc.

But amidst the foreground about glittering headlines and fleeting trends, a crucial question lurks in the background, that is how do we distinguish true signals, indicative of genuine opportunities, from mere noise, masking the underlying reality?

For example, the theme of "appearances can be deceiving" clearly shows us how seemingly important financial news might not hold real substance. I would argue some are used as tools to sway market sentiment.

Noise Vs Signal

In a financial context, noise refers to any information or activity that confuses or misleads, obscuring the underlying trends and valuable insights.

This may include short-term market fluctuations, fleeting news headlines, biased analyst opinions, and even irrelevant economic data.

It's essentially the "glitter" that doesn't hold true value, but confuses and distracts investors from focusing on the underlying fundamentals.

Conversely, signal represents the meaningful information that truly reflects the financial health and potential of an investment.

This includes factors like long-term economic trends, a project or company's long-term growth prospects, its competitive advantage, and perhaps, the stability of its financial. It's the "gold" worth digging for.

Examples of Financial Noise

If you think about it, short-term market volatility such as daily or weekly swings in market prices are often driven more by emotional reactions and temporary news cycles, rather than fundamental changes in value.

On one side, this is mostly propelled by clickbait headlines and fleeting news stories that magnify short-term movements and create hype sensations out of them.

In certain cases, analyst opinions can be regarded as noise. While some analysts offer valuable insights, many base their opinions on vested interests, short-term trends or personal biases, which can always be misleading.

Focusing on every economic data point released can be overwhelming and lead to misinterpretations. Not all economic indicators are created equal. Paying attention to economic metrics that have no bearing on a specific investment decision simply creates unnecessary noise.

Strategies For Filtering Out Noise

Recognizing and filtering out noise is crucial for successful investing. Having recognized what noise is and examples of it, filtering them out becomes simple.

The antidote to short term volatility is long term trends. Stepping above the noise through focusing on long term fundamentals, these don't change often, which makes them more reliable.

A solution to analysts creating noise is diversifying information sources. Don't rely on a few sources of information. Seek out diverse perspectives from different sources such as reputable analysts, research reports, and industry experts.

Irrelevant economic data can be remedied by conducting fundamental analysis. Whether it is the general economy or a specific market, always start by establishing what the fundamentals are.

Why get lost in the noise of every economic data point when one can focus on the fundamentals that directly impact their chosen investment?

It is often said that true investment success lies in identifying and capitalizing on the genuine signals of opportunity that seemingly lie beneath the surface, covered by all the noise.

Thanks for reading!! Share your thoughts below on the comments.

Posted Using InLeo Alpha