Rate Cuts , Bonds And Investing Opportunities

Lately, I have been trying to find investment opportunities in traditional markets because, as I mentioned in a previous post, despite offering lower returns compared to crypto, traditional investing carries significantly lower risk. It is also easier to find liquidity to buy or sell large amounts and cash out when you want, as the regulatory framework is much clearer.

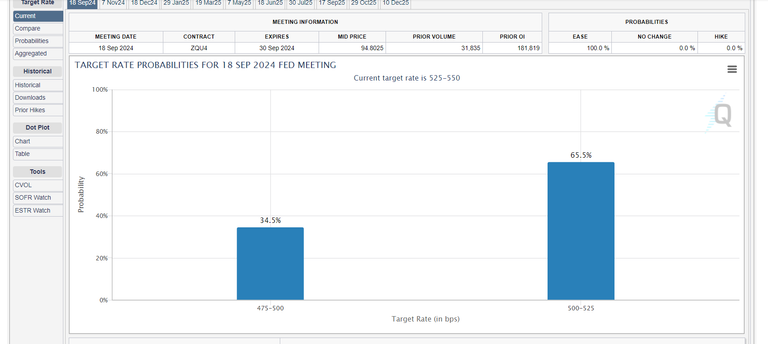

With that in mind, there is widespread expectation that in the next FED meeting, we will finally see a rate cut after years of increases. The only question is how much the rate will be cut. The most likely scenario is a 0.25% cut at the next meeting because they will probably want to see how the markets react and what the CPI data will show before considering a more aggressive 0.5% cut. The chances are currently 65.5% for a 0.25% cut and 34.5% for a 0.50% cut.

What does this mean for the markets? Despite the high rates, sentiment and expectations matter more. Initially, everyone will start believing that cheap money is back, and the “fat cows” will start producing “free milk” for anyone to drink, so people will begin entering risk mode once again.

How will this affect the bond market?

Bonds, like all risk assets, have an inverse relationship with interest rates. When interest rates are rising, it’s more profitable and less risky to keep your money in the bank and earn the 5% interest available until now. But when rates are falling, it’s better to invest in assets like bonds because they will provide better returns than keeping your money in a bank account. This principle also applies to all risky assets like crypto, stocks, etc.

So, with that mindset, what is the best type of investment one can make? Buy IDTL.

The IDTL is a bond ETF that tracks 20-year U.S. Treasury bonds 🇺🇸. (And it's UCITS, meaning it's tax-exempt.) The main characteristic of this ETF is that, in the long term, it moves inversely to the direction of interest rates. Given that the FED’s interest rates are expected to decrease within the next two years, the IDTL is expected to rise. This rise could be significant, and the ETF also offers dividends close to 4% per year. So, a likely increase in price combined with a 4% dividend is very appealing.

My next move will be to buy some of that and wait to see what happens. What I’m aiming to achieve is a balanced portfolio with both crypto and traditional market assets that will provide passive income, allowing me to weather any situation—whether it’s bull markets, bear markets, rate cuts, rate hikes, wars, etc.

Read More About My Portfolio Diversification

Posted Using InLeo Alpha

I agree that rules and paperwork on your investments in the Traditional market are a lot clearer, and the investments easy to make. The returns are not Bitcoin like or even HBD, but perhpas the advantages make up for the lower returns. The tax savings along increase the effective yield, so there's that. It's nice to see someone in crypto still using the traditional markets and writing about it.