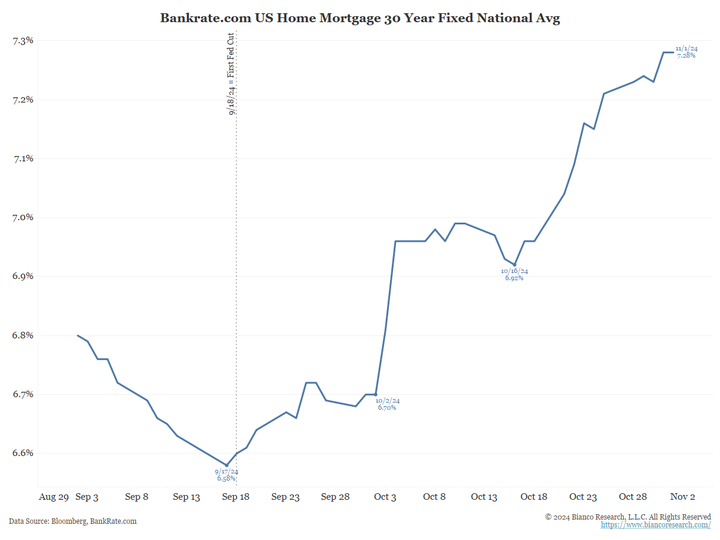

US 30-year mortgage rates are back above 7%

Here is the chart:

They'd been heading downwards, right until the Fed in it's wisdom decided to cut the base rate by 50 basis points on Sept 18th 2024. And then instead of mortgage rates continuing to fall, they started to climb again.

So, what has caused this? Well, in anticipation of the rate cut, some people went long mortgage bonds, and when the news came in, they closed those longs, the price of mortgage bonds fell and yields rose.

Another set of speculators who thought the Fed cut was "too much", then started selling mortgage bonds pushing yields higher still.

Every bit of economic news that comes out showing that the US economy is healthy, reinforces this trend.

The consensus in the market is that Jay Powell made a mistake cutting rates. Normally you wait till the economy starts to weaken before you cut rates. If you cut when the economy is strong you risk igniting inflation - and a resurgence of inflation is the market's biggest worry.

So why did the Fed cut? I think they were trying to help China which looks like it is in some trouble. But by doing so, the Fed may have put the US at risk.

What can the Fed do to fix it? Signal that there are no more rate cuts forthcoming, and then just hold steady for the next six to eight months and hope the market panic subsides and mortgage rates and bond yields start drifting down to where they ought to be.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .

Thanks