How MIght SPI look by Q1 2026

Hello SPIers, today we look at the best-case scenario ending for SPI and this bullrun. When im talking about projections I'm always very reserved with the numbers because it's better to aim low and overshoot the target as opposed to saying SPI will be 20x and then delivering a 2-3x instead. Aiming low is more of a mindset, you aim low, you hit your targets easier and you're motivated to hit your next target.

Best Case Scenario for SPI by Q1 2026

Let's do the set-up first, to get the best result we need to start long before we sell anything in 2025. The 2 main trades I want to make before the HIVE pops off in 2025 are converting HBD into HIVE (that boat is gone) and converting our 1 BTC into 200k HIVE. I still believe that we will get 200k HIVE for 1 BTC so let's say it happens and we lock in 200k HIVE.

Going into the bullrun, our sellable bags would be...

- 200k HIVE

- 3 ETH

- 1800 FET

- 1500 KAVA

- 300M PEPE

- 34M BONK

- 200 RUNE

- 9600 DOGE

- 1500 ADA

Now best case, let's say that everything does a 5x on average. Some things will do more like HIVE FET, PEPE, BONK and KAVA, and some less like ETH, DOGE and ADA but I would consider an overall 5x to be a good overall rounding number. Selling would happen mostly in Q4 2025 regardless of the price but if our sellable bags were to 5x from today's prices and we'll count HIVE as $2 because that would be our selling price. It might go to $3-5 and if it does, it'll be very short-lived and we'll sell ours at $2. Let's see what our bags would be worth.

- 200k HIVE - $400k

- 3 ETH - $45k

- 1800 FET - $60k

- 1500 KAVA - $7k

- 300M PEPE - $10k

- 34M BONK - $4k

- 200 RUNE - $7k

- 9600 DOGE - $9k

- 1500 ADA - $4k

Total = $546k in $ stable tokens by Q1 2026

To give a ballpark number of the total fund value at this time, we can look at today's fund asset allocations and see that 45% of SPI's assets are directly on HIVE as HIVE, HBD, HE tokens and the rest. I have not set this up but if we sell our non-HIVE assets (including 200k HIVE as BTC trade) for $550k, our HIVE assets would be worth $450k and the total fund value best case would land bang on 1 million dollars!! That could not have worked out better.

Wow, thats alot of money. The bulk of it would come from selling off the 200k HIVE we got with our BTC. This kinda means we could get $400k for our 1 BTC by converting it into HIVE when its market dominance is peaking and then selling the HIVE when ALT season kicks off and HIVE moons.

SPI would become almost a stable token in dollar value. The price would still increase/decrease because we still hold alot of other things that we will not sell. These will be pretty much everything we hold in HIVE wallets. No plans to powerdown any accounts are anything to take advantage of high HIVE prices.

What would we do with $550k in stables tokens?

Not alot to be honest, I'd say $100k into HBD and the rest onto the Ledger as USDT and USDC to store for 1 year.

I'd not put more than $100k into HBD because it starts to become less liquid. During a bull market when daily trading between HIVE>HBD is large, no problem but in a bear market converting 10k HBD a day over 3-5 transactions would be a push. For this reason, we only put into HBD what we dont need to take out. It would be a permo holding 💎. Anyways, i guess we would compound 50% of the HBD interest and withdraw 50% to do a new monthly SPI HBD dividend.

The other $450k would just chill in the cold wallet safe away from the danger of defi are even worse, cefi. Yes, we would be losing alot of possible income by not using it in a stable LP are staking it somewhere but for what? to get rugged? or hacked for a 5-10% APY. No no, not I, they can keep it. We'll sacrifice that short-sighted 5-10% defi APY for 1 year in return for the security of a cold wallet.

We fast forward to Q1 2027

Ohh, look!! everything is on sale!! Look, look, BTC trading at 50k, ETH at $5k, HIVE's back down to 50 cents. It would be our time to seize the moment and load our bags and get ready to become a million-dollar fund.

We are still missing our 1 BTC but it's ok, we've got $450k in spending money. To start we get BTC, we buy 4 of them SOBs and spend $200k. Next, we buy 20 ETH, boom!, $100k spent. 100k HIVE for $50k, no worries! That would leave us $100k, we dump $50k into the SP500 and keep $50k as walking money for new cycle tokens.

We wait for 2029 to roll around and get rich slowly, lol.

I could keep going on and on for cycles until SPI is worth tens of millions of dollars but you get the idea. If we can trade our 1 BTC for 200K, we'll be set. The worst case would be we sell the HIVE for $1 and we still get $200k.

Thinking back at SPIs history, I would say that the thing that had the biggest impact on SPI as a fund was getting the HIVE airdrop that let us sell all our STEEM tokens. This let us buy our BTC ($9k) and we had around $10k leftover in USDT. This was alot of money to us back then. If this had not happened, the SPI fund value would be valued at under 50% of what it is today. Much of our growth last cycle came from non-HIVE holdings and defi investing which was all funded by selling STEEM.

This BTC > HIVE I am waiting on doing will have the same impact as the HIVE airdrop for SPI. If we can bag 200k HIVE for 1 BTC, it will shoot us to the next level. Not instantly because we'd need to wait 12-18 months for the price of HIVE to moon to $2 but that will come at the end of the bull cycle when we get that last massive run before pop.

It's nice to daydream but maybe this is not so impossible. Last cycle the peak BTC to HIVE conversion in Jan 2021 was 1 BTC > 330K HIVE and its lowest in Dec 2021 was 1 BTC > 25k HIVE. Thats a massive 13x spread, we're not greedy looking for 200k this cycle.

What do you think about the best case for SPI?

I guess you really only care about the HBD dividends? Haha.

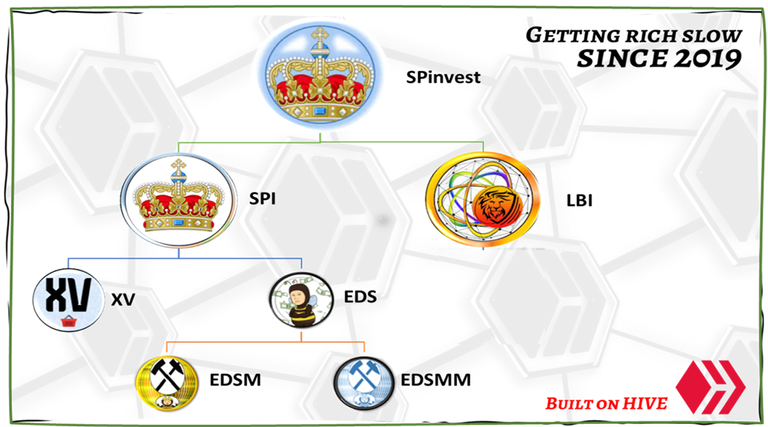

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

It was nice getting the Hive fork and selling that Steem.

!pimp

You must be killin' it out here!

@tbnfl4sun just slapped you with 1.000 PIMP, @spinvest.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

sure was 🤑

2027 Million dollar fund. Here we come.

Is this with us still getting dividends?

Yep, but dividends are based on HIVE income so not sure how thats going to work out. The HBD one would be an extra monthly payment. I guess it would be 835 HBD a month, which works out to 0.89 HBD per 100 SPIs 😁

ooooh, so that's why you mention that we only care about HBD interest...

And to think that I got started buying SPI when they were only 0.11USD each.

Yeah, was half joking.

11 cents is pretty cheap, that must have been back in the STEEM days

Yup, I was one of the first investors.

Read my mind, definitely like the HBD divs idea! Just gotta make sure I don't default on my SPI savings payments and see if I can pick some up from the market

You can normally SPI for under-book value. Thats why I have so many in my personal account. 3-4 years back, they were trading at 80-90% book-value and I shilled it in posts for a few months and nobody was buying them so I bought them all myself, haha. I'll pay 80 cent for a $1 worth of investments any day of the week.

SPI is only small and not well known within the larger HIVE community, i guess this is why the always trade undervalue. (even when we offer a 95% buyback)

Keep stacking them and soon you'll have a big pile

Loving the outlook. Even if we don't hit perfect conversion ratios, the future appears bright. Your past learning is leading to future opportunistic times for SPI

Yea, that's exactly it. All im doing is remembering what happened in past cycles and then adjusting my actions to put SPI into good positions for massive growth.

Today 1 BTC > 170K HIVE, we're close :)