Some Tips in Managing Your Loans

Why Do People Take A Loan?

There are big purchases in life wherein most people cannot afford immediately. Example, buying a car or owning a home is something one may immediately need but cash may not be readily available. Hence, people go to a bank for some financing help.

In my case, I had a pre-selling condo ready for turnover but I needed to pay the remaining outstanding balance first. So I started trying to get the best loan deal from banks I knew. I created a spreadsheet that can simulate any loan so that I can choose my own terms.

These are the main parameters to consider in my calculator:

- Principal loan amount - How much money do you need?

- Monthly Amortization - How much to pay per month?

- Tenor/Years of Maturity - How long you need to pay?

- Interest Rate - Cost of Borrowing. This is the rate at which the bank will earn from the transaction.

Example:

Let's say you need Php2 Million and the bank offers 8% Fixed Rate for X years.

From the spreadsheet above, if you can only afford to pay at most Php25k a month, then the advisable tenor for you is 10 Years assuming 8% is fixed for the whole term.

Tenor / Years of Maturity

It is important to payoff loans as early as possible, because there is a cost of borrowing. The longer you pay, the more you are paying the bank. In the simulation above, you can see that one's interest payments has reached 51% of the loan amount after 11 years. Longer tenors can make the monthly amortization more affordable, but over time, you are paying more.

Interest Rates in the Philippines

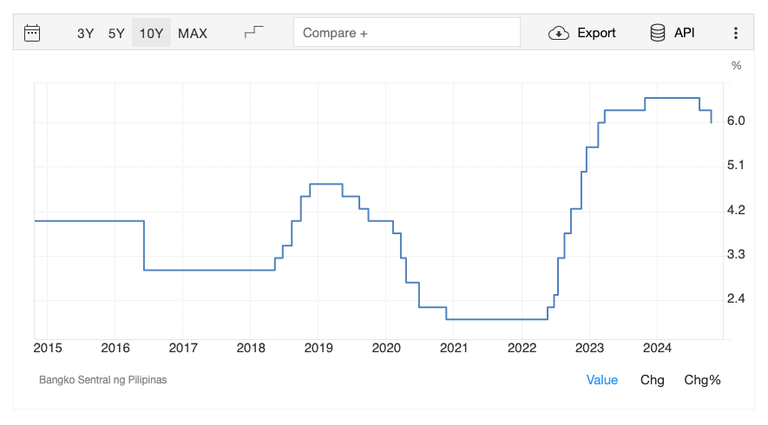

A country's policy rate influences the cost of borrowing in a broader economy. For example in the Philippines, its Central Bank (Bangko Sentral ng Pilipinas / BSP) has its benchmark rate below:

I took out a housing loan for my condo last December 2019 when the benchmark rate was at 4%. During that time here is what the local banks were offering:

| Bank | 3 years fixed | 5 years fixed |

|---|---|---|

| BDO | 5.88% | 6.88% |

| BPI | -- | 6.88% |

| Bank of Commerce | -- | 6.75% |

Check the difference between the bank's interest rates and the benchmark rate, that is how banks are earning through loans. The benchmark rates even went down to around 2% during the pandemic years, but has increased again starting mid-2022 to reach up to 6.5% early 2024.

Haggle with Banks for Better Rates. Go for Fixed Interest Rates.

After making comparisons and doing some haggling, BPI even eventually gave me further a discount which ended at 6.63% per annum, fixed for 5 years. I did not bother shopping around for more so I settled with this contract.

If I remember correctly, a 1 year fixed loan can be as low as 4.5-5% during that time (Dec 2019). This is typically a promotional interest rate that banks give out to entice consumers in availing a loan. For me, it is a trap! Get a fixed term loan instead because as soon as the fixed term rate ends, the bank would impose a not so favorable prevailing rate right after.

What Happens When a Fixed Rate Loan Ends?

Now at 2024, my 5 year 6.63% fixed rate ends and I was informed that the prevailing rate is currently at 9.5% (!). I checked the bank's website and computed their 1-yr rate is around 7%. This increase is a lot and would mean an additional Php700 monthly on my loan. I didn't like the notion of my monthly amortization increasing; hence, tried to haggle for a repricing. They offered to lower it down to 8% but with a repricing fee of Php3500. While this is better than the initial rate, I thought of paying off the loan instead since it only has 2 years left.

Paying Off a Loan Early

Pros:

- I saved myself from interest cost amounting to around Php60k cumulative for the next 2 years.

- Debt free! It's good to see that my next monthly earnings no longer need to be allotted to a loan.

Cons:

- I had to shell out a significant amount of money.

Looking back, this money would be sitting in the bank anyway as part of my idle funds. Putting the same amount on a Money Market Fund or a high yield online bank account would just earn around max of 4%. So I think this was a great move.

This is exactly what I love about learning and working in the Finance industry. I've always been passionate about Personal Finance and Financial Literacy. If anyone wants help in terms of getting and choosing a loan, I'd be very much happy to give out some free advice and recommendations (I don't work in a bank and I don't sell any product). Just send me a message. :)

I have never taken a bank loan, to be honest, so this is educational for me. I might ask you for a recommendation next time I find a house and lot elsewhere :) Congratulations on being debt-free! 😉

Thanks, glad you learned something from my post. Feel free to reach out by then. :)