Getting my first Health Insurance (HMO). Plan yours too for as low as Php 500!

Let's break the myth. Insurances are NOT just for elders!

Healthcare in the Philippines is often tagged as "unfortunate expense". Extreme internal pain? Go to Google and just purchase the over-the-counter medicine mentioned in there.

This extreme health culture doesn’t only happen in the Philippines, but it’s all around the world where corrupt institution manifests.

The majority of people, especially those living paychecks to paychecks are afraid of hospital bills. Falling sick is unacceptable. It is an inconvenience. A bad luck.

But, can we blame our bodies for falling ill? Especially those who do labor jobs, which also are the people that seem to get the smallest amount of salary. The demands of their daily jobs are often too rigid, too dangerous, and too physical where bodies can break their limits. Yet they are mostly the ones who are afraid of hospital check-ups because of the possible hospital bills that might put them in debt.

For a country with poor financial literacy, the financial costs of a bad accident or an unforeseen diagnosis can set a whole family down.

Why did I get an HMO?

Just right after my incubation period (3 months) on my full-time job, I got all the benefits that all regular employee gets, namely:

- Monthly Internet Allowance

- SSS

- PhilHealth

My HMO Plan

There are several affordable health insurances here in the Philippines that everyone can avail of, working or not. As long as you have the money to purchase it, off you go! But I encourage all the employers out there to please give their employees the benefits they deserve.

LinkedHelpers, the company I'm working with, allows all their regular employees to purchase a maximum P3,600 HMO Plan ($61.28).

I got the My MediCard Plan from MediCard. This includes 1-year membership period with benefit inclusions of:

1. Unlimited out‑patient consultations by the following specialists:

- Family medicine

- Internal medicine

- Cardiologist

- Endocrinologist

- Pulmonologist

- Gastroenterologist

- Dentists

2. Dental Services by MediCard-Accredited Dental Clinics

My MediCard member may also avail of one-time oral prophylaxis (mild cases only - few tartar and plaque build-up on surfaces of teeth and those hidden in between and under the gums).

How to sign up?

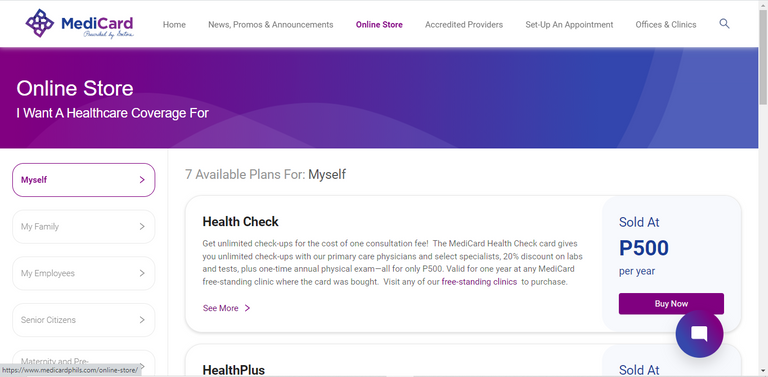

- Go to MediCard site and hover over "Online Store" tab.

2 . Select the right HMO plan according to your needs. You could get a plan for:

- Yourself - Starts at Php 500

- Your family - Starts at Php P10,739

- Your employees - Starts at Php 30,000

- Senior Citizens - Starts at Php P25,739

- Maternity and pre-existing conditions - Starts at Php 30,000

- OFWs with beneficiaries in the Philippines - Starts at Php P16,524

There are also several HMO plans you can get depending on your needs. Just check these websites out!

At 20, I honestly feel that I'm too late on building my financial freedom, especially with the income I'm getting now. But I've learned that as long as you budget with plan, and compute your alloted compunding money for investments, with respect to the inflation and other variables, I can compute the amount I should have to retire at my desired age.

As I'm entering my financial life, any tips from you would be soooo helpful! Any kind of investment, passive income, and insurance would be appreciated. 😍 Just drop them! I'll be happy to explore them 💗

P.S. I'm not affiliated nor a partner of MediCard.

Very informative blog. I love it! Yes, I totally agree, one of the most common reason why most Filipinos don't have or doesnt even care to inquire about HMO is the common misconception that it's way too expensive. What's even more ironic is that when you or a family member gets sick, the hospital bill is way more expensive than years worth of payment to an HMO insurance.

Agreed. This HMO plan equates to 7 individual check-ups excluding laboratory fees. Definitely, unlimited consulation is a win-win! Hopefully, with the era of 2020's, financial literacy would be discussed unlike the previous years po.

Sana nga, it's about time we break the cycle and one way to do that is to increase information drive like this.

Cause Information is Power - the more we know, the more we understand things and take appropriate actions.

Fully agreed! Many financial influencers are rising now on TikTok & YouTube, and those really help a lot. I hope there will be more in the future po <333

How are you @sellennee, we have chosen this post to be curated by MCGI Cares(Hive) community. We are inviting you to join our community that study the words of God.

We can also follow our official Facebook page

Keep doing the great job ❤️

Hey! Thank you so much for picking this article as part of your curation <33

My mom had been looking for an HMO plan but I don't know the current status now. This is so informative. Thanks for sharing! Will definitely let my mom know about this.

Yay! Glad that it helped. If I may recommend, you can explore PhilCare's plan. I was too late to realized that it's much better than my MediCard.

I'll try to check that out too. Thanks for the advice!

You're welcome! Hope you'll find something that'll be helpful in the long run. <33

https://twitter.com/itswitzu/status/1576887621258600449

The rewards earned on this comment will go directly to the people( @wittyzell ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @sellennee! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 3750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Youre only 20 bata ka pa trust me. Im on late 20s na pero im still building it without a clear view of the finish line 😅

Yesss maganda talaga may hmo ka e.. youll never know when youll need it.

Hys. If we ever had a financial education sa curriculum natin, siguro hindi po tayo magpa-panic in adulting life :<< Hopefully ma-include po 'to sa education system so everyone can build their financial freedom as young as they can.

Feeling ko part sya ng finance di nga lang talaga naeelaborate ng maayos 😅

Yes po. We had this sa Finance na subject but not too detailed, just the advantage & disadvantage. But never po naturo if pano malalaman 'yung the best plan for you + where to start :<<

Also, wala rin po siya sa other courses :<< Those who are under business & finance courses lang po ang meron :<

We had finance pero engineering ako 😅...di kase talaga binibigyan ng importance ng educ systems yung nga real life scenarios

Omg, true po? Bat po kaya sa mga friends ko sa engineering, wala? Sabagay, iba-iba po pala kasi ng curriculum per school.

Yes baka depende sa curi ng school

Congratulations @sellennee! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!