A look at the house price crash in China

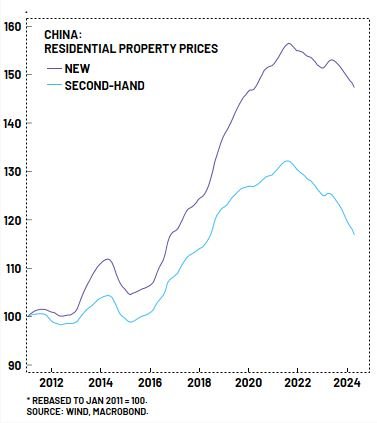

China’s property sector crisis started in 2021 with the default of the Evergrande Group. And Chinese house prices have continued to fall ever since. See

As you can see from the chart, second hand house pricess are falling faster, which means that many existing mortgage holders are suffering from negative equity (their mortgage is worth more than their house. The American word for this is "underwater").

When will it end? The Chinese govt hopes it will resolve by next year. They've provided $41.5 billion in cheap loans to state-owned enterprises to buy unsold houses from developers. They've authorised local governments to do the same. They'll be used as social housing for the poor.

They also cut mortgage rates and reduced the deposit for first-time buyers to 15%, and for everyone else to 25%.

But nothing seems to be working. Confidence has gone, and existing home owners are grimly paying down their debts. Everyone else is saving cash or gold.

From experience in the west, it usually takes ten years to recover from property crashes.

China has an additional problem, which is demographic. Birth rates were really low 25 years ago, so twenty-somethings are a small generation, no way big enough to provide demand for all the homes being built. The only thing that would help would be decreasing the supply of new homes being built - but that would clobber the construction industry. And foreigners cannot buy Chinese property, so the foreign money that props up the property market in London and Vancouver is absent.

So the doldrums in the Chinese property market are here to stay.