It Pays to Take Some Risks

It's common knowledge that having money set aside for unanticipated costs, such as auto or home repairs or emergency medical bills, is a good idea. Savings accounts are the ideal place to keep that money. Then, you won't have to be concerned about your major contribution losing value because you'll always have access to it.

However, even if having a sizable emergency fund is a smart idea, you shouldn't make the mistake of depositing all of your money in one savings account. Even at current levels, interest rates may be insignificant in comparison to the gains you are able to achieve by investing in bonds, stocks, exchange-traded funds (ETFs), mutual funds, or even in a brokerage account.

Money is safe when it is deposited into a savings account. Contrarily, there is danger involved with investing. Nevertheless, if you're willing to take that risk, you might be able to increase your return on investment above what a savings account can offer you. This could have a significant impact in the long run.

In a high-yield savings account today, you might be able to earn 4% on your investment. That's not a bad value for a risk-free deposit.

According to Investopedia, the S&P 500 index, which includes the 500 largest publicly traded firms, had an average yearly return of 11.88% between 1957 and the end of 2021. Source: Investopedia

Let's be a little more conservative than that, though, and say your portfolio only generates an 8% return on average per year. That's still a lot more than the 4% interest rate that you may receive on money kept in a savings account. And that can have a huge impact in the long run.

Any money you set aside for short-term objectives like buying a car or house or for emergencies should be placed in a savings account.

However, investing your money may prove to be a much more profitable option if you're seeking to save for long-term objectives like retirement.

😍#ilikeitalot!😍

Best Regards,

I am not a financial adviser. This article is not meant to be financial advice. My articles on cryptos, precious metals, and money share my personal opinion, experiences, and general information on cryptos, precious metals, and money.

Gold and Silver Stacking is not for everyone. Do your own research!

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Thank you for stopping by to view this article.

I hope to see you again soon!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.

You received an upvote of 99% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Thank you @ssg-community.

Posted Using LeoFinance Beta

For me the past 10 years tough me that savings account is just for emergency, everything else is invested, leaving money on a savings account only give me the sensation that its on a more safe place than a box in my apartment nothing else, with how fast things go up in price anything in a savings account devaluate very fast too, in that sense I like taking risks, so far pays off sometimes and sometimes it goes sideways, as long as there are more winners than looser investments Im ok with it, thx for sharing ✌️

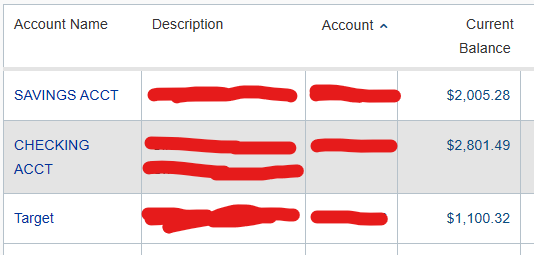

Same with me. Tough times or not, I only keep a minimum of 2000 dollars in savings. All the rest is in short-term and long-term investment/gold&silver/keptelsewhere.

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Great advice! Always have some in easily saving for easy access. I've always found that emergencies have a funny way of happening on the weekend so having easy access is important. If you have a lot it makes since to invest though, with bigger risk comes bigger rewards (or losses.) Thanks for sharing

!CTP

!LUV

@silversaver888, @thebighigg(2/3) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

Hehehe! Maybe you should keep your savings untouched and have the money you need for weekends in your regular account.

!LUV

Posted Using LeoFinance Beta

@thebighigg, @silversaver888(3/10) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

https://twitter.com/794006782171561988/status/1623335001092919297

The rewards earned on this comment will go directly to the people( @silversaver888 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks @poshtoken.

Posted Using LeoFinance Beta

@silversaver888, @pixresteemer(5/10) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

I think having multiple savings account is ideal. Not to put all your eggs in one basket, same rules apply to savings !

You can only have so much savings in multiple accounts. I agree with you that it is wise not to put all your eggs in one basket.

!LOL

Posted Using LeoFinance Beta

lolztoken.com

Her height is perfect.

Credit: reddit

@olympicdragon, I sent you an $LOLZ on behalf of @silversaver888

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(5/8)

Investments have higher returns, so investing is better than keeping money in the bank, even for the economy

Banks have their purpose, and keeping most of your money there may not be the best.

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Roth IRA might be good for higher rate return than savings account. Its good for emergencies too and you don't get penalized in taxes for taking out of what was initially invested. Rates are high on easy CDS too right now.

Yes, Roth IRA- an Individual Retirement Account to which you contribute after-tax dollars. I've had a Roth IRA since I was 26! Good deal, @sketch.and.jam.

!WINE

Posted Using LeoFinance Beta

Congratulations, @silversaver888 You Successfully Shared 0.100 WINEX With @sketch.and.jam.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.151

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

It’s always good to diversify @silversaver888 !😇

Spreading your investment around, I learned a long time ago, is much safer than putting all your eggs in one basket! One of the easiest ways on our block chain is in savings of HBD!

20% ROI 🤗

Very nice !🤗

You can't beat HBD's 20% ROI, @silvertop!!!

Yeah, I never did put all my eggs in one basket.

!PIMP

Posted Using LeoFinance Beta

You must be killin' it out here!

@silversaver888 just slapped you with 1.000 PIMP, @silvertop.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/1 possible people today.

Read about some PIMP Shit or Look for the PIMP District

That’s what I keep telling my neighbor up the road that was a crypto trader!😇

A stable coin with 20% ROI that’s awesome @silversaver888 !🤗

Investing and saving is very important to grow financially and this however need to be put in place.

Prudent people are investing and saving their money... especially when there is a limit to their earnings per month.

!LOL

Posted Using LeoFinance Beta

lolztoken.com

It’s fine he woke up.

Credit: reddit

@emeka4, I sent you an $LOLZ on behalf of @silversaver888

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(1/8)

It’s good to have multiple options like savings and investments. As nowadays one doesn’t want to have everything tied up on one option. You never know what happens.

Have a lovely day @silversaver888 👋🏻😊

!LADY 🤗🥰🌺🤙🏻

Posted Using LeoFinance Beta

View or trade

LOHtokens.@littlebee4, you successfully shared 0.1000 LOH with @silversaver888 and you earned 0.1000 LOH as tips. (1/4 calls)

Use !LADY command to share LOH! More details available in this post.

Yes! It's so sad to hear that many people got burned with the collapse of bitcoin last year. Not the ones with so much money to spare, but the ones who put all their eggs in one basket!

Have a beautiful Thursday, @littlebee4 🤗

!LADY🥰🌺🤙

Posted Using LeoFinance Beta

I know… it’s always the little ones… it’s sad.

Thank you kindly @silversaver888 👋🏻😊 you too enjoy every moment of it and make it count.

Bigg hugg 🤗🤗

!ALIVE

🤗🌺🤙🏻🥰

@silversaver888! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @littlebee4. (1/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

I'm not so sure about Savings Accounts being "Risk Free"... Not when Banks can close their Doors and un-plug their ATM's and do Bail-Ins... As far as Savings go, I think Piggy Banks filled with U.S. Coinage, is your best bet at the moment...

That is why it is best to keep the minimum in savings accounts and all other accounts. $2000 is my number. Withdraw any amount over it, and transfer to an investment account. Savings is risk free for me.

!PIZZA

Posted Using LeoFinance Beta

Saving money is always very hectic and difficult to me. I've tried saving but I end up spending so my instincts tell me everytime that you need to have much to be able to save

Try saving a little less at a time and DO NOT TOUCH IT. You'll be surprise !!!

!PIZZA

Posted Using LeoFinance Beta

The investment is a game of counterweights that depends a lot on the objective to be achieved. A young person should risk more and have an investment portfolio that yields close to 10% per year and an older person should be more conservative and seek a return closer to 5% per year.

There are different personal financial strategies at different ages, you are correct there, @florakese!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

At least I got into a great super-annualized defined Benefit retirement fund on top of my RRSP(401k), to go with my standard Canada Pension Ponzi. No including my Off-the-Grid plan.

Always, with love 🤗🌺❤️

Posted Using LeoFinance Beta

Hahaha, YES!

It pays to be conservative! It is tedious to be watching your monies, and transferring this and that once a month, but I'm used to it... it pays to be watchful. My Roth IRA, CALPERS, and 5 AAA stocks are automatic, so it's a no brainer.

My hope is that no unfortunate events happen until I retire, hehehe! 20 years is a long, long time yet!!!

Hugs and kisses🤗

!LADY🥰🌺🤙

Posted Using LeoFinance Beta

I do believe investing is way much better than keeping your money in saving account, The way inflation is increasing, your money is getting devalued day by day. But if have invested it somewhere, with right strategy you can make them double in a very short span of time.

Just leave the minimum in all accounts. Banks have their purpose!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Sometimes you have to invest money in yourself to make more money.

Yes, for sure!

Nothing is worse than feeling stuck in one's business or job, especially if you've been working in the same field for a while. It pays to deliberate about acquiring new skills related to one's field of employment. (It's okay if it doesn't, too!

!PIZZA

Posted Using LeoFinance Beta

It's all about the Turtles Ms. Saver @silversaver888

!LOL

lolztoken.com

to use Control-C as a shortcut.

Credit: marshmellowman

@silversaver888, I sent you an $LOLZ on behalf of @stokjockey

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(1/4)

!LOL

Posted Using LeoFinance Beta

lolztoken.com

Chicken tenders

Credit: reddit

@stokjockey, I sent you an $LOLZ on behalf of @silversaver888

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(2/8)

I had a long comment, but instead turned it into a post!

https://ecency.com/hive-167922/@ironshield/lessons-learned-about-what-we

I've read it! Very insightful, @ironshield!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Ms. Saver @silversaver888

!LUV

@silversaver888, @stokjockey(2/4) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

As money is depreciating, our savings should not be kept in money, it should be kept in gold or silver that are going up and down. Until we learn to take risks on things, we will not profit from anything. A person must keep some money with him because good and bad times are unknown, they can come to a person at any time.

Keep only the minimum, that is, if you should use the banks.

I agree that you should have access to your money without having to go to a bank.

!invest_vote

Posted Using LeoFinance Beta

If I have to give delegation to SSG then how can I do it please tell me I don't know.?

@silversaver888

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Planning ahead is very important especially for the future where Investments and savings will come help to secure the future.

Thank you for your comment!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Yup Yup!

My bank only gives me .05% APR, so I'll glady take the 'risk' of HBD at 20% APR, as well as HIVE or LEO or other hive related things.. :)

Hehehe, yes, @chinito!

!ivest_vote

Posted Using LeoFinance Beta

A Chance for some FREE Silver Ms. Saver @silversaver888

!LUV

@silversaver888, @stokjockey(1/4) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

!PIZZA

Posted Using LeoFinance Beta

Cash is King, debt is dumb, and the paid off home mortgage has replaced the BMW as the status symbol of choice.

Also, here, the banks take gold, so storing the emergency fund in maples here is just like cash...

Wow! The banks take gold as deposits?

How does that work, @fat-elvis

!invest_vote?

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

Diversity is the name of the game! We have always said that "it isn't good to have all of your eggs in one basket"! The same can be said for saving, investing, etc. All valid points you have there, sis. Thanks for sharing! Much love to you!🤗😘💞🌸 !LADY

View or trade

LOHtokens.@elizabethbit, you successfully shared 0.1000 LOH with @silversaver888 and you earned 0.1000 LOH as tips. (1/16 calls)

Use !LADY command to share LOH! More details available in this post.

Diversity, sis! Diversity.

Thank you for your comment, sis🤗

!LADY🥰🌺🤙

Posted Using LeoFinance Beta

💞😘🤗🌸

It pays to take calculated risk because not all risk is worth taking

Yes, not all risks are worth taking!!!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

I started investing from a very young age and i have been so used to it, i rarely keep too much money in my savings account and since the money is not so much it keeps my spending in check.

Investing your money is always a good idea.

Hahaha, you and me both!!! I started investing seriously when I was 25. I started with a Roth IRA. I didn't know what I was doing then, hehehe! A happy fault!

!invest_vote

Posted Using LeoFinance Beta

@silversaver888 denkt du hast ein Vote durch @investinthefutur verdient!

@silversaver888 thinks you have earned a vote of @investinthefutur !

I gifted $PIZZA slices here:

@silversaver888(5/5) tipped @stokjockey (x1)

silversaver888 tipped pocketechange (x1)

silversaver888 tipped mohammed5 (x1)

silversaver888 tipped silverd510 (x1)

Please vote for pizza.witness!

Awww that's so nice of you... Thank you for that🙌