Litecoin – The Next Store Of Value Asset

Longevity

I have always had a soft spot for Litecoin. Like Dogecoin, it was one of the first Crypto assets I held along with Bitcoin. In the early days, there were few quality altcoin projects around. Of course, Ethereum launched in 2015, and in the bull run of 2017, we experienced the ICO boom. It was at this point that the Crypto space began to garner the attention of regulators, specifically, the SEC.

Like Bitcoin, Litecoin is fairly launched. The launch did not include a pre-mine, apart from an initial 150 LTC, which was a technicality. Founder, Charlie Lee has since sold all the coins he mined during Litecoin’s formative years. There are varying opinions regarding this move. Some see it as a rug pull, while others see it as Lee removing personal incentivization of Litecoin’s future success.

In Lee’s opinion, he was leveling the playing field by diluting a controlled interest in the asset. Either way, it’s done and Litecoin has since moved on. As I mentioned in an article from last year, Litecoin has seen steady growth regarding new wallet addresses and other metrics. However, the market is yet to respond regarding Litecoin’s valuation.

A New Chapter

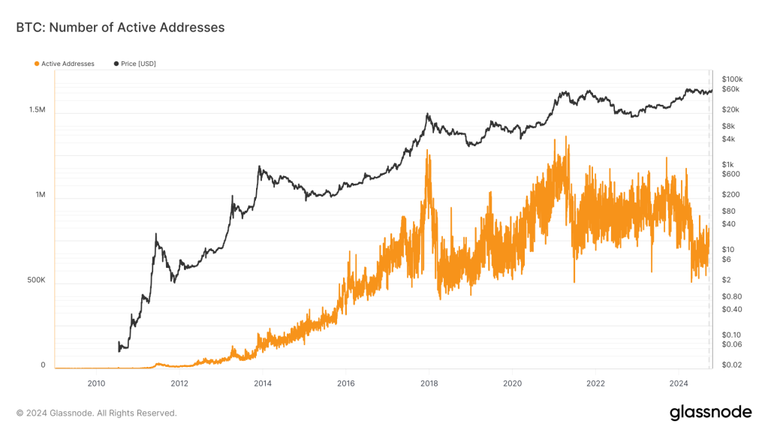

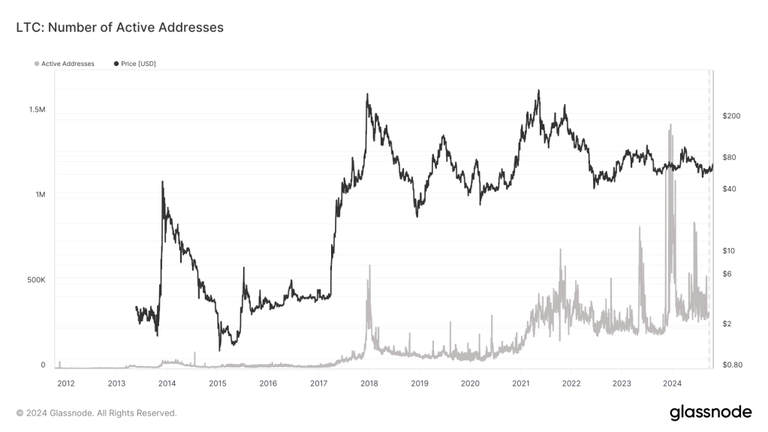

In Litecoin’s defense, the altcoin market as a whole has been largely underwater. Apart from a few isolated cases such as Solana, altcoins are still awaiting the Summer sun. Litecoin’s active addresses compared with Bitcoin’s reveal a bullish case for Litecoin. During 2024, active Litecoin addresses have seen some significant spikes, even outperforming Bitcoin.

This is an interesting metric considering Bitcoin is the largest Cryptocurrency by market cap and holds a market dominance of 59% while Litecoin is a lot lower on the ladder. Litecoin is currently ranked 26 by market cap. A lot of institutional interest has helped to propel Bitcoin beyond the trillion-dollar market cap. LTC has a market cap of only $5.3 billion, and I foresee a strong Altcoin Season for Litecoin.

Many will disagree, stating that Litecoin is an outdated and irrelevant chain. Like Bitcoin, Litecoin was created, only more scalable and speedy. With all of Bitcoin’s values in place, store of value investors will eventually turn to Litecoin. As Bitcoin continues to rise it will eventually begin to plateau relative to alternative chains like Litecoin.

Litecoin adoption is more significant than many Crypto enthusiasts realize. Before the clever clogs arrive with their innovation narratives, let me remind you that I identified Solana long before the market. This is documented in my blog on Publish0x. I identified SOL below $0.30 and introduced readers at approximately a dollar if I recall. I wrote about Kaspa and BlockDAG before the masses.

My point, I am not ignorant of technology and the role it plays in this space. However, it’s not the only narrative that can drive gains. Memecoins are another example and carry zero technological superiority or use case. Alternative store of value chains will arise once Bitcoin becomes heavily saturated. Furthermore, it is likely to become extremely heavy once it reaches a multi-trillion market cap.

I envision a new season for Litecoin. A season of widespread industry awareness and adoption. A Litecoin ETF is also a likely outcome that not many are considering or discussing. A chain that has survived over a decade and still ranks in the Top 30 deserves attention. It is evidence of substance and demand from investors and speculators.

Final Thoughts

Litecoin remains relevant in its own right and has an ardent community dedicated to its widespread adoption. Regardless of the opinions of many, I expect Litecoin to perform exceptionally well over the next 6 to 12 months. A few interesting developments are required to spark renewed interest from the doubters. Multiple narratives drive this space and Litecoin is an example of this. See you next time!

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in me receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.

Posted Using InLeo Alpha