Orderly Netword

Lately I am searching for good decentralized platforms to trade with leverage and Orderly peaked my interest so I made some research.

What is Orderly Network?

Orderly Network is a decentralized finance platform that provides developers with the tools necessary to build their own DeFi applications. At its core, Orderly is built on a foundation of shared liquidity and seamless integration across various chains and protocols. This unique approach enables developers to create decentralized exchanges (DEXs), liquidity pools, and other DeFi applications with minimal friction.

How Does Orderly Work?

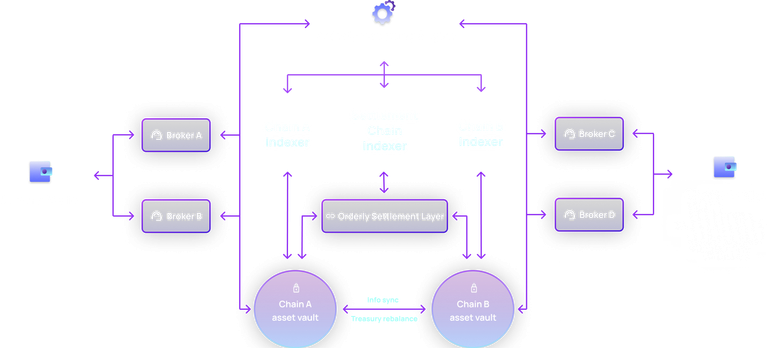

Orderly operates across three main layers: the Asset Layer, Settlement Layer, and Engine Layer. The Asset Layer resides on each supported chain and allows users to interact with the platform by registering, depositing, and withdrawing assets. The Settlement Layer acts as a transaction ledger, facilitating the seamless transfer of assets between users. Finally, the Engine Layer houses the order book and other order-related services, providing traders with the tools they need to manage their positions.

What Does Orderly Offer?

What Does Orderly Offer?

- Shared Liquidity: By pooling liquidity across multiple chains and protocols, Orderly enables traders to access deep liquidity pools and execute trades with minimal slippage.

- Developer Tools: Orderly provides a comprehensive suite of developer tools, including APIs, SDKs, and customizable UI components, to streamline the development process and accelerate time-to-market.

- Decentralized Liquidations: Unlike centralized exchanges, which often trigger cascading liquidations during market downturns, Orderly adopts a decentralized liquidation model that transfers positions to liquidators at a discount, minimizing the impact on traders.

What Problems Does Orderly Solve?

- Complexity: DeFi can be notoriously complex, with fragmented liquidity and interoperability challenges. Orderly simplifies the process of building and accessing DeFi applications, making it easier for developers and traders to navigate the ecosystem.

- Liquidity Fragmentation: By pooling liquidity across chains and protocols, Orderly addresses the issue of liquidity fragmentation, enabling traders to access deeper and more liquid markets.

- Market Manipulation: With its decentralized liquidation model and shared liquidity pools, Orderly mitigates the risk of market manipulation and cascading liquidations, creating a more stable and resilient trading environment.

Where is Orderly Built?

Orderly Network is built on top of Ethereum Virtual Machine (EVM) chains, including Arbitrum and Optimism, as well as non-EVM chains like NEAR Protocol. This multi-chain approach allows Orderly to leverage the unique features and capabilities of each chain while maintaining interoperability across the entire network.

How can Someone Use Orderly?

- Developers: Developers can leverage Orderly's developer tools and infrastructure to build their own DeFi applications, including DEXs, liquidity pools, and trading platforms. By tapping into Orderly's shared liquidity pools and seamless integration, developers can accelerate development and reach a wider audience.

- Traders: Traders can access Orderly's decentralized exchanges and liquidity pools to execute trades with minimal slippage and maximum efficiency. With access to deep liquidity pools and a wide range of trading pairs, traders can take advantage of opportunities across multiple chains and protocols.

I am keeping an eye on this and so should you.

Links

https://twitter.com/OrderlyNetwork

Posted Using InLeo Alpha

@tipu curate

Upvoted 👌 (Mana: 27/47) Liquid rewards.

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: