Inflation Is A Pain In The Ass

Hey Guys

Yesterday, we had the first CPI report after the FED's interest rate cut.

INFLATION

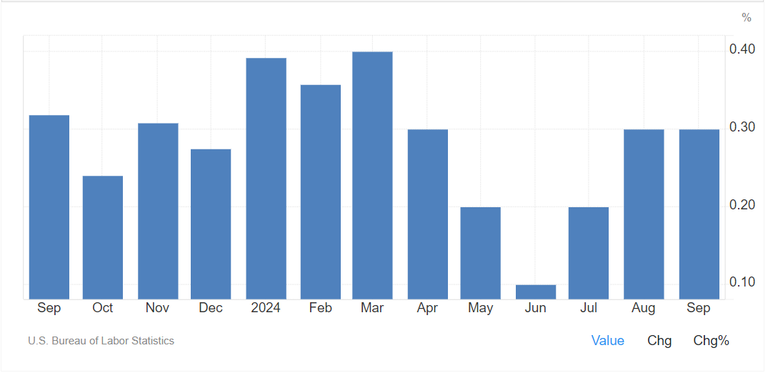

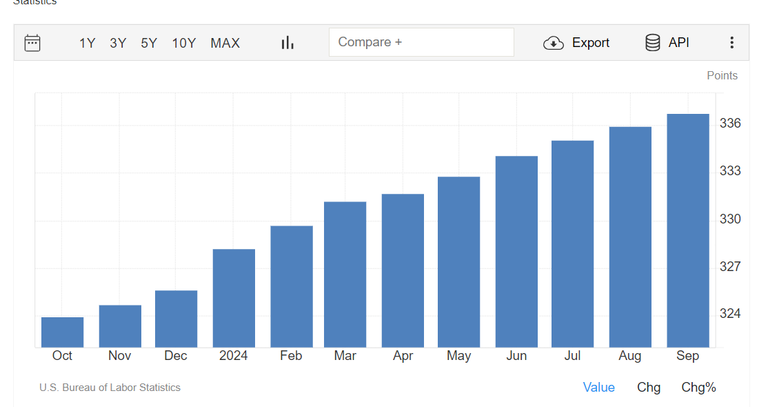

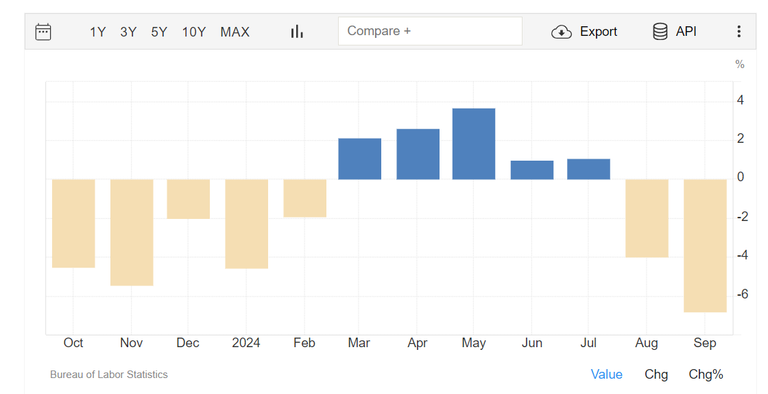

So, let’s start from the beginning. Inflation in September didn’t drop as analysts had expected. In fact, on a monthly basis, the Consumer Price Index (CPI) increased by 0.2%, exactly as it did in August, and slightly higher than the anticipated 0.1%.

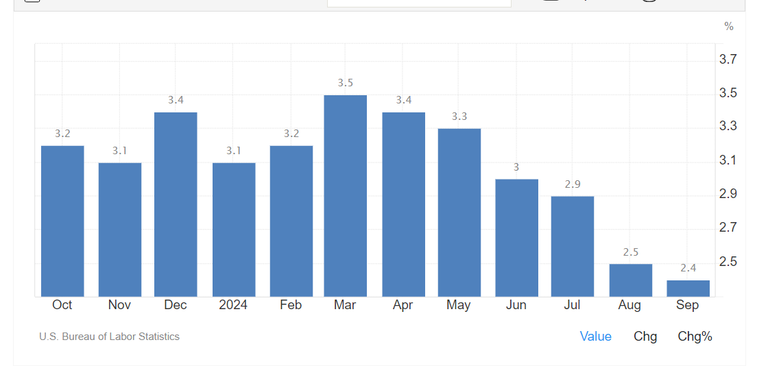

Now, on an annual basis, although it fell to 2.4% (from 2.5%), it was still marginally above the expected 2.3%.

Some of you might wonder Why does this 0.1% matter? What difference does it make? The difference is that the lower inflation is, the higher the chances the FED will reduce interest rates. So, even a small 0.1% can mean much more for the markets!

As usual, the biggest contributors to inflation’s rise were housing and food. In fact, these two categories were responsible for more than 75% of the total increase! More specifically, housing rose by 0.2%, significantly lower than August’s 0.5%. However, food was the surprise, increasing by 0.4%, compared to just 0.1% the previous month.

Food

Housing

At this point, you might ask , what about energy? Didn't it drop? The energy index dropped by 1.9% since August, which helped prevent an even larger increase in inflation.

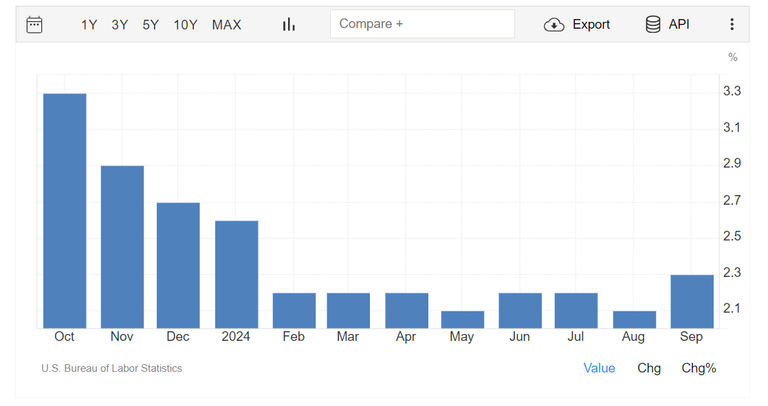

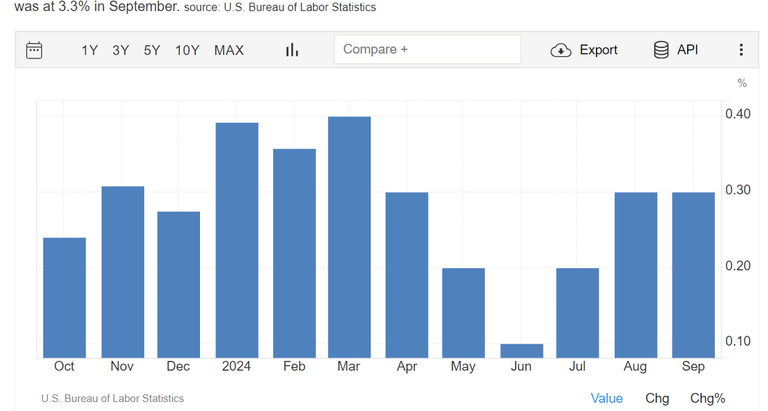

As for the Core CPI, which excludes food and energy, it remained steady at +0.3% on a monthly basis, higher than the expected +0.2%. But why did this happen? This happened because other categories, such as car insurance, medical care, and airfares, increased significantly. For example, car insurance jumped by 1.2% in just one month!

FED

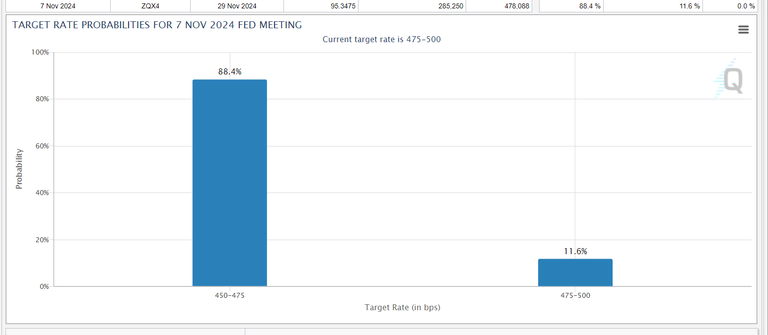

And now the big question, so what will the FED do now ? Look, despite expectations for a rate cut in November, this data suggests the FED will likely take a wait-and-see approach. In other words, they won’t rush to cut rates.

However, the chance of a 25-basis point rate cut in November remains high, standing at 88,4%. But the scenario of a 50-basis point cut, which was at 32.1% just a week ago, has fallen to 0 .

Posted Using InLeo Alpha

@tipu curate

Upvoted 👌 (Mana: 13/43) Liquid rewards.