Don't wait till your 50 to save for retirement

You'll frequently hear people stress the necessity of saving for retirement, and you should be aware that these cautions are not exaggerated. Social Security benefits only replace roughly 40% of pre-retirement wages.1

Seniors who must rely solely on them frequently find themselves in financial difficulty. Try to save as much money as you can, unless the thought of a 60% pay decrease appeals to you.

There are two issues with beginning to save for retirement in your 50s. Firstly, your running out of time to put money in an IRA or 401(k). And secondly, you won't receive as much from your investment gains.

The stock market has produced an average yearly return of 10%2 during the past 50 years. $300 down each month in an IRA or 401(k) between the ages of 25 and 65, you'll have contributed $144,000 of your own income to your retirement account.

Assuming your assets generate an average 10% annual return, you'll end up with close to $1.6 million. You're looking at gains totaling more than $1.4 million.

Let us say that you are starting late, and you can only save $300 each month between the ages of 55 and 65, you are contributing $36,000 to your retirement account in that situation.

But you'll only get roughly $57,000 in the end. Your potential gains are only about $20,000. That is not a sizable nest egg for retirement.

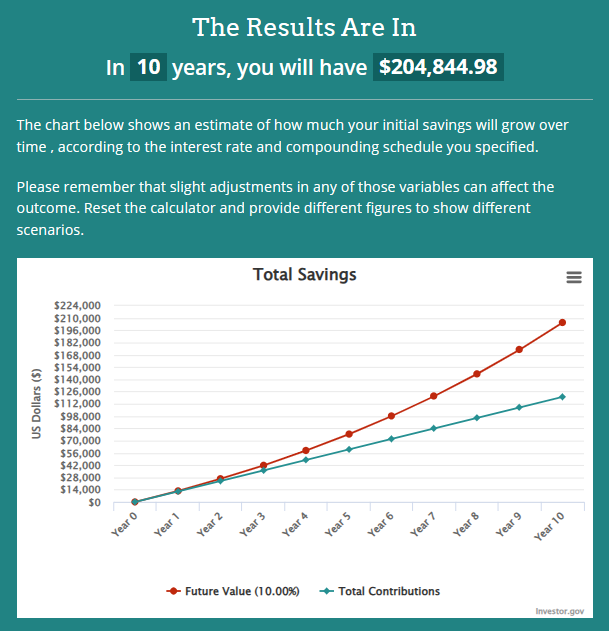

But save $1,000 per month, and you'll have a little over $200,000 saved for retirement.

Even $200,000 isn't much money over the period of a retirement that could last 20 years or longer, though it is better than $57,000.

So, what should you do if you're 50 and just starting to save for retirement?

You can work longer! You can continue to receive a salary and leave your savings untouched, with the possibility to grow them, if you're ready to extend your career by a few years. In the previous illustration, saving $1,000 per month for ten years at a 10% annual return produced a nest egg of nearly $200,000. You will have a savings balance of over $400,000 if you work just five more years and save $1,000 each month for 15 years.

Compound Interest Calculator3 Plan to continue working once you retire. Many people believe that employment should be fully eliminated once retirement arrives. To impose that abrupt stop, however, is unnecessary. In order to supplement your lack of savings, you can work a part-time job. In a gig economy, occupations are now more flexible than ever.

It's best to start thinking about retiring as soon as possible.

It is unlikely that you can go back in time if things did not turn out as you had hoped and you were unable to plan for retirement early.

The best course of action is to keep going, make as many financial sacrifices as you can, and save while you are still working.

Reference

1https://www.fool.com/investing/2020/11/18/how-much-of-your-pre-retirement-income-will-social/

2https://www.slickcharts.com/sp500/returns

3https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

😍#ilikeitalot!😍

Gold and Silver Stacking is not for everyone. Do your own research!

If you want to learn more, we are here at the Silver Gold Stackers Community. Come join us!

Thank you for stopping by to view this article. I hope to see you again soon!

I hope to see you again soon!

Hugs and Kisses 🥰🌺🤙!!!!

I post an article daily. I feature precious metals every other day, and on other days I post articles of general interest. Follow me on my journey to save in silver and gold.

You received an upvote of 97% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Thanks, @ssg-community !

Thanks for the rehive!

https://leofinance.io/threads/silversaver888/re-silversaver888-2dhh6fbnw

The rewards earned on this comment will go directly to the people ( silversaver888 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Thanks @poshthreads !

So true, there are two things in life that never come back, time and money, Im 35 now and for the past three years I have been thinking about the future a lot, retirement included, because of my current job and profession I might be able to work a few years after retirement but Im trying to safe and invest now thinking for the next 15 years

Good for you, @skiptvads !!! Just contribute towards your retirement... every month, with no fail, no matter the amount. Some people don't think about saving for the future.

Well, I guess, to each their own.

!PIZZA

With folks seemingly unable to afford to buy a home (I know some who think it's impossible) more and more people will find themselves working well beyond retirement age just to afford the astronomical cost of rent. Combine general cost of living (utilities, food, taxes, etc,) it's not looking pretty. The sooner folks begin saving, the easier time of it they will have when reaching retirement. Also, an abrupt stop to employment can also leave people feeling lost and with no objectives. If there aren't things to do (besides sitting and vegging) working will keep people's minds younger because of the social interaction.

Saving is obviously important. I hope people who read your article really stop and think about this!

Much love sis!🤗😘💖🌸🌻🍁🍂 !LADY !LUV

View or trade

LOHtokens.@elizabethbit, you successfully shared 0.1000 LOH with @silversaver888 and you earned 0.1000 LOH as tips. (1/25 calls)

Use !LADY command to share LOH! More details available in this post.

Words of wisdom, sis! We all need to save for the future. Saving is important, even in retirement.

Much love sis, and xoxo🤗

!LADY😘💖🌸

!LUV🌻🍁

@elizabethbit, @silversaver888(4/10) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Info🤗😘💖🌸😍

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @elizabethbit and you earned 0.1000 LOH as tips. (3/30 calls)

Use !LADY command to share LOH! More details available in this post.

It’s always best to start saving as early as possible @silversaver888!😇

So many people wait till they have extra cash to start saving.

Putting savings last………

Savings always needs to be first!😊

Savings is NOT extra money. I can never find extra money... it is carved out of your monthly budget. And it may be difficult at times, especially when one loses his ability to earn, @silvertop .

!PIMP

Aw man @silversaver888, you are out of PIMP to slap people.

Go Stake some more and increase your PIMP power.

(We will not send this error message for 24 hours).

Read about some PIMP Shit or Look for the PIMP District

Very true @silversaver888….😲

Hard times make it very difficult for so many to save ….😮😇

Going fwd only Rich people will have gold. And so the implications are clear. Buy gold (over time) = get rich

🤩👍👍

Yup! So, while you can, stack gold and silver!

CHEERS @thedamus !

!LOL

!PIZZA

lolztoken.com

It was clear from the gecko.

Credit: reddit

@thedamus, I sent you an $LOLZ on behalf of silversaver888

(2/8)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

If it wasn't for Steemmonsters I would be BROKE........ I have no Money Ms. Saver @silversaver888

!LUV

!LADY

!LOL

View or trade

LOHtokens.@stokjockey, you successfully shared 0.1000 LOH with @silversaver888 and you earned 0.1000 LOH as tips. (2/4 calls)

Use !LADY command to share LOH! More details available in this post.

@silversaver888, @stokjockey(2/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Infololztoken.com

I understand they're really marking headlines.

Credit: reddit

@silversaver888, I sent you an $LOLZ on behalf of stokjockey

(2/6)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

!LUV

!LADY

!LOL

@stokjockey, @silversaver888(5/10) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Infololztoken.com

Receding airlines.

Credit: reddit

@stokjockey, I sent you an $LOLZ on behalf of silversaver888

(3/8)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @stokjockey and you earned 0.1000 LOH as tips. (4/30 calls)

Use !LADY command to share LOH! More details available in this post.

!LADY

View or trade

LOHtokens.@ladiesofhive, you successfully shared 0.1000 LOH with @silversaver888 and you earned 0.1000 LOH as tips. (23/30 calls)

Use !LADY command to share LOH! More details available in this post.

!LADY

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @ladiesofhive and you earned 0.1000 LOH as tips. (5/30 calls)

Use !LADY command to share LOH! More details available in this post.

Really informative. Thanks for sharing.

Yes, information that should be taught in school!!!

!PIZZA

Ms. Saver @silversaver888

!LUV

and

Peace to All

@silversaver888, @stokjockey(3/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Info!LUV

@stokjockey, @silversaver888(6/10) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoI started with my first paycheck right after Nursing college, that was after some advice from a wise friend.

Always, with love 🤗🌺❤️

Hahaha, you and me both, sis!!! I started working right after college. Since I worked for the public service, my contribution towards retirement was an automatic deduction from day one. I never changed jobs. So, you and I lucked out!!! I was clueless when I started working, hahaha! I've maxed out my contributions every month.

xoxo🤗

!LADY🌺❤️

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (2/30 calls)

Use !LADY command to share LOH! More details available in this post.

I've been Semi-Retired most of my life... I still am... I started stacking when 90% Silver Coins were still in Circulation, including Silver (Morgan and Peace) Dollars...

It must be nice, @pocketechange !!!

!PIZZA

I still work for myself... I always have plenty to do, out in the Garden...

Start planning for retirement in your twenties is always my advice!

It should be taught in schools!

!LOL

lolztoken.com

Theyre super sketchy

Credit: reddit

@thebighigg, I sent you an $LOLZ on behalf of silversaver888

(4/8)

It should, from the time I was working at sixteen my dad had me put ten percent away for savings for retirement. At the time I thought he was crazy, now I think he was the smartest man on earth!

https://kzoobullion.com/

!LUV

!LADY

@silversaver888, @stokjockey(4/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Info!LADY

!LOL

lolztoken.com

Boara Boara.

Credit: reddit

@stokjockey, I sent you an $LOLZ on behalf of silversaver888

(5/8)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @stokjockey and you earned 0.1000 LOH as tips. (6/30 calls)

Use !LADY command to share LOH! More details available in this post.

View or trade

LOHtokens.@stokjockey, you successfully shared 0.1000 LOH with @silversaver888 and you earned 0.1000 LOH as tips. (1/4 calls)

Use !LADY command to share LOH! More details available in this post.

$PIZZA slices delivered:

@silversaver888(5/5) tipped @qwr

silversaver888 tipped thedamus

silversaver888 tipped skiptvads

If you wait until you are 40 or 50 to think about retirement money. You are TOTALLY F**KED……

That’s a fact….