REIT's And NVIDIA

The entire REIT (Real Estate Investment Trust) sector has been under pressure lately

What kind of pressure exactly?

Patience, we’ll get into all of it. According to a relevant report, REITs have seen their average FFO (Funds From Operations) per share decrease by 6.32% year-over-year and 9.10% quarter-over-quarter, reaching $0.73.

Additionally, total FFOs for equity REITs fell to $18.59 billion from $20.27 billion in the previous quarter. Compared to the same quarter in 2023, the figure was also lower ($19.64 billion). This decline reflects the challenges facing the sector, particularly due to the pressures of high interest rates.

But haven’t interest rates started to decrease? you might point out. Yes, they have, but they’re still at elevated levels, which remains the root of the problem' for REITs right now. And the reason is straightforward: Most companies in the sector fund their investments through borrowing. When interest rates are high, borrowing costs rise, squeezing profit margins. And as you can imagine, the market had priced in the expectation that the Fed would cut rates faster than it seems to be doing.

At the same time, volatility from factors such as the U.S. elections and general economic uncertainty is playing its part.

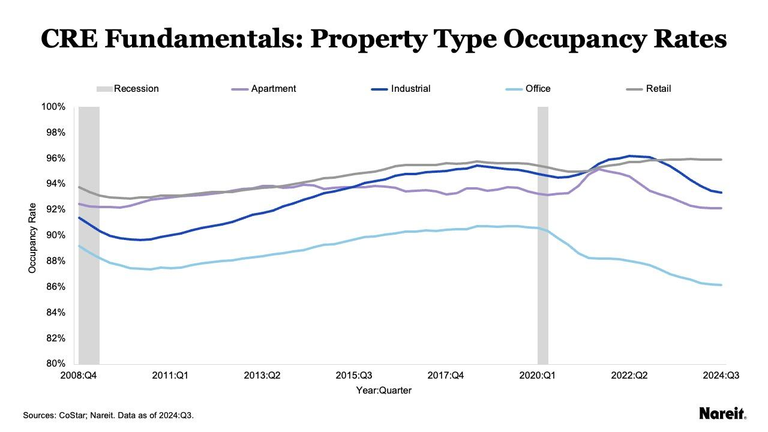

That said, it’s not all bad news. While net operating income (NOI) per share dropped 2.37% from the previous quarter, it remains 0.70% higher compared to last year. Moreover, the occupancy rate increased to 93.60%, which is undoubtedly a positive sign for the sector's stability.

This tells us that, despite the challenges, REITs remain a significant tool in real estate. And let’s not forget that falling prices can create opportunities for long-term investors like us.

REALTY INCOME

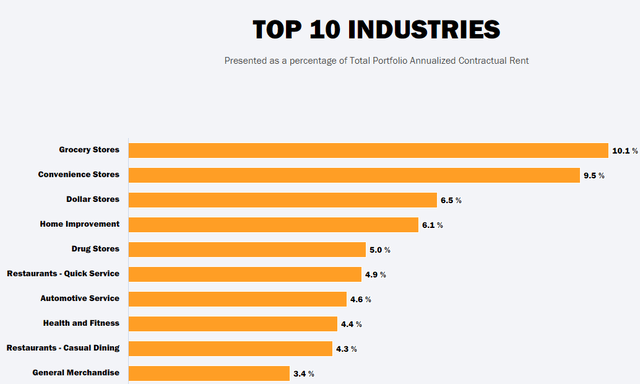

Despite the broader sector’s performance, Realty Income continues to showcase strong fundamentals. The company has an impressive strategy, with long-term leases and high-quality properties that help it remain steady in tough conditions.

Although the drop in its stock price stems from general sector pressure, Realty Income is still increasing its FFOs and delivering higher revenues. This demonstrates that the recent decline in its stock is not linked to the company’s fundamentals.

To look at specifics, the biggest losers during the recent period have been REITs focused on hotels, self-storage, cell towers, and cold storage. Realty Income doesn’t belong to any of these troubled categories, which gives us more confidence in its future.

NVIDIA

Tonight, after the markets close, all eyes are on Nvidia’s quarterly earnings .

Nobody can say for sure what to expect . Some analysts are predicting strong results due to high demand for the Blackwell, while others argue this demand might not be sustainable in the coming months .

On the bright side, we’re seeing big tech capital expenditures skyrocketing , with a significant chunk of that money flowing straight into Nvidia’s pockets .

Also, Nvidia has a stellar track record of beating analyst estimates for over a decade.

However, with a forward P/E of 42, the stock is priced for perfection. Expectations are through the roof, and even the slightest misstep could trigger a sell-off.

Posted Using InLeo Alpha

All eyes on NVIDIA tonight for sure. 👀🙏🏻

@tipu curate

Upvoted 👌 (Mana: 25/45) Liquid rewards.