Economic News For The Week And Why I Invest In US Stocks

The Week Ahead in FX and Bond Markets

United States (Fed)

The Fed is expected to cut interest rates by 25 basis points. While rate cuts typically put pressure on the US dollar (USD), recent inflation increases could keep the USD strong, as the Fed may adopt a cautious stance on further reductions.

Japan (BoJ):

The Bank of Japan (BoJ) appears inclined to wait before hiking rates again, as hinted by Governor Ueda. This strategy might weaken the Japanese yen (JPY), especially if the USD remains robust on the back of US data.

Eurozone:

Key PMI and inflation data will reveal whether recovery is on the horizon. Prospects remain subdued, and weak economic data could further pressure the euro (EUR).

United Kingdom (BoE):

The Bank of England (BoE) is expected to hold rates steady at 4.75%. Elevated inflation and labor market figures may help keep the pound sterling (GBP) stable against both the USD and EUR.

China:

Retail sales and industrial production figures will indicate whether stimulus measures are yielding results. Positive data could boost commodities and currencies like the Australian dollar (AUD) and New Zealand dollar (NZD).

Australia & New Zealand:

In Australia, the budget release might influence future Reserve Bank of Australia (RBA) decisions. In New Zealand, growth data will shape expectations for further rate cuts.

Many people ask me why I started investing in the US market.

Well, of course, it’s because, in my opinion, the US is the most stable and strongest economy on the planet .

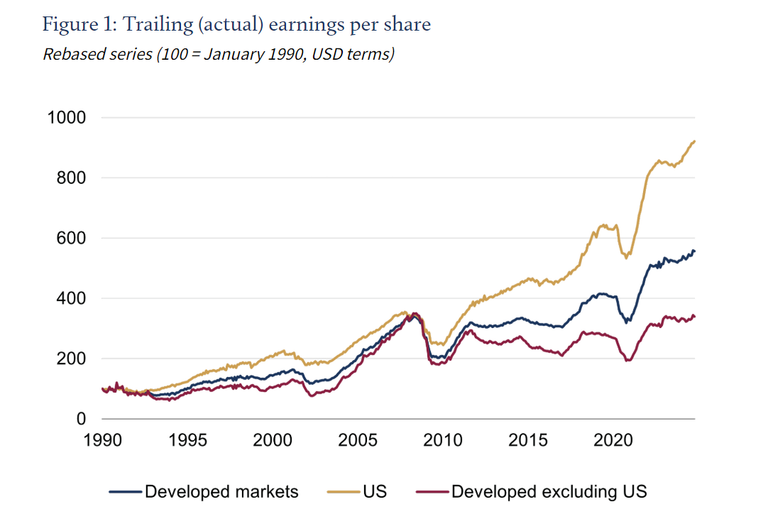

The US is home to the world’s highest-quality companies—the ones that innovate and generate the most profits .

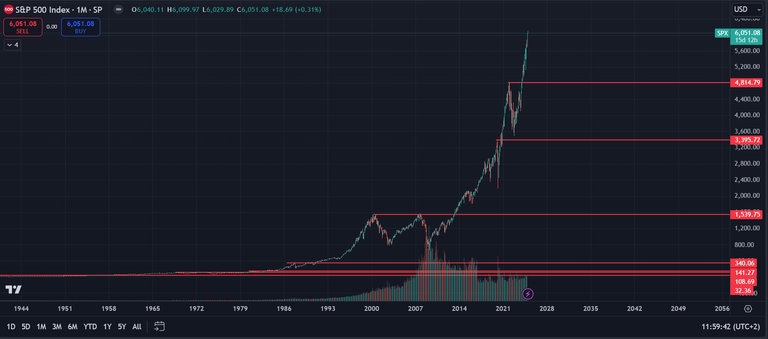

So, it’s only logical that the US stock market also delivers the best returns .

In other words, it’s not just the American market—it’s the global market , filled with the highest-quality global companies .

This has been the case for the past 200 years. But if we focus specifically on the last decade, the bull run we’re experiencing is directly tied to corporate profits .

Think about all the negative events that have happened over the past decade and how little they’ve impacted the US market.

Let me give you recent example.

Broadcom has officially joined the elite club of companies with a total market capitalization exceeding $1,000,000,000,000 .

Following the announcement of stellar earnings, the stock skyrocketed by +24% in a single day and is now up an impressive +101% for 2024 .

Broadcom designs AI chips and boasts strong partnerships with giants like Nvidia, Google, Meta, and Apple .

It’s even possible that deals with other hyperscalers, such as Microsoft and Amazon, could be finalized soon .

The company’s CEO predicts that demand for the XPUs they design will grow exponentially through 2027.

Posted Using InLeo Alpha

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 102000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: