Not Convinced Interest Rates are Going to go Down!!!

I'm still a little bit undecided about whether or not to lock up some funds in a longer term savings bond...

Or at least I'm undecided about whether to lock up X amount or X * 3 amount, the lower being NOT very much, the later being more of very much, to be more, but still not very specific.

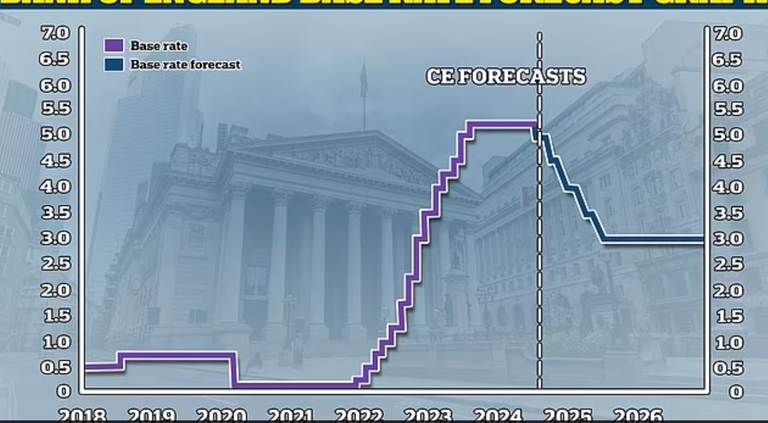

If i were to go with the Base Rate Prediction of a reduction from the current just over 5% down to 3% over the next couple of years then the calculation is easy to make....

Base Rate prediction...

If base rate slides from 5% to 3% over 18 months, that gives us an average rate of 4% over the course of 2025 and slightly less than that into 2026.

So this is easy over a couple of years to get an APPROXIMATE amount of interest to be earned...

For every £1000...

- A Tracker account @ an average of 4% = £40 interest

- A fixed rate account @ 4.5% = £45 interest.

If that were £10K we'd be talking about a £600 difference over a year so this makes it worth thinking about.

It's worth me factoring in my ISA limit

I'm at my current UK ISA limit for this year already. It's worth it for me to have at least something in ISAs, tax savings and all. These are both flexi instant access ISAs.

I figure it may be worth switching some of this into a fixed rate ISA this year, then that's my 2024-25 ISA, and then back into the flexis from next tax year.....

Fortunately/ Unfortunately I don't anticipate having that much spare cash to stick into savings accounts anyway

I think the above Interest rate forecast is HIGHLY OPTIMISTIC!

I mean look at it, it's just so NEAT. Compare this to the actual change in interest rates over the past 5 years which are much more chaotic.

And it's not as if the world is getting less chaotic. More chaos tends to breed more chaos.

The likely scenario is that interest rates remain significantly higher than the above.

Final Thoughts...

So getting back to the ISA thing I think I'll put around 20% of my savings into a fixed rate long-ish term ISA.

That's my level of confidence at interest rates ACTUALLY going lower, I feel it's MUCH MORE LIKELY I'll earn more in a live tracker account over the next couple of years.

I mean when Iran or Israel or Russia or China send the troops into the next country that's hardly going to be deflationary, after all!

Posted Using InLeo Alpha

I've no idea where such things are headed. I have money in various accounts, including ISAs to earn me something. At least I'm not being taxed on those.

Those ISAs are useful, once you're over that £1K for free!

Weirdly for me with Monzo, my instant access pot o' gold has basically the same, potentially even higher, interest rate than the fixed term option. I've been getting a nice 4.6%! I was dismayed to hear interest rates were going down and monzo reflected this with a new 4.15% rate. Ugh.

I did note that days after hearing that, inflation in the UK rose for the first time again, albeit slightly. Seems like it's a very delicate balancing act, I imagine so many people see even the slightest reduction in interest rate and pull all kinds of triggers.

The 'this is the moment to buy that house!! It won't get better than this! crowd

I'm so glad I'm not on the other side of this, needing rates to go down! Being objective I can only see them sticking around the 5% mark, or worse...

You mean 'or better' (for me) lol

I put some money in a 20yr US Treasury fund inside my ISA (IBTL).

My logic is that if rates fall this will appreciate , or if we hit a recession, bond funds are more likely to appreciate than shares. Its a little more than risk rebalancing as bonds would not usually appeal to me, however currently I see a some potential for a little speculative upside and the divi give a little buffer too

It's good to diversify too methinks!