Fiat Currency Like US Dollar Has Lost 97% Of Its Value since 1913, Does It Really Matter? Why Should We NOT Care?

Any gold bug will tell you how US dollar is trash and has lost 97% of it's value due to inflation and money printing

Likewise, if you asked a Bitcoin maximalist, you will get the same story except now Bitcoin is the future, the sound money, the hard money, and it is the only thing that will protect your wealth and store value when everything goes kaboom (I wonder how we are going to keep Proof of Work going and connect to internet when everything goes kaboom and we are back to stone age)

The purpose of today's discussion is not to debate whether gold, Bitcoin, or any crypto is going to be be the future, or store of wealth, or going to the moon.

The purpose is to present you with another perspective and answer what "losing 97% of its value" really means and why it does not matter.

Here is a useful website I found with quick google search, for visuals I will borrow a few charts:

https://www.in2013dollars.com/us/inflation/1913?amount=100

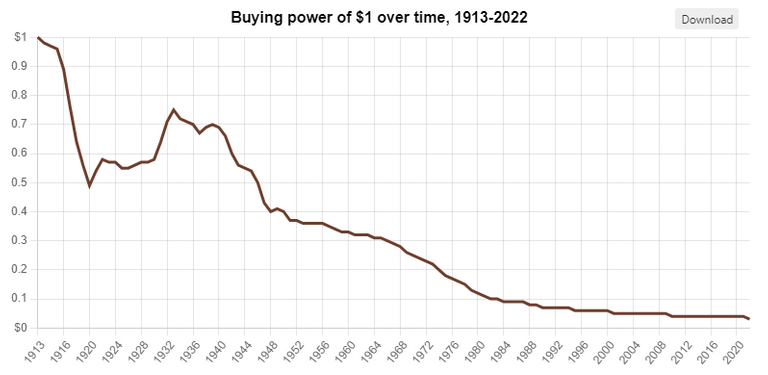

$1 from 1913 is worth about 3 cents by 2022 (in other words, if you saved $1 you need to 30x over 109 years to maintain the same purchasing power - crypto people probably want to do it in 4 years #lol)

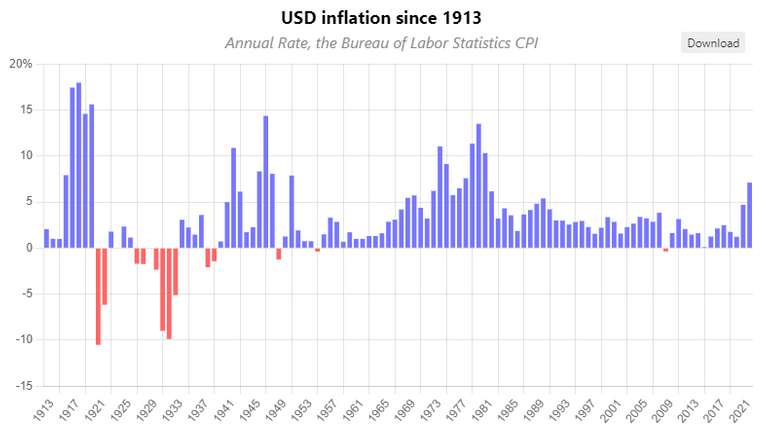

This is the official US annual inflation rate since 1913, individual experience may vary depending on individual consumption mix

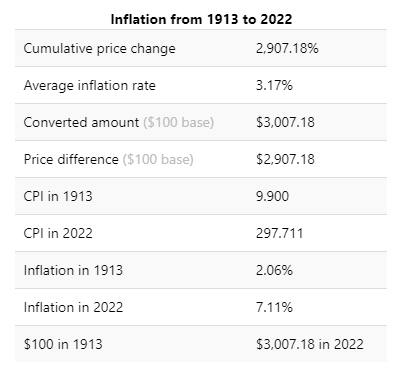

Other ways to present what this inflation means over 109 years

Why it does NOT matter?

- The 97% lost in purchasing power is not the real world experience, because:

- If you are reading this, you know most people do not hide the cash under the mattress and do nothing with it

- To lose 97% of purchasing power you had to literally dig a hole and hide that coins/bills for the entire 109 years

- Even if you have only recently dug up the buried coins/bills from your ancestor, chances are you are going to be able to sell for more than the face value to collectors (and you won't lose 97% of the value)

More likely than not...

- Spenders living pay check to pay check would have spent the $1 rather quickly, purchasing power is stable in the short-term

- Savers would have put the $1 in interest bearing investments to offset the impact of inflation

- Investors would have invested the $1, some options below:

30x is the number to beat to keep up with inflation

(let's ignore taxes, that is a whole other discussion)

*Note: the multiples you are about to see is dramatic, because the historical index value (the denominator) is very very small. This is a comparable presentment to the fiat losing 97% value since 1913 narrative

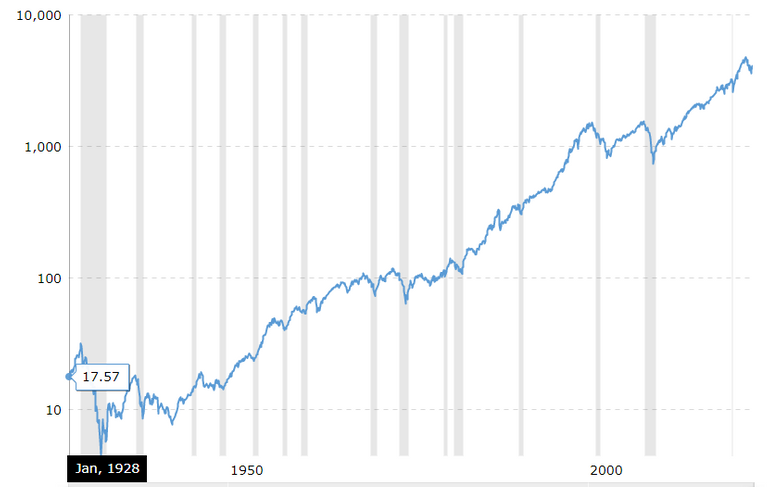

S&P 500 Index (1915 to now) - 7.48 to 3852

- 515x

- source: https://www.multpl.com/s-p-500-historical-prices/table/by-year (citing this source to line up the starting year closer to DOW Jones)

chart below is 1928 to now, 219x

https://www.macrotrends.net/2324/sp-500-historical-chart-data

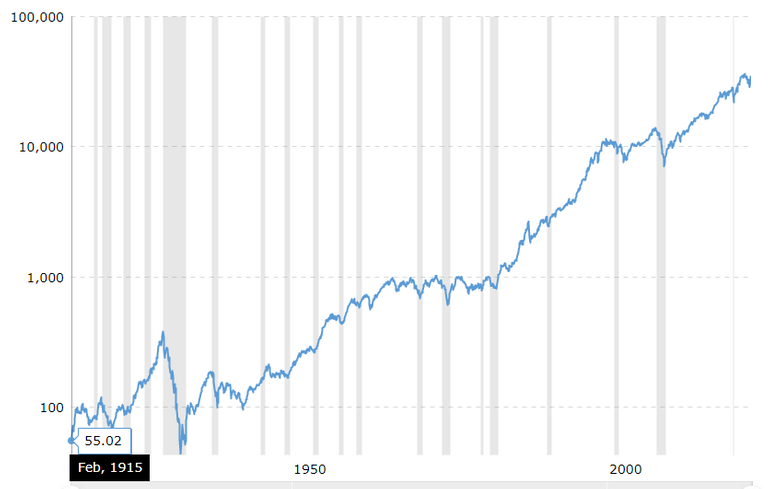

DOW Jones Index (1915 to now) - 55.02 to 32920

- 598x

https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

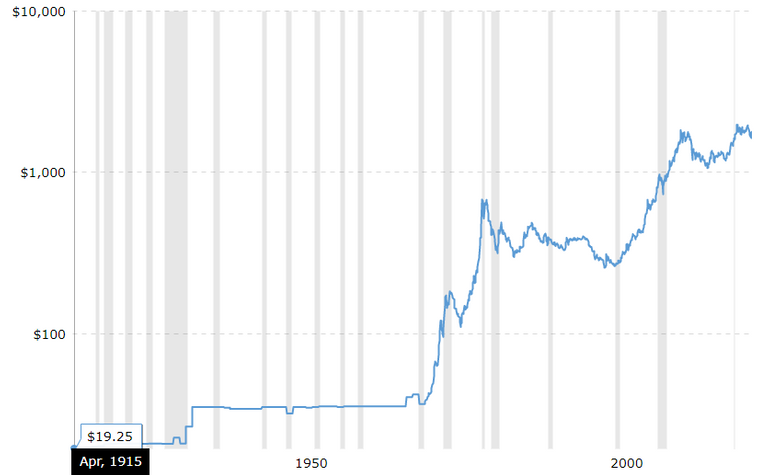

Gold Price (1915 to now) - $19.25 (pegged) to $1804

- 93x

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

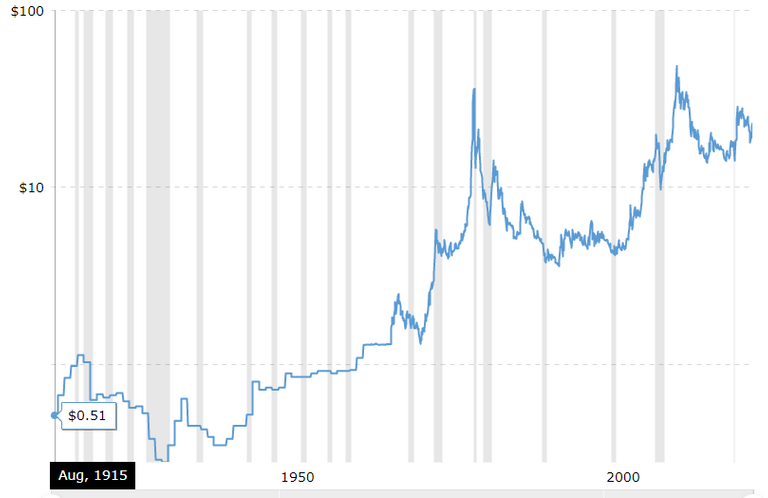

Silver Price - $0.51 to $23

- 45x

https://www.macrotrends.net/1470/historical-silver-prices-100-year-chart

As you can see, all the options offset the impact of inflation, even burying coins/bills in a hole for 109 years

We need to appreciate fiat currency, it is not a long term store of value but it is good at what it is design to do

Fiat currency = fiat money = medium of exchange = pay check = income = interest = dividend, they give you the ability to exchange for other assets

- The most important mindset is that currency/money is transitory. They are stable in the short-term

- Assets are for hoarders (investors, speculators). They could be volatile and the cycle could be years

- They each have pros and cons, pick the right tool for the right job!

Fiat currency is not meant to be stored forever. Like electricity, use it or lose it. Even if you stored electricity in a battery, use it or lose it (battery too, degrades over time)

Fiat currency, like electricity, energizes the system, it gets the job done and keeps the system up and running (exchanging value from one person to another)

Not all assets should be hoarded. Fiat money is not designed to be hoarded forever. Have fiat money for your day to day, fulfill your hoarding habits with other better options.

I hope crypto will shape the new financial order,,,it is happening and very soon conquer...

I think crypto is here to stay, it is an important step overall, but it will not be the one and only

Last year i have invest my life savings in crypto and my all investments almost going to zero. Now i was thinking last i have invest my money on gold and silver and know i have earn huge amount but i think its totally depends on luck. Thanks for sharing your valuable review about gold and silver.

I have to disagree with a large portion of this.

While going back to 1913 doesn't have a whole lot of meaning since there are few people alive now that were alive then. However, inflation in general is problematic (especially when it is relatively high) because it operates as a regressive tax. Government prints money by issuing debt and has the advantage of spending it before the loss in value takes place. Salaries eventually follow. 'Eventually' being the key word. This hurts people with a fixed income the most but hurts anyone who must work for a living.

Historically, most of savings that people hold have been kept in a bank in a savings account. While these do earn interest and helps to mitigation inflation, it only does so to a small degree. Certainly investing in stocks, etc. offers a way to avoid the effects of inflation but this is risky, especially if you are retired.

I'm not suggesting that it is reasonable to operate a modern economy with 0 inflation but I do think every effort should be made to keep it at very low levels. However, politicians aren't particularly good at keeping spending levels reasonable so often inflation is not kept in check.

Money shouldn't 'expire' otherwise it is not serving one of the main purposes of money. That is a store of wealth.

Fixed income is like a derivative of fiat, still fiat, still IOU. In recent years it does not keep up with inflation, even on a before tax basis.

The issue with hard asset as currency is hoarding, cornering the value. Eventually the society will run out and rich is forever rich, or the masses will trade on something else. Hardly functional most of the time.

With population continues to grow, hard asset is like “I am forever rich because I have this gold or BTC handed down to me”, forever increasing demand while the supply does not go up and if everyone must use it, the value will go up parabolically and encourage even more hoarding. Fiat is more closely aligned to what are you contributing today and tomorrow in exchange for what you are getting today and tomorrow, always more current. Central bankers try to keep it at 2-3% in North America.

Government screwing up has been the end of fiat for yet another fiat. Responsible government try to keep inflation rate predictable but since the financial crisis on the global scale, it is difficult to not follow the crowd.

Wait until CDBC, it could be programmed to expire or limit what you can buy with it.

(I agree high inflation is problematic, I also agree inflation is like a hidden tax, and retirees have lower capacity to manage fluctuations in asset prices when they need the stability in income and price to live comfortably. Some pensions and annuities are indexed, if you believe in the inflation figure and the associated adjustments)

By definition, fixed income does not keep up with inflation because it is fixed. While perhaps not quite literally fixed in all cases, we are usually talking savings account level earnings at best which can range from a small fraction of a percent to 3% or so (but only when interest rates and usually inflation are quite high). I realize certain things (like social security) do have adjustments for inflation but these don't generally actually keep up with inflation.

As far as central bankers aiming to keep inflation at 2-3%, they don't seem to have succeeded. Over the last 60 years, inflation has been above 3% more than half the time, is currently more than double that and has been for a while. The average from 1960 to 2021 is nearly 4% and that is only rising. That's if you trust government numbers. This is the problem with fiat. In theory it works great if managed properly. But when does government (or more broadly, centralized authorities) manage things properly?

Things like gold and bitcoin may be ultimately limited in quantity but they can be subdivided which mitigates that problem. Especially with bitcoin. Also, there can be many competing currencies. It's not as if we are limited to one thing. Gold, silver, copper, Bitcoin, Ethereum, Lightcoin, Platinum, and on and on and on can all be used. I seem to recall banks being bailed out and then holding on to the cash so it's not much different anyway. You can't just print unlimited fiat because people are holding on to it because you never know when people are going to stop holding on to it. At any rate, those that inherit wealth will simply put that wealth into things that maintain their value better (gold, real estate, art, collectibles, whatever). Changing the nature of government controlled currency doesn't change the nature of wealth. It just makes the poor even more poor because you are taxing their savings through inflation.

As far as CDBC and expiration, If they do that then they will have to institute a myriad of other oppressive laws regarding currency or people simply won't hold CDBCs and instead will trade them for other things of value (precious metals, stocks, non-CDBC currencies, other crypto, etc.). I mean I guess getting you to spend it is the goal but if it succeeds so well that it drives the value to nothing then it really hasn't succeeded. Seems very problematic to me. Not really sure how that would work anyway. I mean if it expires why would anybody accept it as payment? If spending it resets the expiration then you can just trade it back in forth forever. Or does the value just rapidly go to nothing as it ages? One of the key attributes of 'money' is that it operates as a store of value. Expiration would take this away. Seems like an incredibly stupid idea doomed to failure to me.

This is actually a great perspective! Fiat is primarily intended to be a medium of exchange, first and foremost. 😊

There are several issues that arise, however. The increase in cost of living over time must also be factored, the introduction of numerous technologies and basic living requirements which were not around 100 years ago, and the average and minimum wages that people now earn. The combination of these factors makes the value of fiat even lower than what is implied with the calculation of devaluation of the dollar over time.

Another thing to consider is upward mobility. Fiat, while designed as a medium of exchange, cannot generate sufficient wealth on its own. People want to grow their wealth over time. The devaluation of the dollar in combination with the aforementioned factors makes it more difficult to invest the dollar so that it grows. Basic needs must be met prior to any type of investment. Of course this is not the fault of fiat in itself, but fiat must function in this environment - and for many people it is not as functional as it should be.

As such, fiat is losing its value as "money" over time (i.e. the three functions being: store of value + medium of exchange + unit of account). That's where cryptocurrency such as Bitcoin may prevail in due time, albeit not yet.

Thanks!

There are other issues.

It used to be single income to pay off the mortgage and own the house free and clear.

Now it takes two incomes yet take a lot longer to pay off the mortgage.

Is this a labor supply problem while demand is lower as a result of technology? (Supply/demand, what happened leading to increased labor supply or imbalance that needed dual income?)

Second is value capture, with technology the living standards are lifted as productivity go up. Who is taking the greater share of the pie and why?

Third is low interest rate, that inflated asset prices. Who benefited by passing on the assets to the buyers and captured greater NPV (present value) that’s an inverse function of interest rate?

These are all very good questions and worth thinking about from both a microeconomic and macroeconomic point of view. Thank you! 😊

Deciding what to do with the fiat on hand is clearly an important thing to do. Thanks for sharing! !PiZZA