Whats the marketcap of each token under SPinvest

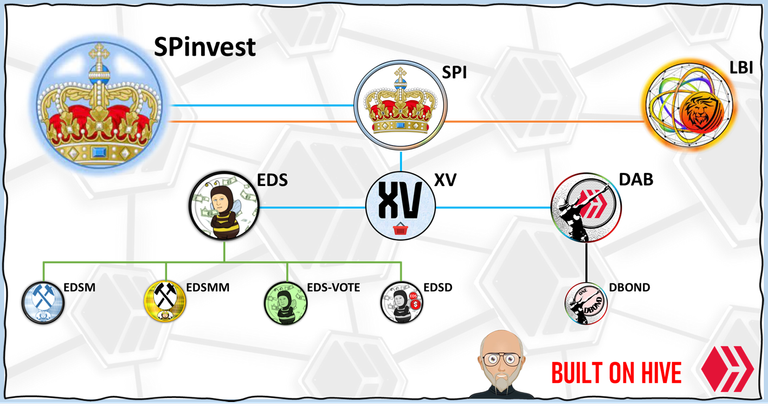

Hello SPIers, today we look at the marketcaps of all the tokens under the management of SPinvest. Why? Why not?, 4 years ago we were 1 year old and had just the SPI token with under $40k under management at the time. Let's have a look and see how we've grown and what each of our subsidiaries is worth.

In total, we have 9 tokens under 5 projects. Because all of the projects released under SPinvest are backed with assets, our marketcap is our liquidated value or book value, to put it another way. This means that if I say, for example, 1 SPI token is worth 5 HIVE, we have 5 HIVEs worth of assets backing each SPI token we can buy back every SPI token in circulation for 5 HIVE each. Every token under SPinvest is either a backed asset token are a token that yields a backed asset token.

Let's take a look, I'll do them in order of release date.

SPI Token

This is the flagship token for SPinvest. SPI is a growth investment fund token with over 30 investments on and off HIVE. SPI tokens have seen explosive growth over the past 5 years with the token trading at 7x its HIVE launch price (including token splits) and 15x its dollar value. Its is well positioned to take full advantage of the coming bullrun with large holdings in BTC, ETH, DOGE, PEPE, ADA, FET and of course HIVE.

SPIs book value today = 454,261 HIVE ($191k)

EDS Token

EDS was the first token released under SPI and at it's heart, EDS is a pegged HIVE bond that yields a weekly HIVE income payment. Its weekly HIVE income pool is equal to 12% APY of the @eddie-earner HP balance. This correctly is paying out EDS token holders 25% APY. EDS has 3 sub-projects that feed HIVE into the @eddie-earner account in exchange for newly minted EDS tokens.

The first of these to be released were EDS miners (EDSM and EDSMM). These yield 20% as EDS per year for 20 years giving the owner a 4x in EDS on their invested amount. Next was @eds-vote which currently has almost 140k HP from incoming delegations. This HP is used for curation with half of the rewards being used for minting new EDS and the other half going directly to @eddie-earner. Lastly is @eds-d EDSD which is an HBD-pegged bond token that uses half of the interest earned from saving HBD to mint EDS mint with the other half being converted to HIVE and going directly to @eddie-earner.

EDSs book value today = 54,564 HIVE

EDSDs book value today = 12,855 HIVE

XV Token

XV is a 2-year experiment which is halfway done and sitting at over 2x buy in cost so far. This token is backed by a basket of cryptos, 15 cryptos within the top 50 ranked by marketcap excluding stables, pegged tokens and tron. There are 4 weight class allocations so the higher the marketcap, the more allocation that token gets. This basket is rebalanced every 2-3 months to take profit from the strong and feed into the weak. With crypto, all cryptos are strong are weak but just at different times.

This project will wrap up in June 2025 by converting it basket of 15 cryptos into HIVE. SPI takes 5% as a 2-year management fee and splits the remaining 95% by the amount of XV tokens in circulation and then buys back all the tokens cashing everyone out. Its nice to have an end goal/date for a project.

XVs book value today = 37,625 HIVE

DAB Token

This is a co-run project with Bro. DAB is a daily HIVE drip project. The only way to get DAB is to mint them from staking DBOND tokens or stake DAB you've already minted. DBOND tokens are pegged to 1 HIVE each and DAB tokens yield HIVE drips but have no backing.

DAB is a little bit like EDS but tweaked in a few ways, it will grow out nicely over the next 1-2 years as it introduces sub-projects under it like a curation trail and maybe even miners to mint DBOND. We'll have to see how it matures but it's side projector for us.

DBOND book value today = 120,872 HIVE

LBI Token

LBI is the LEO equivalent of SPI. It is its own project not related to SPI in any way. Released during the project blank airdrop hype, it's lost alot of value and with LEO's massive token inflation/mintage, it's lost even more. Based on how the LeoFinanace ecosystem has been performing over the past 3 years, I dont have much hope for LEO to ever see new time highs. Its token inflation is just too high and we're all being liquidated because LEO has no use case are way to combat its inflation rate.

LBI book value today = 147,651 HIVE

What's the Total under Spinvests management?

= 827,828 HIVE

Getting Rich Slowly from June 2019

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server