Happy (?) New Tax Year...!

So another new tax year starts today, and in attempt to mark myself out as the saddest man on the chain I thought I may as well mark the occasion!

it means that I can finally download the various tax documents I've got from various sources of income, scrutinise the PayPal account, look at the the payslips and figure out how much I earned last year.

The great news is that it wasn't actually that much! I've roughly worked it out but won't say how much, that'd be indiscrete, but it's quite a lot less than the previous year.

So I'm kind of hoping that if I can get my tax return in early HMRC will recalculate my next payment on account downward before it's due in late July, which would be nice. (I had a good year last tax year, not so good this year).

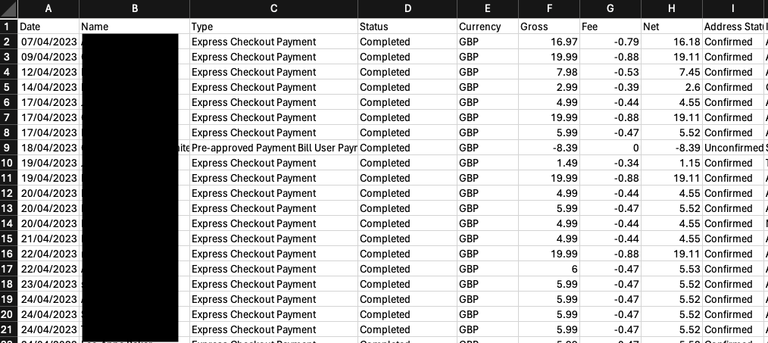

Tax time = spreadsheet time!

It'd be useful to be able to keep another grand or two or so in savings earning interest!

I've actually almost done my calcs, I just have to go through my PayPal payments. It's a little annoying as I've got about one payment a month in dollars, which i have to work out as pounds, using HMRCs variable conversion rates, it takes a while, but almost there. Should be able to submit an early return by the end of next week!

The lower tax illusion

So the headline tax news at the last budget was the lowering of NI by 2%, but the problem is that the no tax threshold stays at around £127000, and the cost of living increase and wages being worth less pretty much eradicates a 2% reduction.

What we needed was for that tax limit to go UP to around £14 000 to reflect the intense inflation of the last couple of years.

In fact that limit is frozen until 2028, meaning we get taxed even though these amounts aren't enough to live on, which is something I REALLY don't understand. It makes 0 sense.

So that NI reduction is basically a lie in the context of 'fiscal drag'.

In fact the whole tax system just needs sorting out - like one tax and thresholds that rise in line with inflation.

Capital gains tax limit goes down to £3K

Like OUCH, I've pretty much maxed out the last two years at £12K and £6K with nothing to declare if it's lower than the threshold, but £3K is gonna be a struggle.

Maybe I'll get lucky and lose money and won't have to make a declaration...? in fact I sold my land in Portugal recently and that was for a loss so there's another grand clawed back, it wasn't a big loss.

New tax year final thoughts...

Thankfully one only has to think about this once a year, it is pretty painful after all!

Posted Using InLeo Alpha

I admire you being so on top of your tax already. I usually do my return at the end of January and then swear I'll do it earlier next year. 😂

I'm motivated by getting my payment on account reduced this year!

Makes sense. 😁 Still impressive that you're on it this early tough.

I just do PAYG, but I did returns for a while. We did have to pay some capital gains the other year, but most people don't deal with that too often. The Tories make sure their rich mates don't 'suffer'.

You mean PAYE? I think PAYG is a phone thing?!

Oh yeah. Shows how little I need to think about it. 😁 Similar idea anyway.

It is a hassle, all this work. I start in August, aiming to be ready by October. He he!

That's still prettty early I guess whenever one has the time. It's a crap task fr sure!

No luck. I hate tax return time and also have payments on account this year. But look on the bright side - we have an awesome government and they put all that tax money to great use, I think ???? Oh, wait a minute....