Santa Came Early For Us (100K BTC)

The Santa Claus Rally

With Christmas around the corner, it’s time to talk about Santa Claus. And you might be wondering, What does Santa have to do with investments? Surprisingly, a lot! Because sometimes, Santa doesn’t just bring gifts for kids—he delivers some to investors too. Enter the Santa Claus Rally.

What Is the Santa Claus Rally?

For those scratching their heads, the Santa Claus Rally refers to a small but consistent stock market uptick that happens around Christmas. Specifically, it occurs in the last five trading days of December and the first two trading days of January. Think of it as a little "holiday bonus" for your portfolio.

Where Did This Term Come From?

The term was coined by Yale Hirsch in 1972, through the Stock Trader’s Almanac. And here’s the cool part: Historically, the stock market has risen during this period about 80% of the time, with the S&P 500 gaining an average of 1.4%.

Why Does It Happen?

There are plenty of theories as to why this rally occurs. Here are some popular ones:

Holiday Cheer: General optimism and festive vibes.

End-of-Year Bonuses: Many investors reinvest their year-end bonuses.

Less Institutional Presence: Big institutional players (a.k.a. the market's “grinches”) are often on vacation, leaving the market in the hands of retail investors, who tend to be more optimistic.

What Does the Data Say?

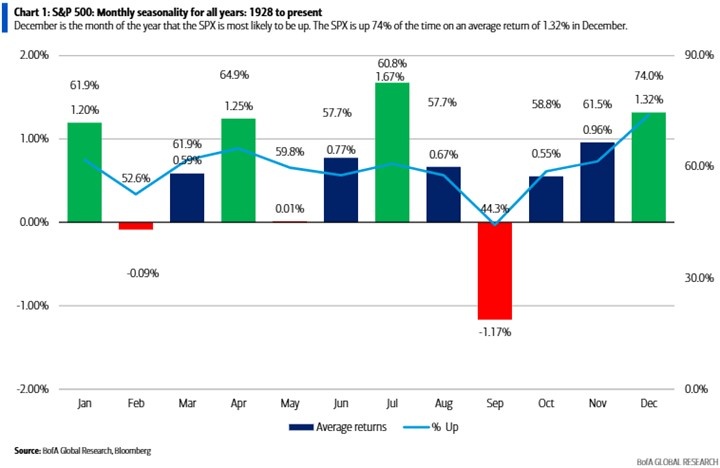

The Bank of America studied the Santa Claus Rally and found some interesting patterns. Since 1928, December has been one of the most positive months for stocks:

74% of the time, the market sees gains in December.

The average return? 1.32%.

Even better? During U.S. election years, like this one, the numbers improve:

- Gains occur 83% of the time, with an average return of 1.51%.

Does Timing Matter?

Absolutely! According to BofA, the real magic happens in the last 10 trading days of December.

First 10 days of December: Market rises only 59% of the time, with a measly average gain of 0.05%.

Last 10 days of December: Gains shoot up to 72% of the time, with an average return of 1.17%.

What About Bitcoin (BTC)?

Let’s talk about the crypto market’s own version of a holiday boost. Over the past 15 years, Bitcoin has also shown interesting patterns in December:

General Trend: December tends to be a mixed bag for BTC, with noticeable spikes in bullish years and crashes in bearish ones.

Average December Performance (2009–2023): BTC has seen a median return of ~5.3% in December.

Biggest December Gains: In 2017, during the crypto bull run, BTC skyrocketed 42% in December.

Biggest December Loss: In 2013, BTC dropped a staggering -33% as the market cooled after a bull frenzy.

BTC Santa Claus Rally?

Although not as consistent as the stock market, Bitcoin often experiences year-end volatility due to factors like:

Tax Harvesting: Investors sell off losing positions for tax benefits.

Institutional Interest: Year-end announcements or fund allocations often shake up the market.

Retail FOMO: New investors jump in, hoping to ride the holiday wave.

Interestingly, BTC tends to perform better in the last week of December compared to earlier in the month. In bullish years, this period has brought average returns of ~12%.

For us investing and holding BTC this time Santa came early and we broke 100,000$ and it a historic time because if you are into crypto from the early days you are now feeling vindicated so be glad you have stayed for all those years this is our day.

Posted Using InLeo Alpha

@tipu curate

Upvoted 👌 (Mana: 39/49) Liquid rewards.

Thanks for some BTC history there. 2013 seemed like such a long time. It looked like 2017 is looking similar what we might be have in 2025 rather than 2021.

In altcoins you mean?