Profiting From The Chinese Stock Rally

Iran launched an attack against Israel—something many expected, though at times I believed it might not happen. Still, with Israel cornering Iran, it seemed inevitable. But that's a discussion for another day.

What I want to focus on today is China, where efforts are being made to strengthen the real estate market, which has been struggling in recent years.

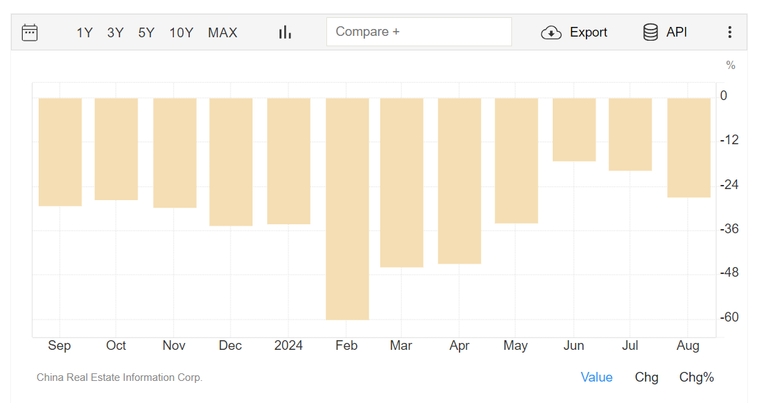

New home sales in China dropped to -26.8% in August, down from -19.7% in July 2024.

In response, China's major cities, including Shanghai, Beijing, and Guangzhou, have introduced significant measures to relax housing market regulations in an effort to stimulate demand. And when I say "relax," I mean some very substantial changes.

For instance, Guangzhou has announced the removal of all restrictions on home purchases. Previously, non-permanent residents had to pay taxes or contribute to Social Security for six months before being eligible to buy a home. Now, these restrictions have been lifted—no more delays. Meanwhile, in Shanghai, the tax payment period required for purchasing a home has been reduced from three years to one.

What does this mean? In simple terms, it means that potential homebuyers can now purchase property much faster, without needing to wait years to meet the qualifications.

Why are they doing it? The past years the housing market in China was crumbling we all remember Evergrande So they want to boost the market and with it seems that the stock market likes it

Hang Seng Mainland Properties Index

The Hang Seng Mainland Properties Index is a stock index that tracks the performance of property companies operating in mainland China but listed in Hong Kong. The index includes up to 30 of the largest property companies. Today, the index surged by nearly 15%.

It's not just the cities taking steps to boost the housing market—the central bank also lowered mortgage interest rates by 0.5% and reduced the down payment for second-home purchases to 15%.

So, how can we profit from this? We can gain exposure to the recent activity in China by investing in the iShares MSCI China ETF. This ETF tracks the MSCI China Index, which includes large and mid-cap Chinese companies across sectors like technology, financials, consumer discretionary, communication services, and more. I believe this is the safest way to gain exposure.

almost 40% rise the past 2 weeks.

Some stocks to also keep an eye on.

Alibaba

36% Up

PDD Holdings

70% Up

Baidu

45% Up

JD.com

Almost 80% Up

Posted Using InLeo Alpha

https://inleo.io/threads/view/omarrojas/re-leothreads-2ojqbrpzr?referral=omarrojas

I have invested in some Chinese stocks in the past and while with some I did great, with others I got pretty burned. I guess there is opportunity in any market, but I find Chinese market hard to predict due to the state interventions.

Yes the the Chinese markets are also more volatile and the performance the past year was bad. But at some point the downtrend is going to stop.

!LOL

!INDEED

lolztoken.com

By the number of gigs it has.

Credit: reddit

@steemychicken1, I sent you an $LOLZ on behalf of gameexp

(7/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

(7/10)

@steemychicken1! @gameexp Totally agrees with your content! so I just sent 1 IDD to your account on behalf of @gameexp.