How Smart Money Flows In Times Of Uncertainty

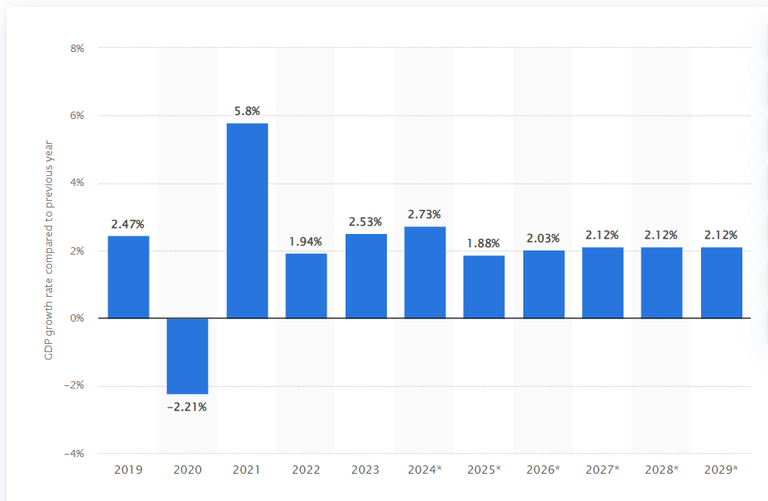

Data, numbers, and the investment community anticipate an almost certain recession, which has already been postponed several times with some amazing math moves from Janet Yellen , and it is wise to prepare for such an event. What should concern us more than anything else is understanding the money flow even if a lot of people believe that those are what doomsayers are saying.

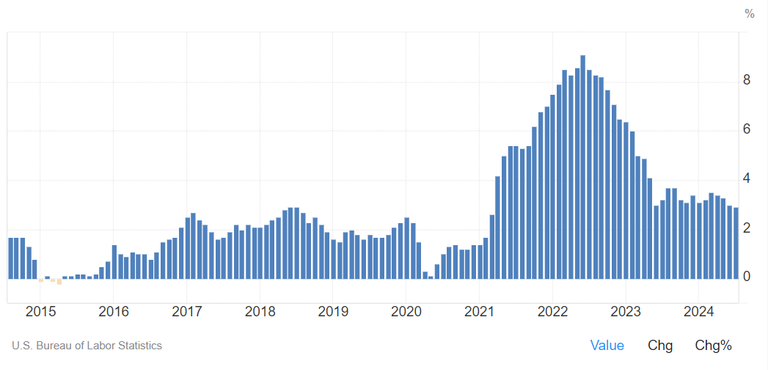

Inflation

In the summer of 2022, inflation reached 9.1% in the US, something that hadn't happened for decades and led to two years of constant rate hikes. Despite the immediate and ultimately effective intervention by the Fed, which raised interest rates to as high as 5.5%, the measures against inflation significantly slowed down the flow of money, decelerated markets, and boosted investments in safer havens. Despite everyone expecting the US economy to enter a recession mode the economy looked stronger than ever in a world wide weak economic environment.

source

**Bonds **

This might be the best time to invest in them. The reasons are high interest rates and yields, the prospect of rate cuts, the safety during a period of economic uncertainty, and the opportunities to lock in these high yields for the future. It's important to understand that investors are turning towards bonds and that a large volume of money will be transferred there. Additionally, it’s worth observing the reductions in interest rates, as this will signal an increase in bond prices and potential profit opportunities for investors, with money possibly flowing into other markets. Finally, this shift towards bonds might reduce demand for cryptocurrencies in the short term, as investors seek safety.

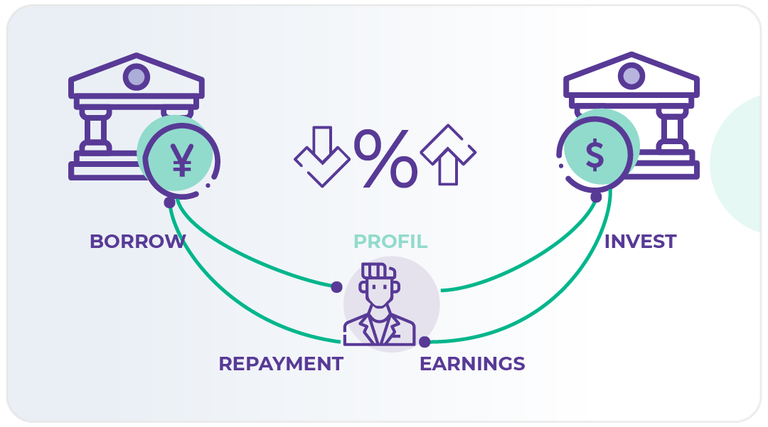

Carry Trade

A widespread and relatively safe investment strategy is to borrow money from an economy with as low interest rates as possible and invest it in another with higher interest rates to profit from the difference. The most popular such currency pair in recent years was USD/JPY, with the dollar maintaining the highest interest rates in the last 15 years and the yen having negative interest rates for years. This changed a few weeks ago when the Bank of Japan decided to raise interest rates after 30+ years. This increase strengthened the yen and caused massive liquidations of positions, creating pressures in the markets. This reversal in the carry trade strategy could worsen economic instability as investors reassess their positions.

More Reading

Gold

We know that gold is a safe haven in times of crisis, insecurity, and wars. Its current state gives us a clear sense of how investors view the situation in the near future. Gold is rising mainly due to expectations of an impending crisis and not so much after it occurs. It’s important to observe where and when it will start to decline and where the capital will be redirected, as it would be interesting to watch for a potential shift towards crypto. Gold is making All time high after all time high

Stock Market

A strange phenomenon where two traditionally opposing markets, gold and the stock market, are both strengthening simultaneously. This is something that is not yet clear why it is happened but the most possible reason will be the rise of AI and all the hype it brought in the stock market. Here, it is crucial to focus on the possibility of an imminent correction in the stock market, as the incompatibility between the rise of the stock market and the rise of gold might indicate overvaluation.

Investors/Whales

One of the most important indicators for the direction and image of the economy is the movements and decisions of the world's largest funds. Recently, we observe the tendency to liquidate large quantities of stocks. Berkshire Hathaway is a prime example

Crypto

Bitcoin

After a strong rally of about 372% that lasted 1.5 years, Bitcoin has been correcting and attempting to break previous highs over the past 5-6 months, with a significant drop occurring a few weeks ago. Unlike gold and the stock market, which have almost fully recovered from smaller corrections, Bitcoin shows signs of fear and weakness. The big question, however, is how Bitcoin will behave in a scenario where traditional markets are correcting and the U.S. economy is entering a recession. Will it be considered a safe haven in a future crisis? Will it be seen as a good investment in a period when any investment in traditional assets seems risky? And how will its rise cycle evolve while miners are not in profitable zones?

On the other hand, crypto-alt-coin are in a much more difficult situation, essentially the alt coin market is dead.

We observe capital outflows towards bonds, gold (and other precious metals), and the stock market.

At the same time, during the same period, and in contrast to the rest of the traditonal markets, we see a corrective trend and a decline of approximately $700 billion in the total market capitalization of cryptocurrencies. This amount corresponds to about 1/4 of the total capital in this market.

Berkshire Hathaway Reached 1 Trillion Market Cap

Rate Cuts , Bonds And Investing Opportunities

Posted Using InLeo Alpha

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Government bonds, USD/JPY, and gold.

It reminds me of my stock trading strategy. I love to pick up "dead stocks."